Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

15:20

Learning the lessons……

Today has reminded me of how important it is to:

- Have zero distractions whilst trading.

- Follow my trading plan.

- Be The Bear……

Over the last two weeks I’ve been updating the blog in real-time and also capturing video footage for the website. It’s gone well overall but it does dilute my focus and today I experienced how important it is to ensure my personal trading is the top priority.

Going forward I’ll update the blog when I’m not looking for setups. Distractions can be very subtle and one thing that’s been neglected is keeping my plan etc. in view along with visualization time to keep my mind focussed.

Having three consecutive losers is not what frustrated me, that’s to be expected and so long as we average 2R per trade a 40% strike rate is profitable. It’s the fact they were really poor trades that hurt.

Before entering a trade I need to ask myself the following:

- Can I talk myself out of this trade.

- Do I have that feeling of “Whatever the outcome, I’d take this trade again.”

Had these been present I would not have entered any of the trades taken.

I’ve looked at the price action since my three howlers and seen at least two great setups that would have ticked both the above.

Time to focus on the basics before blogging. Let today be one I look back on as a necessary learning experience, a minor speed-bump on the journey 🙂

It’s all about the Golden Zone, finding phi along with great confluence, a.k.a the FIBCON!!

09:04

3 Losers – Zero WTA – WTF!!

I’m currently in a state of shock at what’s just happened!!!

Since the bullish open there were three good buy setups, I failed to take one of them. I’d been videoing and maybe that affected my focus. Either way it’s not blame for what followed.

When price reversed off the current session high at the H4 MAB and H1 bear mid-channel I passed on the M1 MAB – Good call!

Then when price spiked down through the H1 EQZ boundary at 12428.2 I went into sell mode and sold the retrace. I then moved my stop – the result was a -1.64R loser.

A poor trade, counter-trend and against order-flow and a 100% Would-Not-Take-Again!

At this point a professional disciplined trader would have either walked away OR managed themselves accordingly.

Emotion took over, I sold again, the trade was in profit at one point, just over 1R but instead of moving my stop to break even or taking the 1R I took the full 1R loss.

I should have walked away BUT no, when price broke below the H1 EQZ again I sold on the micro-retrace, another loser.

None of the trades were:

- With trend, order-flow.

- Juicy salmon, all minnows.

- Buy’s off support, I sold into support.

Right now I’m feeling very frustrated at my trading behaviour, I broke my rules, did not follow my plan and got drawn into choppy price action.

This hurts, I know I’ve made progress in these areas but today is a stark reminder of where I’m at.

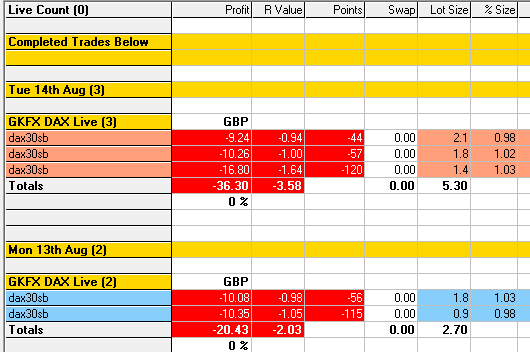

Below are my results for this week so far 🙁

At least yesterday the first loser was a reasoned out M5 MAB, just not the best value option as the M15 MAB just below it was one to take.

The second loser was just a poor trade, I then stopped.

Let today serve as a major milestone lesson on my journey, let the pain I’m feeling right now be transmuted into positive energy 🙂

A real problem would be not to know what you did wrong. Not your case.

Good, painful lesson; one that I am sure you will recover from.

No two days are the same, I look forward to seeing more of your trades!

Spot on!

I’m going deeper into the Holy Grid 🙂

I’m going deeper into phi 🙂