End of Month Review

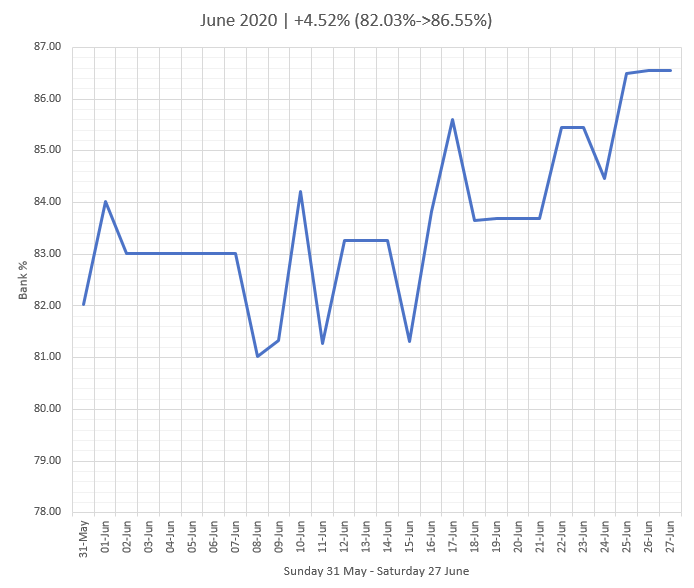

+4.52%

34 trades taken.

12 winners, 18 losers, 4 break even.

% Winners – 35.29%

WNTA Losers: 10

82.03% -> 86.55%

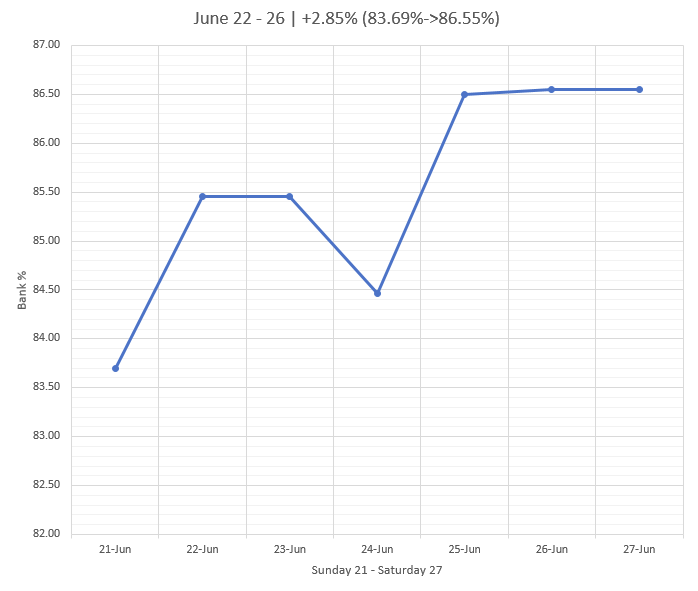

End of Week Review 22-26

+2.85%

6 trades taken.

3 winners, 3 losers, 0 break even.

% Winners – 50%

WNTA Losers: 1

83.69% -> 86.55%

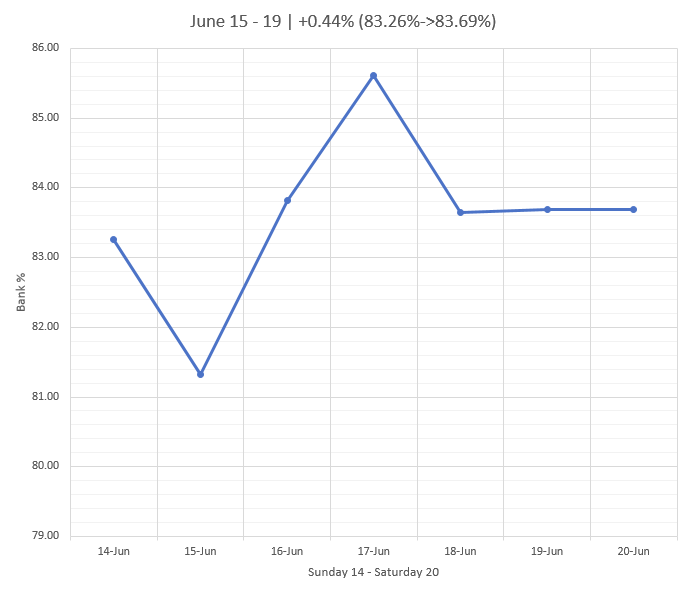

End of Week Review 15-19

+0.44%

11 trades taken.

