Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

15:53

Grade A M5+M15 Sell MAB!!

I’ve just taken a look at the charts to see a Grade A M5+M15 Sell MAB formed after price failed to move above the TOR@12429 – see earlier blog entry showing the Daily time frame.

This had great structure and great context in that price was coming back down after failing to move above the TOR, also note the Role-Reversal at the Grid level@12392

We are updating the section on range trading, the last few days range-bound Price Action has provided excellent examples.

13:04

Tricky REVFIB after bull spike

The bull spike which produced the new High off the Grid midline@12355 was a clue to the REVFIB being tricky!!

I’ve marked up a typical entry but would have been stopped out due to the overshoot of the GZ. The 61.8 level was ideal as it was at the Grid level of 12411

This is something we must note for the future, a spike like this is a purely technically driven move to a level, in this case, the middle of the current D1 EQZ and top of the range I mentioned at the start of the blog when commenting on the daily chart.

We must learn to be wary of these spikes, they can skew the expected symmetry. However, once the overshoot of the GZ had exhausted itself and price broke back below the 50% level it is reasonable to enter on the brief retrace back up to the 50% level.

If in doubt – stay out 🙂

08:55

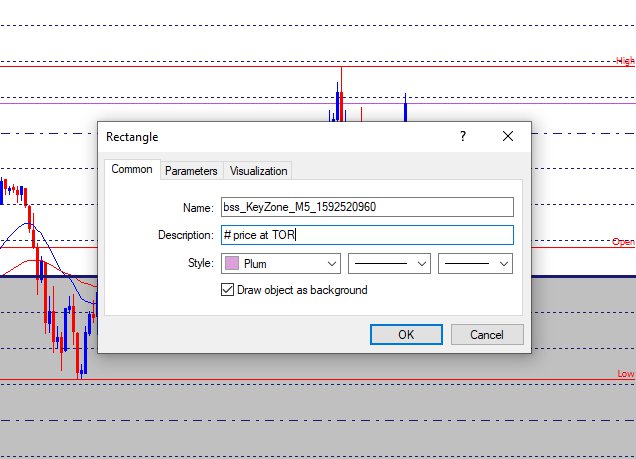

Example of Alerts

A great use of alerts is shown. If price moves up to the TOR@Yes High or the BOR then send an alert to the MT4 Terminal and Mobile device.

To set one up:

- Drag the bssKeyZone script on to the chart, it will create a silver rectangle.

- In its properties window set the Description field to # alert text

- I’ve changed the color to Plum (see below), choose whatever you prefer.

- Then place it where you want it to trigger and double-click it to unselect (activate) it.

You can then minimize/hide the charts and do other stuff. Turn the volume up on the PC, so long as there’s not any other noise to drown out the alert you can hear it from other rooms.

This is a very useful feature if you’ve decided what levels you’re interested in but don’t want to sit and watch every tick.

Test it out, have a play…

08:51

S/W Updates

Today I will be completing the last few s/w updates, ready for Monday.

2 trades: 1 winner, 1 loser, +0.35R

When price reached 12400 and hit previous resistance, I took what I thought might be a reversal FIBCON only to be tapped out before price was immediately sent back down to hit my 2R target.

Just missed the sell at the TOR at 12429 wasn’t quick enough with the trade tool should have considered using a sell limit.

Took the M5 MAB when price moved back down from the high but did not maximise the trade and manually closed due to wicks around 12400 level, would have had 2R if I’d held on.

https://blackboxsoftwaresolutions.com/wp-content/uploads/screenshots/scottyspice/ge30.sb_M1_19jun2020_1103_11502397_buy_M5-MAB.png

Hi Elaine

Unlucky on your first trade! Those losses are so frustrating.

I was looking for a REVFIB Sell from that TOR High, but didn’t enter anything.

I don’t blame you for cutting the second trade early, it was probably the right thing to do considering the previous price action! I considered entering there too, but passed because I was expecting a REVFIB Sell and wasn’t confident about buying up into it.

Hi Joel,

I did note the bull spike up to the 12429 level and saw that the REVFIB was tricky and one BIG clue as you point out is the bull spike up to the high off the 12355 Grid level.

The spike looks to have skewed the normal symmetry so something to note going forward. I did take a screenshot of it and plan to update the blog.