Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

10:36

Such fine margins…

We’ve mentioned many times how fine the margins are between losers and winners. I’ve been sat looking at the price action whilst enjoying a cuppa and allowed myself to visualize how different this morning could have been.

I was not totally focussed early on because I decided to video the setup and myself taking the M5 sell MAB trade. I feel sure I would normally have taken it.

It was also a very bearish follow on from yesterday so I might have moved my target accordingly. Maybe I would have got +4R – maybe?

Then when price produced the next GZ M5 sell MAB I would have – maybe – taken that and got at least +2R.

That’s +6R (+6%) by 9:30am!!

I know this is easy to say afterwards but one thing we’re clear about at Blackbox is we do not want to be in the camp who can talk a good talk via retrospective analysis, there’s no shortage of ‘traders’ out there who do this.

We want only to be the ‘real-deal’, ‘walking-the-walk’ and putting our money where our mouth is. The only way to do this is to trade a live account and prove you can be profitable using the pattern reocognition skill you teach!!

This is our mission and passion, something we’ve seen very little of over the years!

10:00

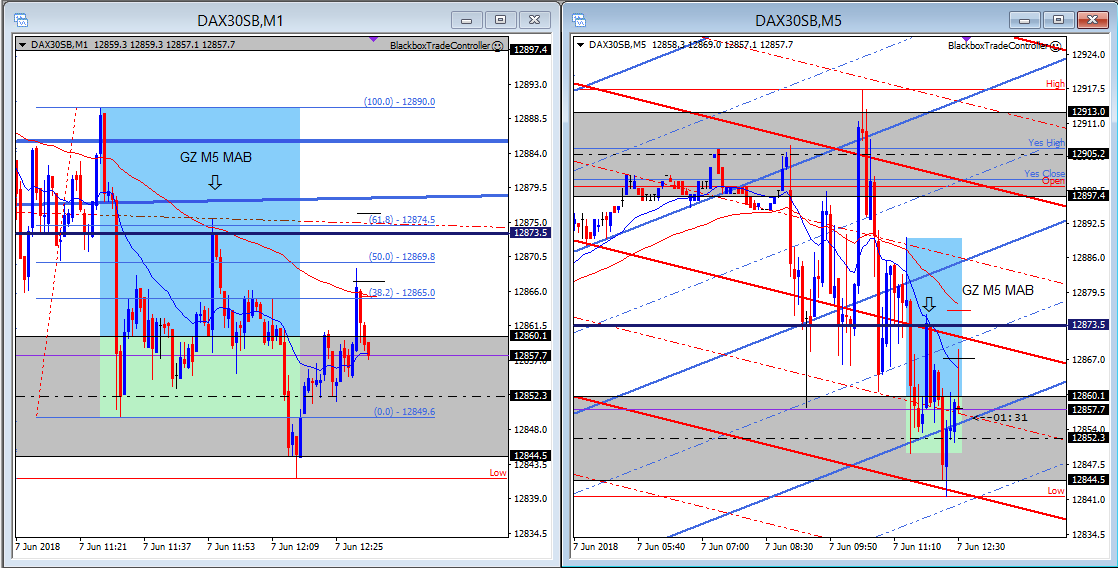

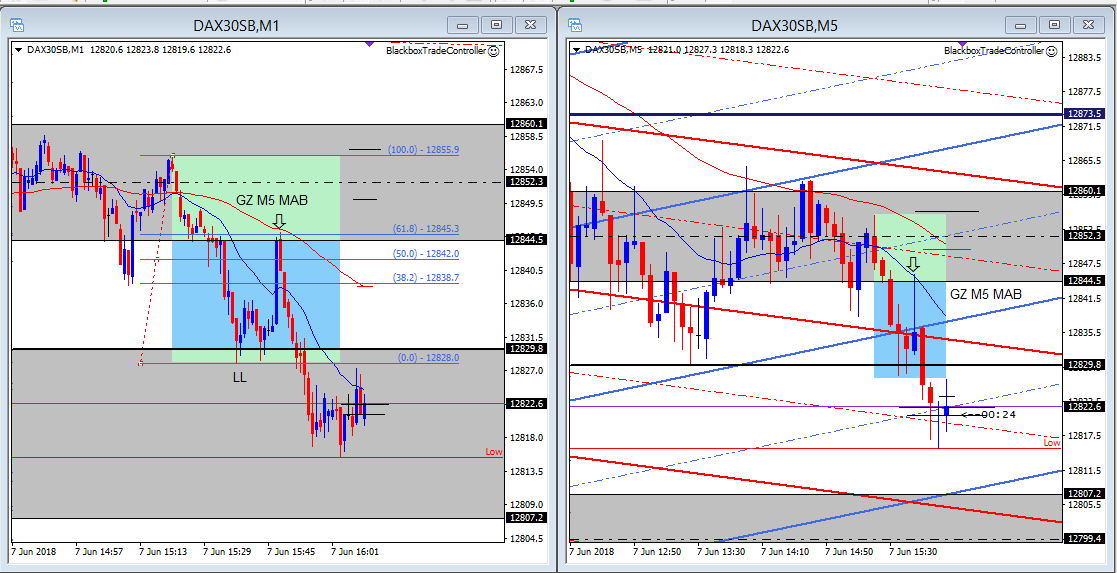

Missed another great GZ M5 Sell MAB……

