Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

21:00

Superb Sell REVFIB at 12281

I returned from our evening ride to see yet another Grade A REVFIB that took place at about 18:30, it had the following characteristics:

- A precise bounce off the EQZ@12281 (point A)

- A low probability M1 MAB

- An M5 Buy MAB (point B)

- This produced a great GZ with great RR

Just look at the chart and see how the Grid levels guide price, this is truly the “Holy Grid” illuminating the pathway as we “Be The Bear” waiting patiently for Juicy Salmon to swim buy.

The screenshot below shows what happened afterward, when price broke back above 12281, a tasty buy setup formed. Point A could be taken 12281 or just below.

Also note the M5 Buy MAB (red line) when price came back down to test the GZ after setting new High.

15:41

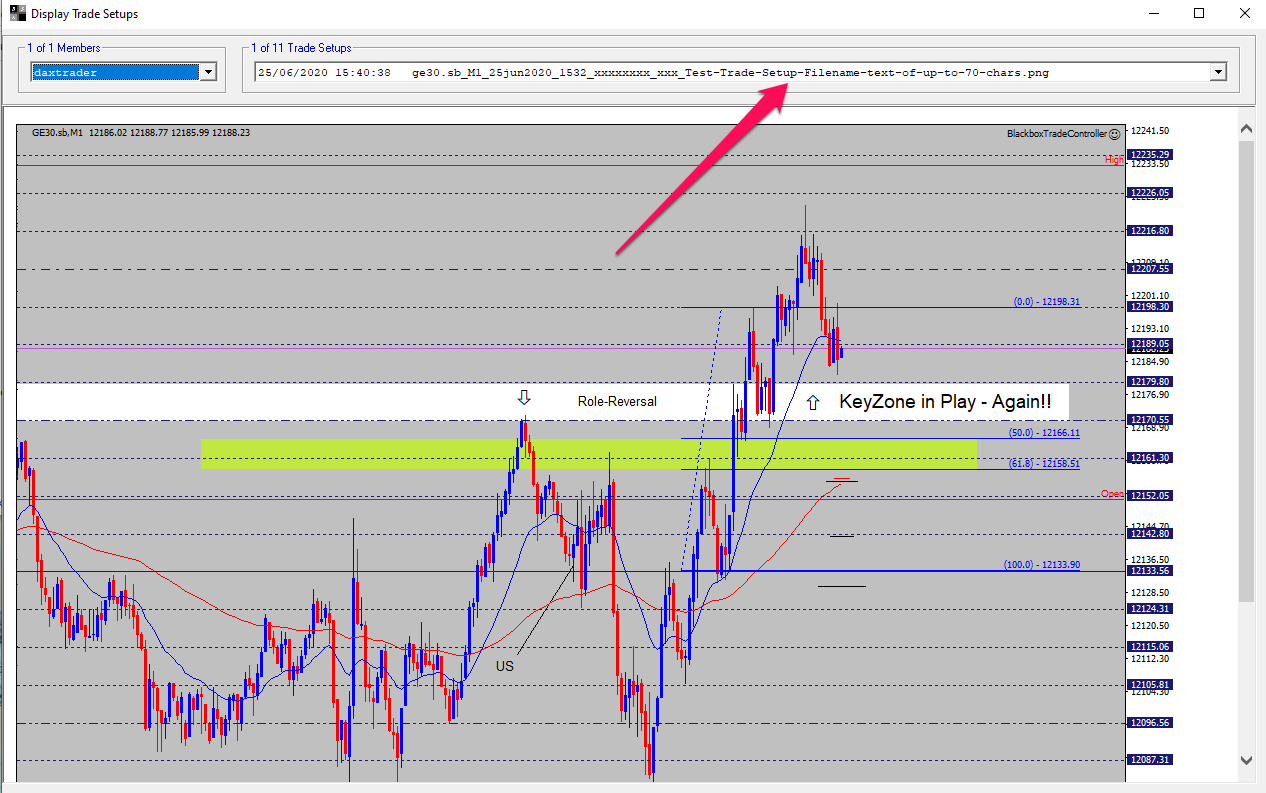

Minor s/w Update

The update will now make use of the additional characters you can add to a screenshot as shown.

This will avoid having to send any additional info via the Comment Share feature.

BTW, note how the bulls managed to push above our KeyZone from earlier, the PB was a buy but it was not perfect M1 Buy MAB as the GZ was below.

However, based on how key the zone was you might have fancied taking the buy at the PB to 12170.

Below is the H1 chart showing the 12207 level – TOR – that the bulls were targeting, another example of how technical the DAX is on a range day.

14:38

Great example of RR KeyZone

I decided to make a minor update to the s/w for use with the Trade Setup feature after my lunch break so I was not looking at the charts.

I heard Elaine’s phone alarm only to find out she’d set a Sell Limit order if price came back up to the 12170 level. She was away from her desk at the time, hence the Sell Limit.

When I looked at my charts I saw what she’d done and ended up with a 2R winner in a few minutes.

She marked up the FIB tool as shown, the GZ was just below the KeyZone from earlier that I’d marked up based on the SH at 7 am.

This is a superb example of:

- How a KeyZone based on a SH, SL or GZ from early in the session comes into play later on.

- Using a Sell Limit to catch a salmon when you’re away from your desk.

