Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

20:16

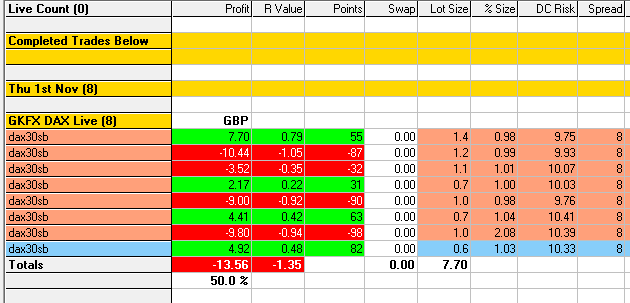

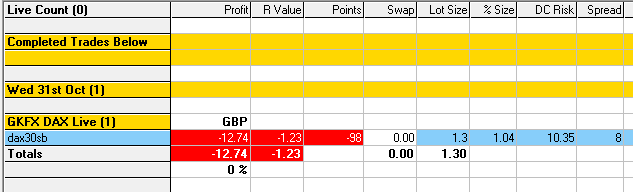

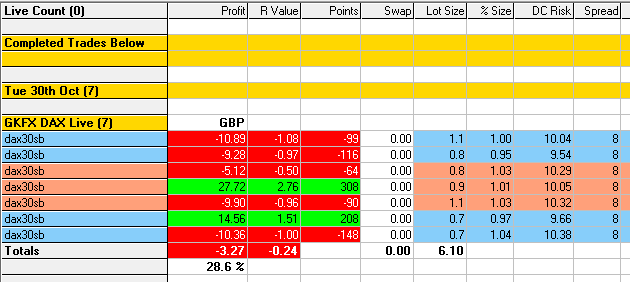

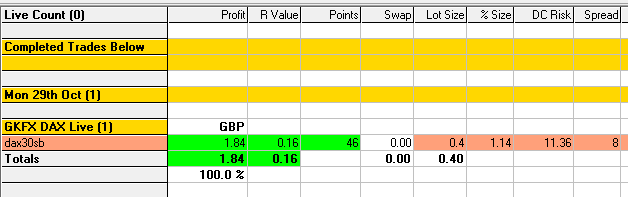

Today’s Results, -1.35R

I traded the afternoon session, a buy trade followed by six sell trades. Once again I failed to realize 2R winners due to not letting them play out and trailing my stop too close.

One loser was Sell Limit that was not supposed trigger but did due to a fast spike up off the D1 Bull Channel.

Another range day that made it tough to trade FIBCONs, the best trades were selling at the top and buying at the bottom.

The main lesson from today is there’s a time to use/consider limit orders as explained in the blog.

16:22

GZ M1 Sell FIBCON winner, +0.79R

I’ve done it again!!!!

Trailed my stop once price had reached the 1R level plus the Golden Zone of the Inner-FIBCON. On this occasion it was just too close, above the M5 EQZ@11468.8, the Inner-Inner-FIBCON was where price turned around – right at my stop.

I marked this up at point B and used a Sell Limit order, it was Freaking Perfect!!!

It even triggered whilst I left my desk for a few minutes – Perfect. Wished I’d not come back to see it and trail my stop, another 2 minutes and the 2R would have come in.

I will sort this, it a good problem to have because you have to be in a good trades to experience this.

Also, the Sell Limit played out perfectly and it’s whetted my appetite for them. As I mentioned earlier, marking up a Limit Order should force a really detailed study of the setup and if done well means you can place it then let it play out without having to watch the screen intensely and have to time the Trade Tool which at times can be a challenge.

There’s a time to use the Trade Tool and a time to use Limit Orders…

Despite not getting 2R from the last trade it was a great example of the Sell Limit.

15:09

Six Sell trades, 2 winners, 4 losers

Wow, after not trading this morning I sat down for the afternoon session.

I’ve taken six sell trades in quick succession, not good practice but here’s the headlines.

After the earlier buy trade where I mentioned about using limit orders I found myself setting one up and it got triggered accidently.

I did set it up, testing how fast I could move and place it but the spike up off the D1 Bull Channel plus the Open was so fast I didn’t have time to cancel it.

That was the -0.94R loser.

I then sold when price reached Yes High, it was a great setup, I got a great entry BUT once again I did not let it play out and only got +0.42R from it.

There’s a real pattern at present where I’m:

- Not letting trades play out.

- Not trusted Grid structure.

This MUST be sorted!!!

I then setup another sell limit for the M5 MAB but did not cover the M5 EQZ@11484.4, got just tapped out before it went on for a 2R winner.

I ended up taking two more sell trades that were not totally rubbish but I should have walked away at that point.

13:35

H1 Buy MAB winner, +0.48R

I was The Bear on this H1 Buy MAB setup at the 61.8 level of the Golden Low-High zone but got a poor entry so my target was above not only the Inner FIBCON’s Golden Zone it was above Yes High.

Once again I did not let things playout, as Adam Khoo points out, that can skew the traders equation big time!!

See below on the M15 chart the KeyZone just below the Golden Low-High zone. I’d marked this up as the best value entry but price spiked such that manually entering using the Trade Tool meant price had moved by the time it was executed.

It’s important to mark up only the obvious KeyZones, it’s easy to over do it

Note how price formed a Micro-Double Bottom perfectly on the top of the lower KeyZone!!

I’ve been starting consider the use of limit orders to get more precise entries and on this occasion it would have been the best option. The 2R target would have been much lower and as I type would have come in by now.

Using limit orders does have the benefit of forcing you to anticipate the setup and mark it up very precisely.

They also mean you can blink and not miss a setup which can happen often on the DAX 🙂

09:33

Another GZ M1 Buy FIBCON

I’ve had a few admin things to sort through so have not traded so far today.

I’ve just noticed the GZ M1 Buy FIBCON at Yes High and have marked up the Inner FIBCON and once again guess what?

Price reached it’s Golden Zone@11516.8 and then reversed back down to Yes High. The bulls quickly drove it back up but the key thing to note is:

The Trade Tool allows us to get a very precise entry such that we want the 2R to be at the 50% level of the Inner FIBCON or better.