Be The Bear

When trading price action the Blackbox mantra is ‘Be The Bear’.

Nature is often a great place to find inspiration.

A mature bear will wait patiently for as long as it takes for a juicy salmon to come along, they have learned to ignore the minnows and tiddlers and not to waste their time and energy on them, but to wait for a much bigger and high value prize!

When trading price action, we must adopt the same mind-set as the mature bear by learning to filter out and ignore low probability trade setups in the same way as the bear ignores the minnows.

The bear has learnt from experience and knows that it will be rewarded with something worthwhile by waiting patiently in-the-zone until the prize appears.

Even then, there’s still no guarantee that dinner will be served. The bear has to manage the catch with extreme precision and timing otherwise the juicy salmon may get away and all the bear’s patience and effort will be wasted.

‘Being The Bear’ is a key aspect incorporated in the Blackbox Trading Plan and simple visualization techniques can be used as a helpful tool to achieve this state of mind.

Visualization

The mind is a very powerful thing, so much so that our state of mind determines our moment to moment, day to day, life experience.

For example, two people sat side by side on a roller-coaster ride can have totally different experiences; one could be terrified and the other could be buzzing with the thrill and exhilaration of it. The external environment is identical for both, the only difference is their state of mind.

A managed mind really can make the difference between success and failure in our trading.

There are many constructive techniques available, we each have to find what works best for us.

Since Blackbox’s mantra is ‘Be The Bear’ we picture ourselves as the mature bear sitting on the rock waiting patiently for a high probability price action setup that conforms to our Trading Edge.

With the picture on display we exercise this visualization technique as follows: –

- Take a good look at the picture then close your eyes.

- Imagine yourself inside the bears body.

- Hear the sound of the river as it flows by.

- Feel the breeze as it gently blows on your coat.

- Watch the occasional minnow pass by, completely unaware of your presence.

- Eventually, you see what you’ve been waiting for… a juicy salmon.

- Feel your body enter into a heightened state of alertness in preparation.

- Determine the strike zone where you will pounce on the salmon.

- If the salmon doesn’t swim into the zone let it pass and wait for another opportunity.

- If it does swim into the zone then you pounce!

If you’ve never used visualization techniques before it might feel a little strange to start with but with practice your mind will soon engage with its power and purpose.

Have fun with it, adapt it to your own style and practice it every time you trade.

This visualization technique can easily be mapped onto our trading by reminding ourselves what a good setup looks like.

- Take a good look at the setup then close your eyes and visualize the setup forming and playing out.

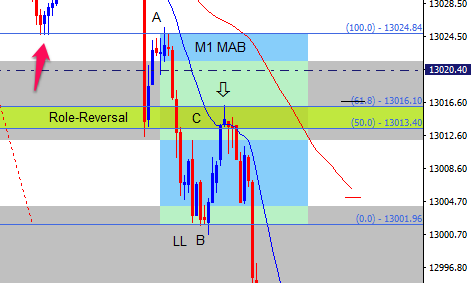

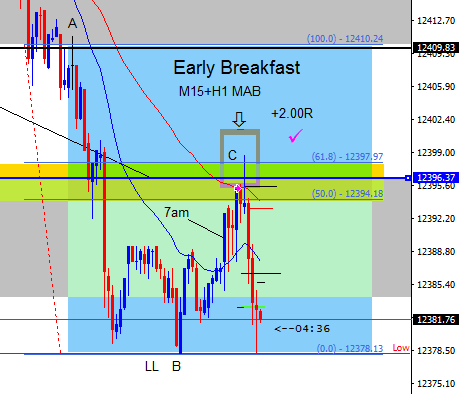

- Imagine the impulsive A-B leg forming to create a higher-high (buy setup) or lower -low (sell setup).

- Imagine marking up the B-C leg using the FIB tool.

- Imagine yourself analyzing the price action looking for confluence with chart structure.

- You see that the Golden Zone is confluent with other components of the Price Action Grid.

- You can see a great Role-Reversal zone when you look left.

- You notice an EMA coming into play that will be confluent with the Golden Zone.

- You cross reference the higher time frames looking for additional confirmation to support the setup.

- You reassess the setup and ask yourself if you still think the setup is good and conforms to your trading edge.

- You move the Trade Tool into position in anticipation of the potential setup should it play out.

- You wait patiently ‘Being The Bear’.

- When price reaches your strike zone you enter the trade.

- You feel good because you know that whatever happens you would take the trade again.