After missing the great M5 sell MAB earlier I had to leave my desk only to come back later to see price has continued to sell off and produce another great GZ M5 sell MAB!!

With point A taken from exactly the London open at 8am price formed a short-term double-bottom at the upper boundary of the H1 EQZ zone at 12556.2. Once again the M1 MAB was low value and low probabilty due to context but the M5 MAB was much bettter value and turned out to be the one – again – to take.

It feels a little frustrating to not have profited from either of these but I’m also pleased that I’ve not been drawn into bad habits such as chasing price etc.

I hope this reflects a maturity in my personal trading, time will tell.

I’m not feeling tuned into the charts today so will work on the website. Well done to anyone who took either of these great GZ M5 Sell MABs 🙂

08:16

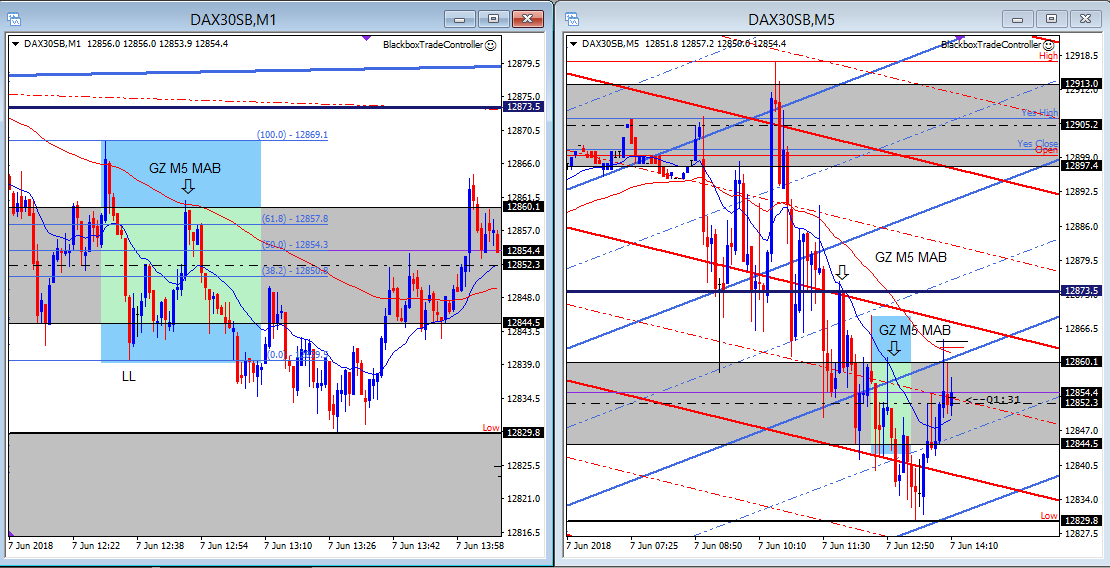

Missed great GZ M5 Sell MAB……

I’m regretting deciding to video the M5 MAB that formed after the 7am open. I just missed taking the sell, probably because I was talking and showing different chart perspectives.

It turned out to be a cracker if you’d moved your target based on it being a very bearish mood just now. Still, that’s life and others will come along 🙂

Price is still selling off as I type….

Another great lesson in the importance of ZERO distractions when price comes into the anticipated buy or sell zones.

On a positive note, it was another great early setup!