Ten months elapsed since my first live trade. My day trading experience at the time was close to zero (one month on a demo account), but I wanted to feel it all, experience it all, win it all, and it had to be quick.

It didn’t take long before all of my personal flaws were reflected in my trading decisions; I had to learn my first and most important lesson, one that took me months to face and show tangible improvement: for me, trading was more a mental state than a technique, a state of the mind where you execute your edge over and over aiming to end up with a profit in the long run.

Being used to succeed in my previous jobs, it wasn’t easy to see myself failing month after month. I had to lose 70% of my initial trade bank in order to take seriously that I wasn’t going to be successful unless I let go thoughts, fears and vices acquired during my 30 years of existence, a program very well coded in my brain that was time to change.

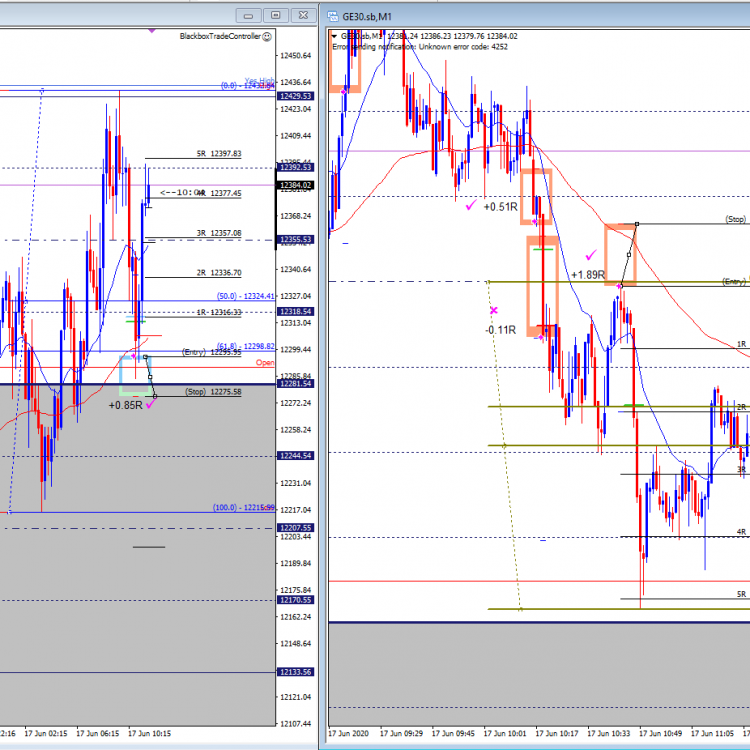

The good news was that I wasn’t alone, being part of the Blackbox community helped me big time on feeling that I wasn’t the only one undergoing such transformation and that the process wasn’t easy, otherwise it would be full of good traders, something that is quite scarce when you ask for consistent profit.

It was only by August that I started to feel that profit was possible, that I was going to be able to get what I visualized over and over again if I was disciplined and patient enough. However, both August and September were, in terms of results, negative months, but at the same time the end number was influenced by two or three days in those months where I wasn’t mature enough to acknowledge that not trading is sometimes better than trading, simply because my mind was somewhere else (problems in general, big decisions, job offers, etc.), days that I ended -7%, -10% or more just after a couple of trades! And then the days were after 50 trades I ended +1%, stressed and probably with less hair than at the beginning of the session.

If I have to share what worked for me in order to achieve profit, here it is:

- Consistent profit is built over time, day after day.

