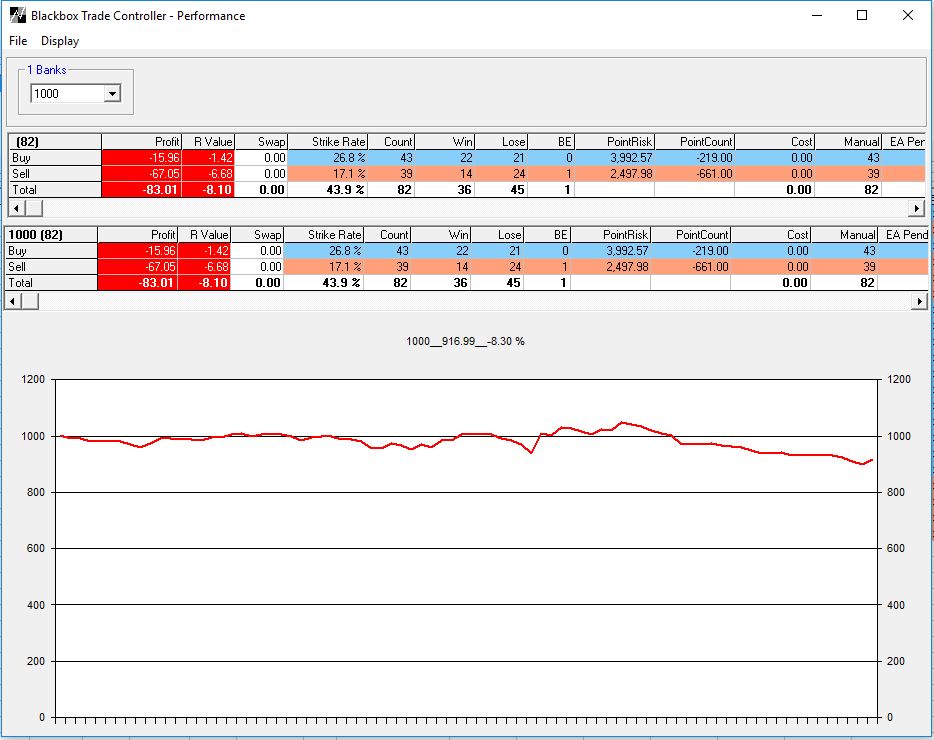

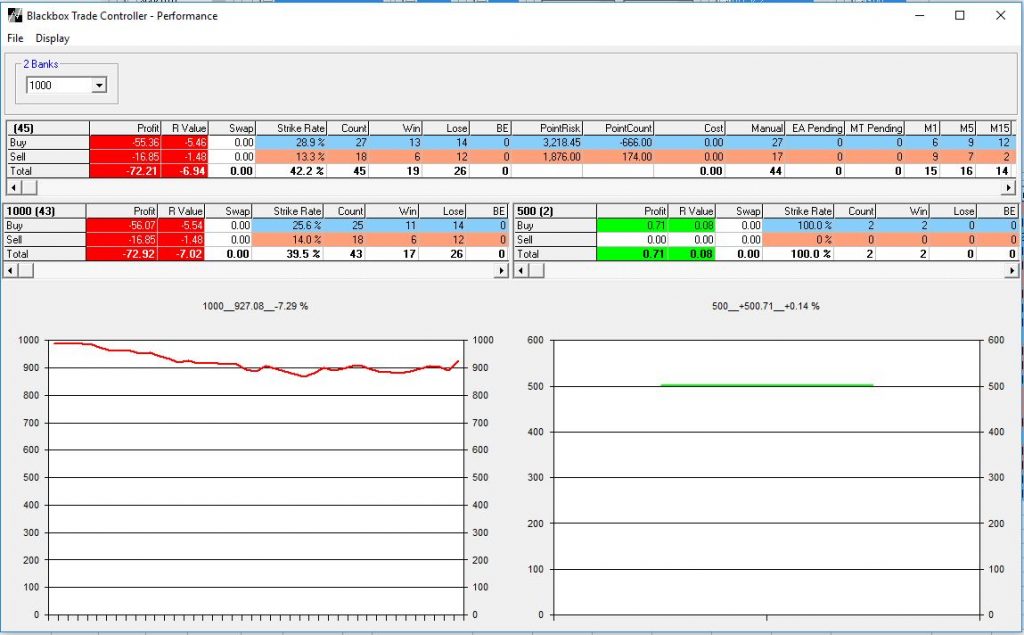

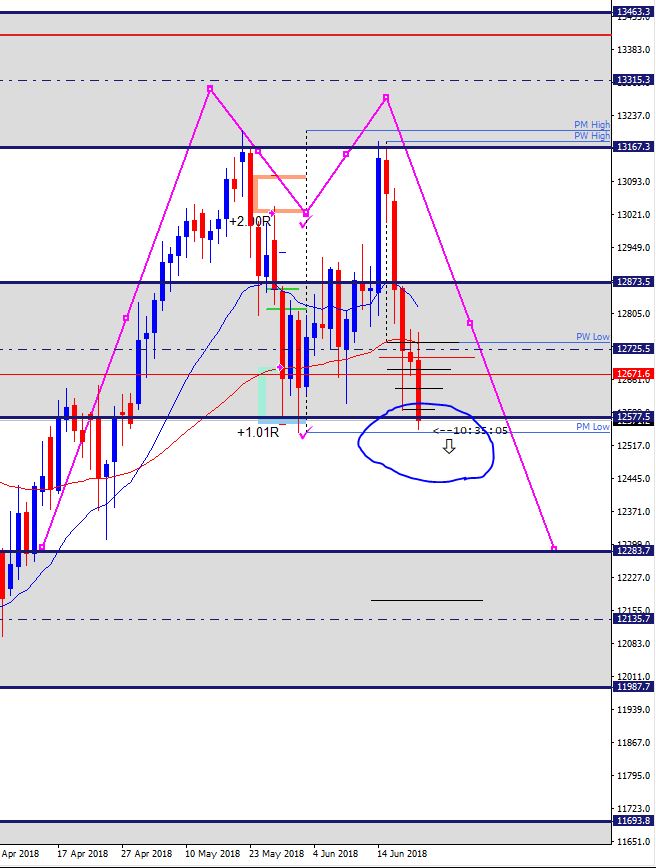

I guess that if you click on the charts and take a look at it, you might feel as upset as I did!

Marked a good M5 FIBCON right after the volatility of the London open vanished, waited for it and pressed Ctrl+E right there, on the edge of a reversal that happened after a short hesitation.

Having the M1 MAB above my entry level wasn’t that exciting, but I decided to let it run at least until it goes above my 1R level. Locked in profit after touching +1.5R (as there was a RR zone looking to the left in the M5 chart), raised my take profit level to the H1 bear channel boundary and left it alone.

The rest is history. Retraced to my entry level, left me out of the trade and went non-stop to my target. A +3.5R ended up being a +0.08R trade.

Should I have left my stop loss at the original level (-1R)? Did I do right locking profit in order not to lose money in case the trend changed? I don’t know.

I think the answer could have been: take profit at +1.5R where the RR zone was, see what happens and if it comes back down and you like it, enter another trade. Worst case scenario, you end up +0.5R. In this case, I would have ended securing +4R.