Price has remained in a micro-range since the US came online.

I will release updates for both the BTC and MT4 modules very soon.

11:16

One M5 Sell MAB Loser, One M5 Sell MAB Winner!

Wow, what a fun 30 minutes 🙂

I sent out the Trade Setup for a possible M5 Buy MAB on a PB to the RR zone from earlier. I took it, 32 seconds later it was toast.

I then marked up the A-B bear leg to see that the GZ was confluent with the RR zone if the bulls could push price back up. This meant a possible sell setup would form so I took a screenshot and sent that out.

The bulls had a fair bit of work to do at that point, in particular moving back above the Open which was tempting to sell at due to the wicks showing it was a battle zone.

However, I reasoned that the best value was the GZ and that the market is very technical at the moment so “Be The Bear” and Watch, Wait, Anticipate!

It paid off, I entered the sell once price poked into the zone. I’m back to being -0.28R on the day but pleased that I’m following my process as I’m still getting used to using the updated PAG (Price Action Grid).

We must keep following our plan, rules, and process and let the traders equation take care of things.

Also, yesterday evening we went for a ride and I listened to a great interview with the legendary Mark Douglas (Trading in the Zone), it was perfect timing for me.

Why?

My challenge right now is my mindset and learning to think like a professional. We ABSOLUTELY have a great edge – BUT – that does not guarantee success.

We have to develop the mindset of a Pro and FULLY define and accept the risk then let things play out.

We must also understand at a deep deep subconscious level that each trade is statistically independent of all those before it and all those after it but so long as we have a genuine edge – which we do – we will be profitable.

Yesterday I passed on two winning setups due to a mindset issue, today I applied what I listened to and worked hard at removing emotions and took the trades where my edge was in play.

Note: My first trade was not our edge in play, it was an aggressive punt on the momentum, I managed it accordingly for a BE.

This a highly recommended watch, link below.

09:48

Buy Loser, -1.39R

I’ve taken two trades, a BE and buy loser.

The BE was an aggressive sell at 11985 based on the speed of the move down to it. I’ve seen price storm on down but due to the 61.8 level on the Daily – see earlier post – I was very wary and closed out as soon as it struggled to go lower, that was a good call.

I then marked up the possible REVFIB with my GZ as shown, however, Yes Low was in play. I liked the idea of a PB to 12000 but it never happened.

If you take point A from 11985 instead of the Low then the GZ was confluent with where price PB to and Yes Low.

I was in buy mode but could not see a safe entry due to the strength of the move up. When the first decent PB came to an earlier SH just after 7am the RR and M1 Buy MAB meant I entered a buy trade.

It struggled so I decided to protect my stop with the Open, talk about FINE MARGINS!!

As soon as I got stopped out price moved back on up – that’s trading!

In summary, the ENERGY of the Daily FIB, and GZ I mentioned earlier sent price back up very strongly, it was a challenge to find an entry without chasing price and breaking rules.

06:50

Bears In Control Yesterday

A big down day yesterday leaves us currently in the middle of the EQZ@12133. I stopped trading after a winning sell trade yesterday afternoon but came back 2 hours later to see that the bears took full control after the break below 12281 offering a few decent sell setups, wished I kept trading 🙁

We do have a GZ (magenta Fib Tool) as shown that may come into play if price moves down to the bottom of the EQZ@11985?

You got me here:

“When the first decent PB came to an earlier SH just after 7am the RR and M1 Buy MAB meant I entered a buy trade.”

That sentence is definitely not for beginners! What do PB and SH mean? I can only risk for “price bounce”, but for SH I am clueless! 🙂

I’m starting use abbreviations to save time so:

PB = Pull-Back

SH = Swing-High, SL = Swing-Low

RR = Role-Reversal

I’ve got to thank Phill and the alerts for this one in a round about way, as I was away from my computer but came to have a look when the alert for the M5 MAB came through.

I was put off taking the M5 MAB Buy trade, as the move down towards it was quite quick.

As price retraced, I marked up a possible triple top, set up my trade tool for the H1 MAB and reasoned that if price could push through the Open and then the daily ema, price could keep pushing lower.

After Entry, I moved my profit target to the bottom of a measured move and trailed my stop as price came down, ending up with a 1.99R profit.

I probably could have left more room for movement with my stop, however I’m happy with the profit and I wasn’t confident about my read of price pushing that low.

https://blackboxsoftwaresolutions.com/wp-content/uploads/screenshots/themabtrader/ge30.sb_M1_25jun2020_1056_19204872_sell.png

I also took the trade and got the winner, Well Done 🙂

Time for a break and some sunshine.

Phill,

Have you looked at the amount of candles in the impulsive ‘A’ leg as clue to efficacy with this strategy?

i.e. Is a 3 candle move that is responsible for 90% of the A leg followed by 12 candles grinding in the to the golden zone in the B leg better than

12 candles in the A leg followed by 3 candles in the B leg ?

Hi Rab,

I’d say on average, Yes, the characteristics of a high-quality A-B impulsive leg are as you’ve described, same with the corrective B-C leg.

It’s all a reflection of order-flow, the battle between buyers and sellers.

Go have a look at the following article by Chris Capre. It’s a quality read, it helped me focus my efforts when defining our edge.

https://2ndskiesforex.com/trading-strategies/forex-strategies/impulsive-and-corrective/