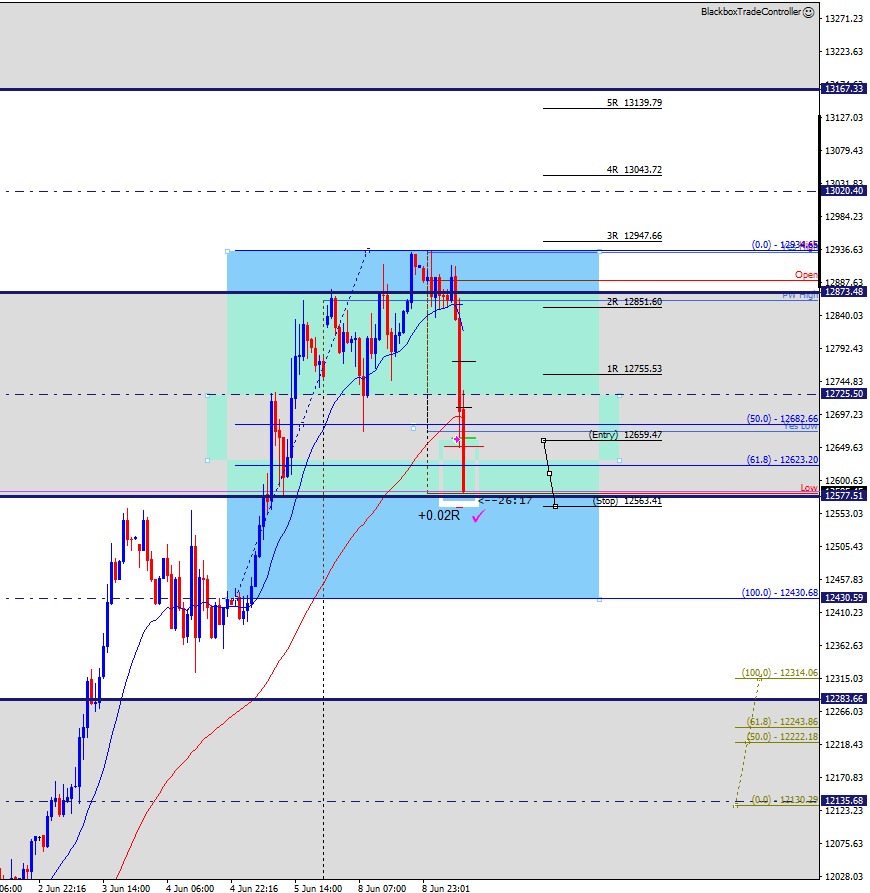

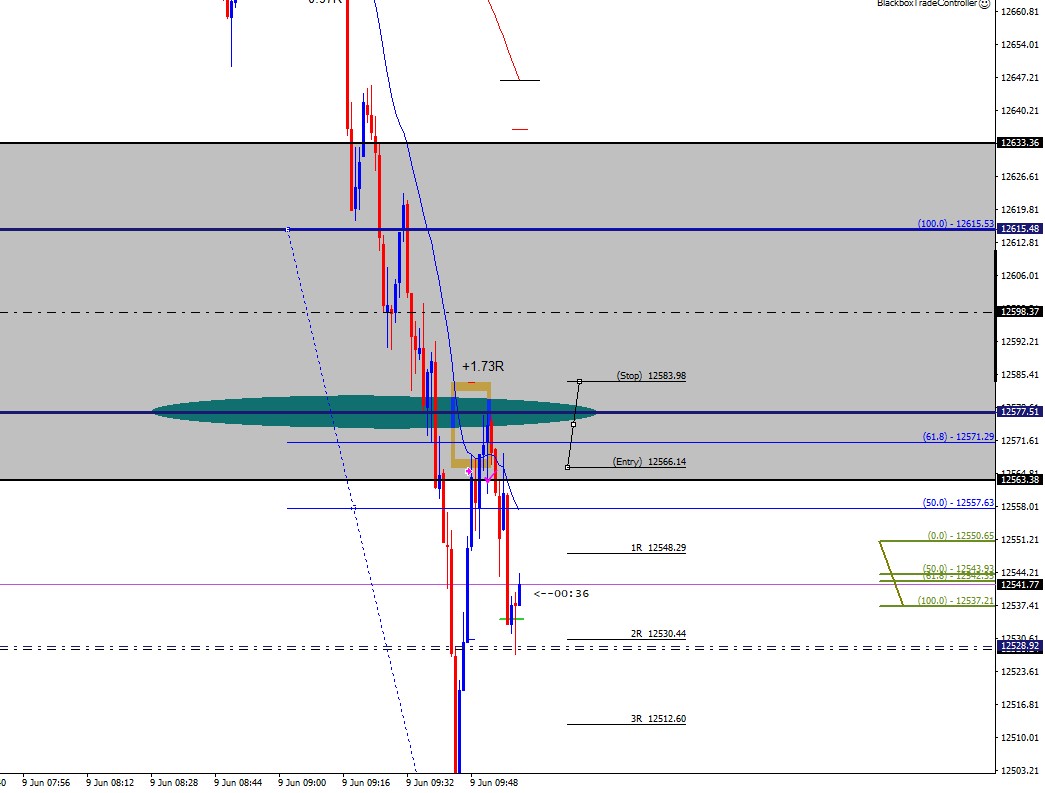

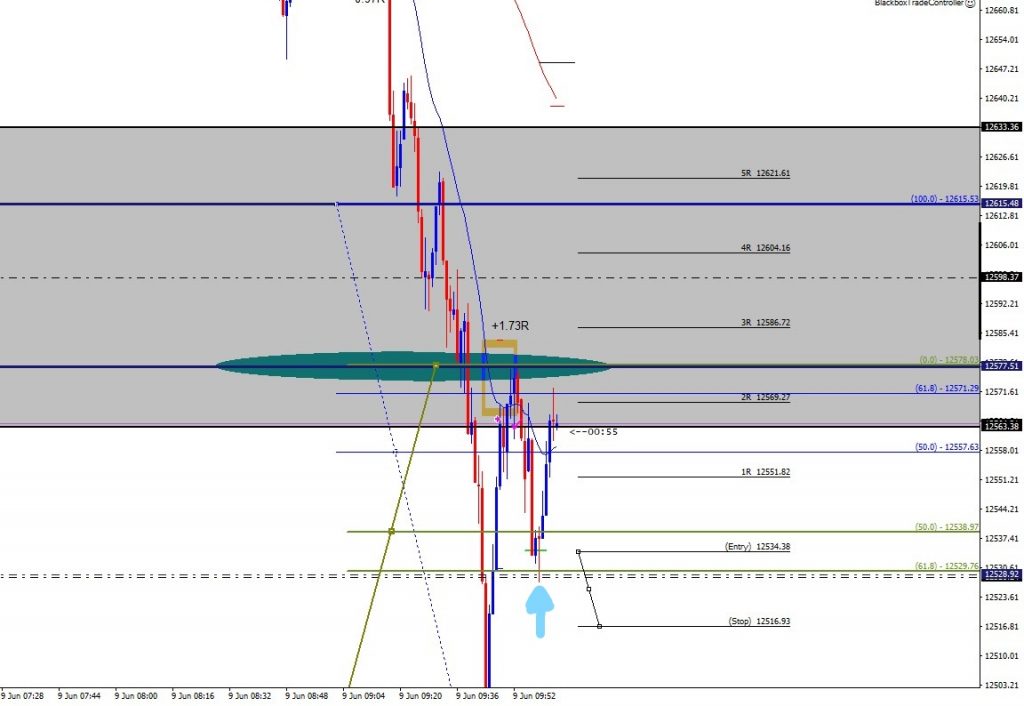

- Take profit! Trust structure, lock-in profit after price breaks certain key levels and be happy with your original take profit target. 2R is a great result! It means 100% return on your investment!

- Avoid moving your stop loss. Trust me, I tried to find a way to move it and get away with murder. 9 times out of 10 it led me to big loses.

- If you have an edge, or if you will trade with Blackbox’s edge, place the trade, set where to lock-in profit if you want to do so and leave the trade alone. I’ve seen the sky fall only to manually close the trade (taking a hit) and see how price went non-stop to my profit target. I forgot to mention, I’ve seen it many times, a painful amount of times.

- Be there in the moment. Answering emails or browsing while looking for setups will not lead you to profit. Connect with the charts, watch price action and learn how it behaves.

Life now has put in front of me a series of challenges that made me decide to put my trading journey on hold. It is definitely not a good-bye, it’s more a see you soon. I don’t know how soon, but I know that as long as we are allowed to trade in the future, I will want to do it. Profit is possible, and it doesn’t depend on the market. It depends on you.

Have a great time trading, and I hope you are able to inspire others!

See you soon.

bbqtrader – Alex

12/12/2018