Review / Analysis

An essential part of a successful traders routine is the review and analysis of their trade results. The review and analysis process should be performed at the end of the days trading session and at the end of each week. This vital part of the process provides the necessary feedback loop for traders to learn from their mistakes and identify any bad habits they may have developed. It also helps to highlight and reinforce their successes and build confidence for moving forward.

The Blackbox Trade Controller has been designed with this in mind as it automates the trade journaling process and provides an interface for the review and analysis of trade results and overall performance.

Traders who overlook the journaling, review and analysis process are setting themselves up for failure! Due to the inherent probabilities and nature of trading they might get lucky at times but in the long term it will be difficult, if not impossible to achieve consistent results and therefore profitability.

To understand why this is such an important part of the process, we need to consider how the mind operates and the brain learns and the way in which we can use some simple, yet powerful techniques to support us in our trading.

An intense desire to succeed will help us to develop a professional traders Mindset. This requires that we pay attention to every part of the process and inevitably it is what separates those who succeed from those who fail!

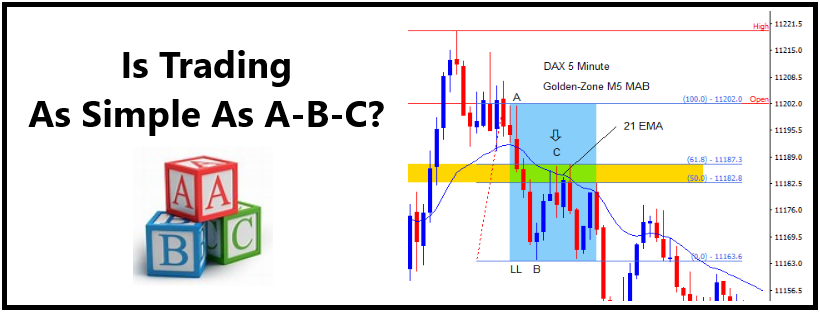

Pattern recognition is a core skill and component of price action trading.

The Blackbox Trading Edge is based on specific price action chart patterns that form regularly as price moves up and down. When these A-B-C chart patterns form, our trading edge is in play providing potential trade opportunities. In theory, this sounds quite straight forward but in practice it is more challenging than you might expect.

So, if asked the question “Is trading as simple as A-B-C?” we would suggest that the answer is both “Yes” and “No”.

“Yes” because the A-B-C chart pattern is easy to explain and understand. This is an important aspect of a trading edge.

And “No” because in real-time the mind can overthink and complicate things and if emotional indiscipline creeps in, along with impatience, greed and FOMO, they can take over and sabotage a trader’s results or worst-case blow-up their account.

Therefore, it is essential for traders to define and follow a Trading Plan which must be hard-wired into the brain and become second nature. Although not guaranteed, this consistent approach will help traders achieve success and profitability.

There are a number of ways that traders can develop and support a professional mindset. When practised and performed on a regular basis the techniques described below can make a significant difference to a traders approach and performance.

Visualization

Visualization is an incredibly powerful technique that can be used to train and focus the mind. It involves focusing on positive mental images in order to achieve a particular goal.

Creative visualization is the cognitive process of purposefully generating visual mental imagery, with eyes open or closed, simulating or recreating visual perception, in order to maintain, inspect, and transform those images, consequently modifying their associated emotions or feelings, with intent to experience a subsequent beneficial physiological, psychological or social effect.

Elite athletes and many other sportsmen and women practice visualization techniques alongside their physical disciplines, to great effect since the brain does not distinguish between what is imagined and what is real.

In a recent interview with world-class tennis player Novak Djokovic, he was asked about his celebrations when he won Wimbledon for the first time and whether they were planned or spontaneous.

He said that he had spent so much time visualizing every detail of winning Wimbledon that he believed it was not a matter of “if” but “when”, so he had already planned and knew exactly what he would do when he won.

Mental rehearsal should be a part of every professionals routine whether they be an elite athlete, a surgeon or a price action trader.

There is a body of scientific evidence to support and back up the positive effects of mental rehearsal and the latest research in neuroscience is truly fascinating.

The saying “neurons that fire together – wire together” has been demonstrated in real-time using brain scans. This TED talk by Dr. Joe Dispenza explains this process and how neural networks are formed when the brain is engaged with learning new skills.

Nobel Laureate Eric Kandel,M.D., showed that the number of synaptic connections in the sensory neurons that are stimulated when people learned one piece of new information doubled from 1300 to 2600. However, if they didn’t review that information or repeat it or remember it those new circuits pruned apart in hours or days.

Therefore, if learning is making new synaptic connections, remembering is maintaining and sustaining those connections.

Pattern recognition is a core skill and component of price action trading. The good news is that we can teach ourselves a new skill by understanding how the brain learns and reinforce that learning by using techniques such as visualization, review and repetition.

