Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

16:41

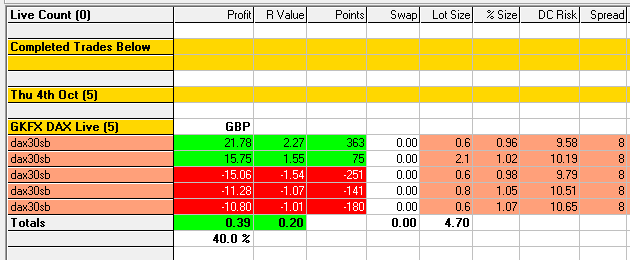

GZ M1 FIBCON, +2.27R

After price sold off once the US came online I anticipated at sell setup if price retraced back up to the area of RESCON at the Open.

I was pleased with the setup and trade entry. I did try for more R but closed out for +2.27R when price reached an M15 KeyZone that had reversed price in the past.

After three losers today its great to have two winners and get back to breakeven.

I was SO close to a multiple R trade at the 12346.2 H1 EQZ level earlier, very happy with following my process 🙂

14:42

Two Sells at RESCON 1 loser, 1 winner -1.54R, +1.55R

A higher zone of RESCON at Yes High looked a good sell setup.

I entered as shown but my stop was just below the H1 EQZ Mid-line at 12346.2, I ended up moving it just above after confirming the strength of the level on the M15 chart.

This is the ONLY acceptable time to move a stop, when structure justifies it and you have confirmed this.

Look how close I was to staying in the trade when the US opened at 14:30, such fine margins!! After the bearish strength of the reversal I entered another sell trade and got +1.55R. Price has since continue to sell off 🙁

What I’m pleased about is how well I anticipated the setup.

10:15

GZ M1 FIBCON sell loser, -1.01R

After price was held by the first zone of SUPCON I took a sell trade on the first decent retrace. My reasoning was that if it was going down to the second zone and the D1 EQZ Mid-line at 12135.7 this might be where it would turn around.

The only thing going against the trade for me was selling into SUPCON, a good enough reason to have passed on it.

Even though it was a loser I liked it because of the Grid components that protected my stop:

- H1 EQZ Mid-line at 12218.6

- M5 EQZ Mid-line at 12217.4

- H1 Bull Mid-Channel

- Top of M5 EQZ at 12225.2

So not an aweful trade at all from a structural POV, it was however a low probability trade. If I was right and price had targetted the lower zone of SUPCON I may well have moved my profit target to more than 2R.

Averaging 3R trades mean you only need to be right 30% of the time to be profitable.

My plan was to then buy at the 12135.7 level at it’s such a major level, see earlier post today.

07:39

Two areas of SUPCON?

After yesterdays German holiday the DAX has moved down strongly after the 7am open. If it does continue to sell off then there are two potential areas of SUPCON as shown above.

The first one is at Yes Low / PW Low where the D1 Bear is in play.

The second one is at:

- The D1 Bull Channel

- H1 EQZ at 12154.6

- H1 Bull Channel

- D1 EQZ Mid-line at 12135.7

This one has the very important D1 level at 12135.7, the Daily screenshot below shows this.

Also, if point A is taken as shown at 11922.4 then the 61.8 level is 12127.3 adding to the area of SUPCON.

I share your feelings Mr. Phi.

I was ready to buy at the 12135.7 level but price went half way on the two possible areas of SUPCON that you very well identified in advance.

My first trade was similar to yours, I waited a little bit more though expecting price to go back down after testing the M5 moving average:

https://blackboxsoftwaresolutions.com/thu-4th-october/