3 winners, 5 losers, 3 break even.

% Winners – 27.27%

WNTA Losers: 4

83.26% -> 83.69%

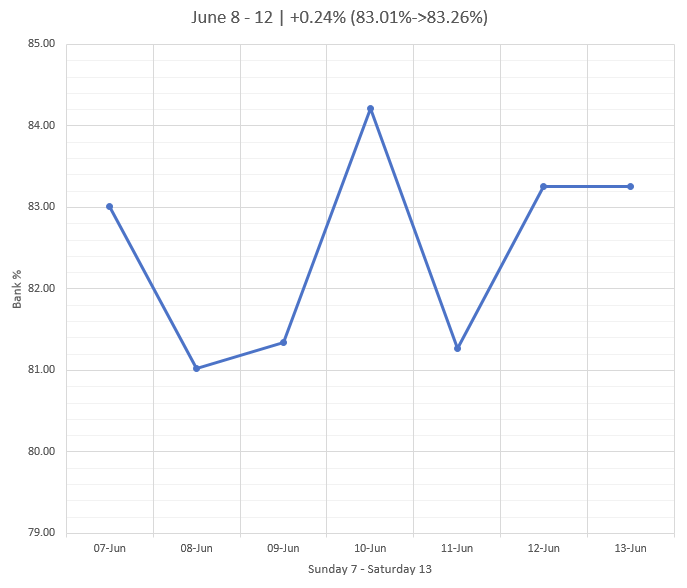

End of Week Review 8-12

+0.24%

15 trades taken.

5 winners, 9 losers, 1 break even.

% Winners – 33.33%

WNTA Losers: 5

83.01% -> 83.26%

This weeks results have been tarnished by one particularly bad afternoon of trading, where I let emotion get the better of me; had I been more discplined this could have turned out to be my best week so far this year. Despite this, the way things have been going the last couple of months, I’m still happy to be ending the week in the green, with some profits however small.

The breakdown of this weeks trades are as follows:

Winners: 2 M5 MABs, 2 M1 MABS and 1 REVFIB.

Losers: 4 failed M1 MABs, 3 failed REVFIBs, 1 failed M15 MAB and 1 failed M5 MAB.

Of the losers, 5 were WNTA trades, 2 I am undecided on, and 2 were WTA trades. Cutting out WNTA trades would have seen a Win% of 50.0%.

The majority of my losing trades this week were M1 MABs and REVFIBs. I got caught up in Low Probability M1 MABs, and I was looking too hard for REVFIBs. The one winning REVFIB trade had good markup in the build up and good confluence to support the trade.

The failed M15 MAB was due to a higher timeframe H1 MAB set up being present, which made the M15 MAB Low Probability.

The M5 MAB failed due to poor Stop Loss placement, however the read of the market for the trade was decent and I ended up getting onto the same trade minutes later for a good profit.

I kept all of my losers to -1R, and all of my winners were +1R and up, which is what I am looking to see.

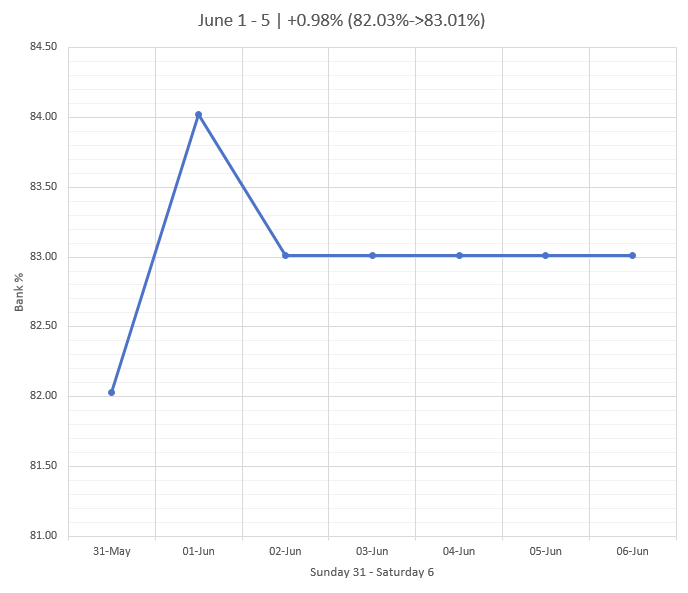

End of Week Review 1-5

+0.98%

2 trades taken.

1 winner, 1 loser, 0 break even.

%Winners – 50.0%

82.03% -> 83.01%