Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

11:16

Tough Day – Great Buy REVFIB

I’ve just taken a look to see what’s been happening and part from the earlier buy REVFIB that Alex took there’s not been much going on as the market digests the late sell-off yesterday.

For me, there have been only two decent pieces of price action so far:

- Just after 8 am the current session high was set within a KZ that I already had marked up from last week, similar to the one from yesterday but lower down. See the H1 screenshot below.

Note again how I’ve used the candle wicks to define the height of the KZ and then projected it forward. Also note how on the M1 chart it fits between the midlines.

There was no REVFIB on the way back down and taking it at the level is not easy though maybe deciding if price penetrated it enough to allow you to place your stop above it there would be decent value.

Also, just like yesterday, these KZs are precise and we must learn to trust the Grid more and more to get more out of it.

- The REVFIB that followed after the move down to set the current session Low was a high-quality one. Point A is taken from the Low where there was very strong support at Yes Low, the impulsive A-B leg that moved back above the EQZ@12577 and the Open shows this.

As per our REVFIB characteristics, this included the M5 Sell MAB at point B. Alex was SO close to getting 4R out of this.

The GZ held price at point C with four tests of the 61.8 level at 12555. This was one where you might wait for at least one wick to show support is there at the level then enter on the next test.

This not easy in real-time as the candle will be red BUT we either trust structure or we don’t. If we do we can get such good value out of a setup due to having a tight and precise stop.

Since then we’ve been in a micro-range offering no decent setups.

Below is the H1 chart showing the KeyZone mentioned above.

We MUST display these all the time and factor them into our trading decisions, the precise manner in which price interacts with them shows that the big players and their trading algorithms are using them.

07:44

Semiconductor Stuff.

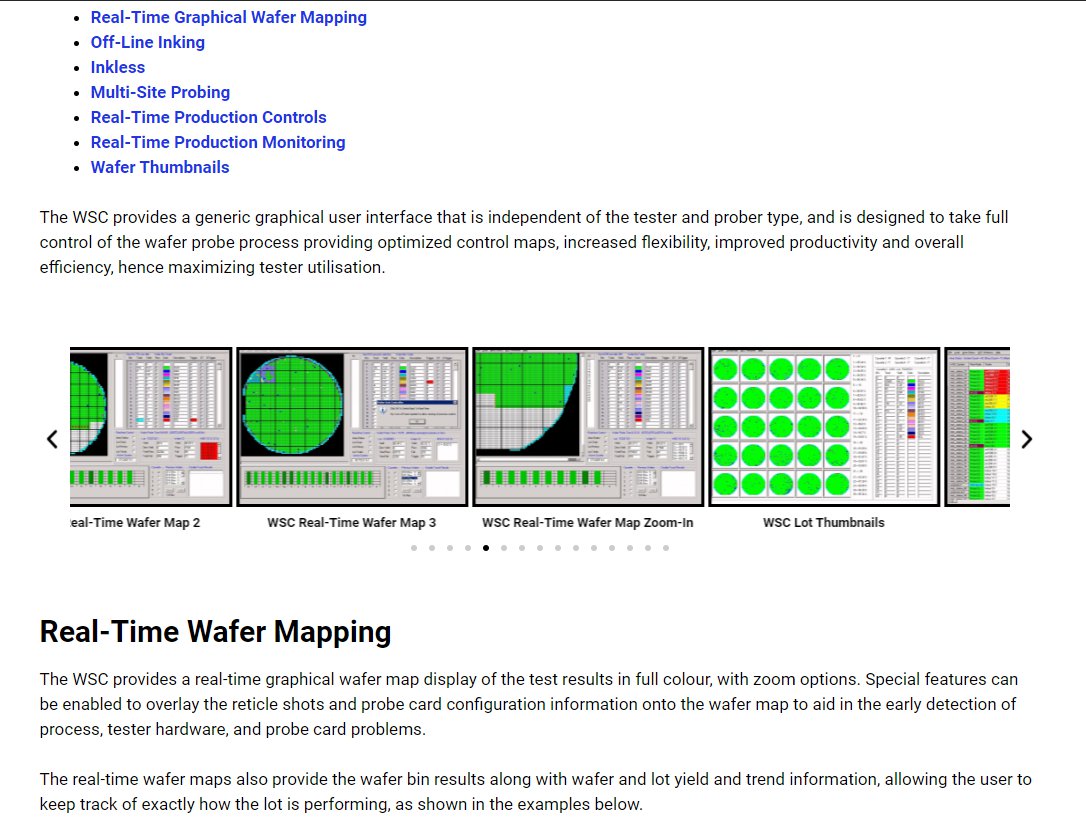

Just to let you know that last week we had an enquiry from a company in Malaysia regarding our semiconductor s/w. They found us via a google search and it resulted in us having a call with them last Friday morning. We are one of several options they are looking at.

We have no idea if it will lead to anything but this morning we had an email asking us if we could do an online demo of the s/w for them. This means that us being a two-person outfit with me the sole developer in VB6 (legacy language) has not put them off.

I’ve not done anything like this for years so have to go prepare a demo for them. We want to do this asap so today I’ll not be trading but will be watching things and maybe posting an update.

Exciting! The WSC it’s your baby, you’ll rock it 😉 Good luck

Almost perfect!!!

Happy to have been involved in both trades though.

https://blackboxsoftwaresolutions.com/wp-content/uploads/2020/07/ge30.sb_M1_14jul2020_0708_xxxxxxxx_xxx_FIBCON-loser-REVFIB-winner-8.54.gif

I’d just looked to see what had happened and spotted the REVFIB, then your comment arrived.

Yes, almost perfect on the sell, such fine margins but a great buy REVFIB afterward. I can’t help but think of the MarkD teaching on letting your edge play out over a large enough sample size, that way we don’t focus on any individual trade.

You had a loser after correctly identifying the setup – the process – then you were able to take the next setup that qualified – the process – and it worked out. 🙂

One of his comments was that “Professional traders LOVE THE PROCESS of patiently waiting for their edge knowing that so long as they do that the outcome will take care of itself.”

We must fall in love with the process 🙂 🙂