A great example of a study looking into the power of visualization was performed by researchers at Harvard University They took a group of volunteers with the same basic intellectual ability who had never before played the piano. The group was divided in half, one half practised a simple five-finger piano exercise for two hours a day over a period of five days, and the other half performed the same exercise only just by visualizing it in their mind.

They took brain scans of each group before and after, and the results were outstanding. Both groups had created a dramatic number of new neural circuits and programming in the region of their brains that controls finger movement.

Similar studies show the same kind of results with muscle training. Research has also shown that when visualization techniques are combined with elevated positive emotions the process is more effective. This is exciting and extremely powerful information!

As traders we should be inspired to apply these techniques to help us develop and master the pattern recognition skills required to execute our trading edge and to review our results with determination, passion and an intense desire to succeed, day after day.

For example, when mentally reviewing a winning trade congratulate yourself for following your plan, anticipating and patiently waiting for the setup. Feel the positive emotion and associate it with progressing towards your trading goals.

Similarly, when mentally reviewing a losing trade where you did follow your plan but the trade just didn’t work out, congratulate yourself for following your plan, anticipating and patiently waiting for the setup. Feel the positive emotion in the understanding of the Traders Equation and that losing trades are par for the course.

And when mentally reviewing a losing trade where you did not follow your plan and broke your rules, imagine yourself being disciplined and patient and passing on the trade. Feel the positive emotion of ‘Being The Bear’ and waiting for a setup where your trading edge is in play.

Remind yourself of what neuroscience has demonstrated goes on in the brain and that over time it will form hard-wired neural networks dedicated to identifying the A-B-C pattern which is at the heart of the Blackbox Trading Edge.

Affirmations

Affirmations refer to the practise of positive thinking and self-empowerment, fostering a belief that a positive mental attitude supported by affirmations will achieve success in anything.

More specifically, an affirmation is a carefully formatted statement that should be repeated to one’s self and written down frequently. For affirmations to be effective they need to be present tense, positive, personal and specific.

For example, we incorporate the following in our Trading Affirmations: –

I am a successful trader.

I am a disciplined trader.

I am a patient trader.

I consistently follow my trading plan.

Mantras

Mantras are typically associated with Hinduism and Buddhism as a sacred utterance, a numinous sound, a syllable, word or group of words in Sanskrit believed by practitioners to have psychological and spiritual powers. Mantra meditation helps to induce an altered state of consciousness. A mantra may or may not have a syntactic structure or literal meaning

Mantras come in many forms, in this context, mantras are phrases which are repeated to aid concentration and express something that we have a strong belief in. They are typically melodic and are designed to penetrate the depths of the sub-conscious mind.

When trading price action the our mantra is ‘Be The Bear’.

Review Procedure

As previously mentioned, the review and analysis process is an essential part of a successful traders routine and should not be overlooked.

Blackbox have devised a very specific and powerful visualization process that we incorporate in our review, analysis and journaling procedure to help train our minds to follow our trading plan, learn from our mistakes and reinforce our successes.

At the end of each trading session, we go through the price action as it unfolded throughout the session, reviewing the trades that we took and marking up trade opportunities that conformed to our trading edge, whether we traded them or not. And we ask ourselves the following questions:

- ‘Should I have taken that trade?’

- ‘What could I have done better?’

- ‘What can I learn?’

Then we close our eyes and visualize ourselves anticipating in advance, each and every trade opportunity that presented itself, executing each one flawlessly and watching as our trade bank increases. Whilst going through this process we think of all the positive emotions associated with winning trades and being successful.

The next part of the process is where we visualize ourselves learning from our mistakes by passing on trades we took that did not conform to our trading edge or where we broke our rules. Whilst going through this process we think of all the positive emotions associated with being patient and waiting for trades that do conform to our trading edge and the successes we have when we follow our rules.

Remember, the brain does not distinguish between what is imagined and what is real. When this technique is practiced over and over again, you will create hard-wired neural networks dedicated to this specific pattern recognition skill that will play a vital role in your journey to becoming a successful trader.

Trade Gallery

Blackbox have compiled a trade gallery for the DAX that documents and highlights great setups that conform to our trading edge.

We recommend that you display examples from the trade gallery during each trading session to remind you of what a great setup looks like, since in real-time it’s all too easy to get caught up in the moment and potentially make bad decisions and get drawn into poor quality, low probability trade setups.

We have learned from experience that trade setups will eventually form and present themselves, we just don’t know when.

So whilst ‘Being The Bear’ and waiting for good quality, high probability setups that conform to our trading edge, it is extremely useful to review the trade gallery as this supports the development of pattern recognition skills and it reinforces all of the components that contribute to putting probabilities in our favour.