Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

20:55

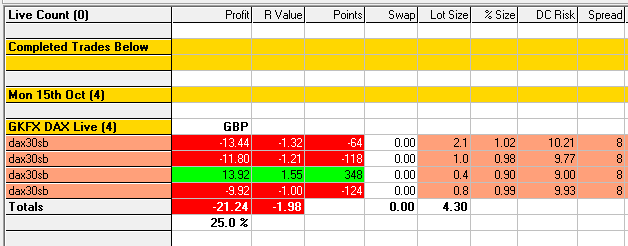

Today’s Results, -1.98R

Another losing day but for the reasons mentioned below I’m pleased that I handled my emotions well after breaking my rules and chasing price. The downward spiral can be fast and after experiencing this in the past I quickly closed down my charts and walked away for the afternoon.

Since last Wednesday’s sell off I’ve taken trades at RESCON that have not worked out like others over recent weeks. I’ve increased my risk on a few of them due to not Being The Bear.

Earlier this month I’d been pleased at the end of the day that I’d followed my rules, win or lose on a trade. I’ve not felt that since last Wednesday so at least I know what I’ve got to work on. Trading is such fine margins at times which is why if you break your rules you can really affect your results.

I want this blog to be an honest account of my trading journey, so on that note I’d say I’d become a little over confident, my trading has therefore reflected LUCK and not SKILL!!

20:45

Broke rules, chased price AGAIN = loser, -1.32R

This Hurts!!!

I walked away after the earlier losing trade, came back to my desk only to see price had come back down to the Open. Next thing I knew I’d entered another trade chasing price in the HOPE that the level would break and 2R+ would be the result.

It started well but then reversed. This is NOT skill, it’s bad habits and I’d not felt this feeling for a few months. The feeling is called “Revenge Trading” and all traders go through this, only those that neutralize it go on the be successful.

I’d not felt this for a few months, I recognised it and reminded myself of the destructive nature of it so I closed my charts down and left my office. I did not look at the charts until early evening and was SO pleased ay my decision, the price action in the afternoon looked very difficult to read, I had therefore limited my losses and handled the negative emotions well.

So despite breaking my rules I feel pleased to have limited the potential damage to my account that comes from powerful unhelpful emotions 🙂

11:44

GZ Sell @RESCON winner, +1.55R

I marked up a Golden Zone with point A taken from Yes High and point B from the PW Low on the hourly chart, the 61.8 level is shown at 11588.6 on the M1 chart.

I left my desk briefly, came back only to see the bull spike, I didn’t get the best entry resulting in a wider stop than I wanted. It was a great area of RESCON to sell as shown by the reaction.

Happy with the anticipation of the setup, would like to have got at least 2R out of it though.

Below is the H1 chart showing the FIBCON setup and how perfectly price spiked up to the 61.8 level, had I not left my desk I like to think I’d have gotten a better entry and had 2R on the first reversal before the M1 MAB sent it back up to test the Open.

10:26

GZ H1 Sell MAB@RESCON loser, -1.00R

I waited for price to reach an area of RESCON that consisted of:

- H1 MA

- H1 EQZ@11516.8

- H1 Bear Channel

- 61.8 of Golden High-Low Zone

- Bottom of M5 EQZ@11521.7

It started well but took me out for -1.00R, pleased with the setup, pleased with my patience and trade entry, just didn’t work out.

If it had and price had moved back down to the D1 Bear Channel it was a potential 4R so from a Risk/Reward POV it was a decent setup.

Good winner! Although I was tempted to sell after the bull spike, I didn’t have a reference as to where to buy so great job marking that 61.8 level in advance!!