Wednesday 18th

09:10

Low-High FIBCON

Let me tell you something: if you saw that coming, you gained my respect. I didn’t! I just traded a FIBCON with the YesClose level as point A.

I was lucky enough that it didn’t hit my stop loss, and as it happens in these trades where the retracement ends near your stop loss, I ended up with a poor entry level. That explains the reason why I didn’t let it go further up. When the last candle you see in the chart reached its top and went down quiclky, I let fear takeover and tightened up my stop loss. It came down, gave me a +1.15R and went for the 2R level, classic!

08:57

1M Chart Double Top

Risky way to start the morning but it made me wake up quickly!

Not a trade that would be among the BlackBox edge, but as soon as I saw the structure forming I realised that if it managed to brake the Key Zone midline at the 12765.8 level, the Double Top could be in play.

I kept the stop loss tight while it was going down as it is a risky trade, that’s why I didn’t max it up. The movement downwards reached exactly the level I was expecting it to reach (Daily channel+Yes High area), but it took me out first!

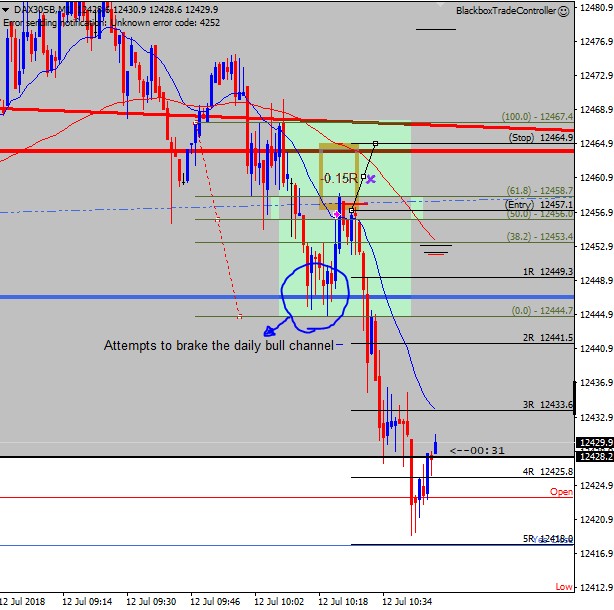

Thursday 12th

08:23

M1 Sell FIBCON

What a frustration! I missed what it would have been a perfect first trade.

After seeing price interacting with the Bull Channel trying to brake it, I thought that price would likely move up to find resistance and then come back down, probably to look for the 1248.2 equidistant channel boundary. So when price went up to the Fib Toll 61.8 level, even though structurally wasn’t perfect I decided to give it a go!

After a couple of mitues I decided to close the trade thinking that price was going up again towards the M5 MAB, only to see that right after I closed the trade, price did exactly what I was expecting when I entered a trade, that is, a strong movement downwards. Guess what? It reached the channel border as originally expected, a 3+R trade that would have been a perfect start.

You may wonder why I took such a poor decision? I need to finish early today and loosing 1R would have put me in a bad position for the rest of a short trading day. Mind tricks that I shouldn’t be listening to!

Wednesday 11th

08:40

Traded Sell FIBCON

Yes! I got my reward for being patient. Unsure of where to fix point A (100.0 level of the FIBCON tool or the place where the downward movement initiated), I guess I put it right where it had to go!

After some playing around with the bottom of the Daily Bear Channel, it managed to brake it and went to my 2R.

Should I have moved my target furhter down? I did :), but then closed it manually to avoid being greedy. Price action showed that for me to get more than 2R I should have allowed a significative retracement, something that I was not going to allow and could have ended with a 1R or less trade.

08:27

Missed GZ M1 MAB

As you can see in the image above, the market today gave us a really nice opportunity to profit from the initial retracement after the sell-off.

Even though we know by experience that the first contact with the M1 MAB after a sell-off usually offers a quick retracement, I doubted too much and decided not to trade it. It would have been an easy 2R trade!