Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

13:56

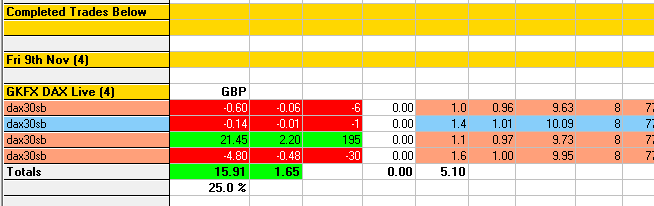

Sell@RESCON Breakeven, -0.06R

I sold@RESCON and on this occasion feel I got the trade management just right 🙂

When price broke back below Yes Low and the H1 Channels I trailed my stop to just above the 61.8 of the Inner-FIBCON.

This resulted in another breakeven trade that proved to be a good call otherwise it would have been -1R.

10:36

GZ M1 Buy FIBCON Breakeven, -0.01R

I liked this buy setup, it had good structure and context after the bull move up. I trailed my stop once price had begun to move up, partly because I wasn’t sure if price wanted to test the M5 MAB.

Yet another wish I’d walked away, I used a Buy Limit to enter the trade.

The 2R would have come in so pleased with the price action read, would take it again 🙂

As I type price has come storming down…..

08:49

GZ M5 Sell MAB winner, +2.20R

At last!!!

A great GZ M5 MAB Sell winner 🙂

With point A taken from just below the H1 Bull Channel at 11468.4 the 61.8 was at 11468.8, the M5 EQZ.

I used the Trade Tool and got a great entry and profit target, I was tempted to for for more profit but decided the D1 Bull Channel might hold. Of course it hasn’t and I’d have had multiple R instead!!

Oh the power we have to influence the market 🙂

08:09

GZ M1 Sell MAB loser, -0.48R

I took the M1 Micro-MAB at 07:36, happy with the setup and context. I trailed my stop once price had tested the 11468.8 level, on this occasion it proved a good call as I’d have had a -1R otherwise.

Structurally and contextually it was decent, after sell bear spike down at 7am it was with the short-term order flow.

I’ve just missed the M15 MAB at 08:11 when price moved up to Yes Low.