Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

19:45

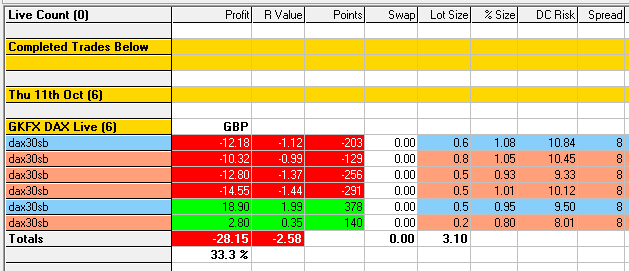

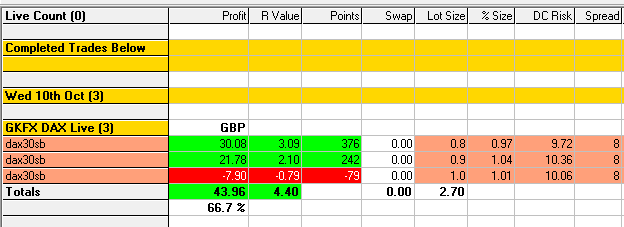

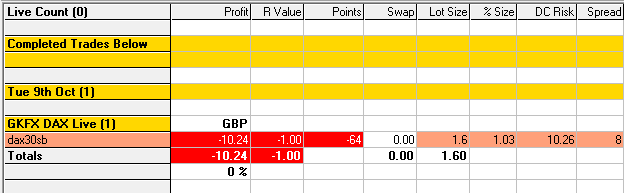

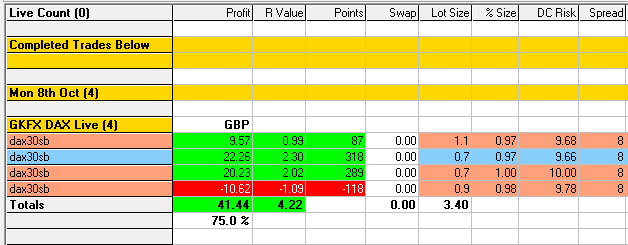

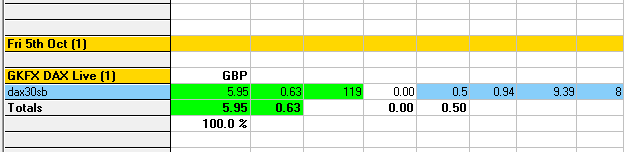

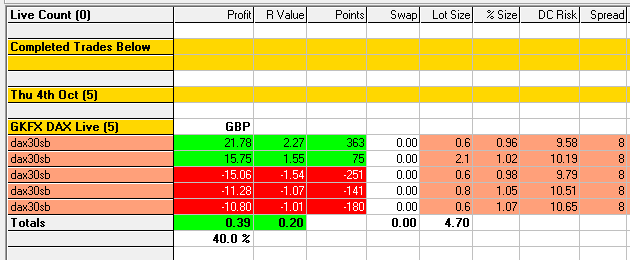

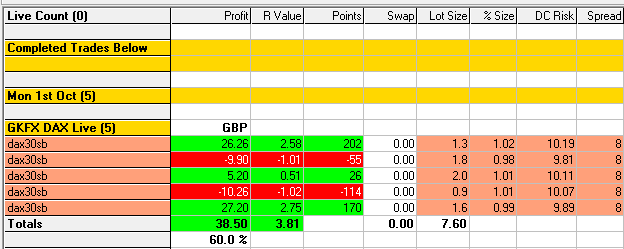

Today’s Results

Not a great day, two of the trades I’d not take again, the 4th and the 5th.

Quite tough reading some of the price action after the big sell off yesterday as the market digested things.

The first trade I should have had a full 2R from and the second – buy – trade should have been at least 4R due to the context, I should have let the trade run for longer.

14:09

Sell at RESCON loser, -1.37R

I allowed myself a second bite of the cherry when price came back down to the 11643.2 level and after reassessing the history of the level.

It started off well but stalled at the D1 Bull Channel at 11627.5. If the level had broken then multiple R was possible but on this occasion it did not work out which would have more than made up for the -1.44R loser.

14:04

Sell at RESCON loser, -1.44R

You can see why I’d wished I’d let my buy trade run higher 🙁

I sold at RESCON with my stop above the major H1 EQZ level of 11643.2, I did move it to allow for this. Price had already been reversed by this level/zone earlier but on this occasion it did not work out.

13:57

Buy at SUPCON winner, +1.99R

I anticipated a buy at SUPCON if price came down to the 11521.7 level as it was confluent with the 61.8 level of the current Golden Low-High zone.

I got a great entry but my stop was larger than I’d preferred. I closed out for 2R but did plan on seeing how high price might go, wish I had….

Very happy with the trade….

09:58

Sell at RESCON winner, +0.35R

After yesterdays huge sell off it was a question of “What next”?

I identified an area of RESCON and entered when price reached the zone but did not get the best entry. I moved my target lower anticipating a follow on of the bearish mood.

That didn’t happen and I ended up with a small winner, if I’d have gotten a better entry the 2R would have come in BUT I did move my target as explained so not sure what that would have resulted in.

Pleased with the setup, another great example of the Grid highlighting where event zones are likely to result in opportunities.