Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

17:29

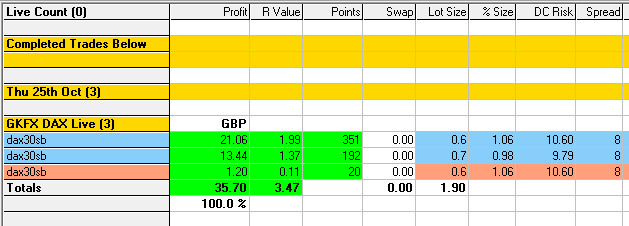

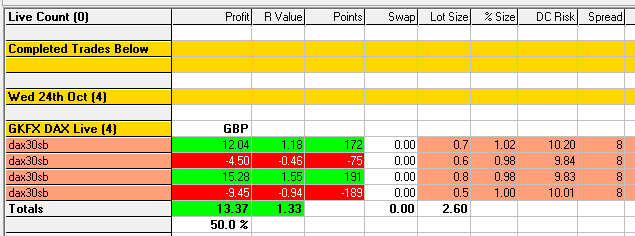

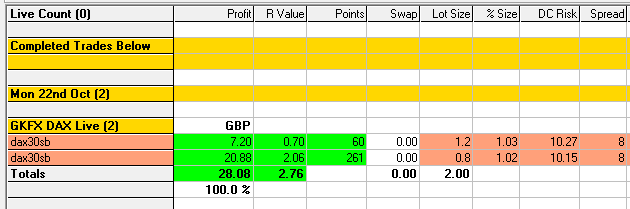

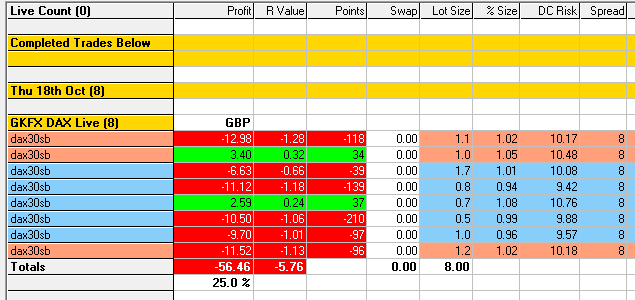

Today’s Results, +3.47R

If I’d have left all three trades alone once I’d entered then today would have been a +6R day!

Like yesterday, I would take them all again. It’s easy to say that when they go well but losing trades are ok and normal so long as you know you followed the process of anticipation and patiently waited to enter at a predefined level.

17:59

Another Outer-Inner FIBCON Example

Following the M5 Buy MAB winner another one formed as shown. I wish I’d been at my desk to see this, it was a good setup, the third GZ M5 Buy MAB on the trot.

However, note the Inner FIBCON’s Golden Zone between 11302.2 – 11308.0, it’s where price reached from the M5 MAB before stalling. This is why I closed out two of my recent trades looking to see if I can use Grid structure like this to profitable effect 🙂

Therefore, the ideal 2R setup is where the target is around the 50% level of the Inner FIBCON or better. Reasoning like this A-B-C setup after A-B-C setup will lead to Mastery!!

16:28

GZ M5 Buy MAB Winner, +1.99R

I Really Enjoyed this one……..

After anticipating it, updating the blog I was The Bear…..

It started well then came the slight sweats as price got within 1.4 pips of my stop. I did not move my stop, even below the D1 Bear Mid-Channel.

Fine margins that didn’t go against me this time 🙂

I trusted the setup, I loved the structure and when I hit Ctrl-E I had that all important feeling of “Win or lose, I’d take this again!”

I did mark up the Inner-FIBCONs Golden Zone between 11280.3 – 11288.5 but this time price was kind to me and pushed on up to my target.

Had I been at my desk I would have taken the earlier M5 MAB at point A (11219.9), to have got both of these at 2R would be a well spent afternoon.

12:08

Two trades – Outer-Inner FIBCON Structure

I totally anticipated the sell@RESCON but ended up over-thinking it and closed out a great entry as I’d ideally been wanting price to move a little higher.

I looked the M15 and H1 charts and reasoned that price might push up to the 11280.0 level, I setup the Trade Tool. Then when price stalled I entered only to tell myself it was FOMO so closed out for breakeven and wait for the ‘better entry’ 🙁

It never came of course so messed that up trying to call the ‘perfect’ entry!!!

I then marked up what might have been an M5 MAB if price had sold off quickly enough at the 11219.9 M5 EQZ level. Eventually price came down so I entered the buy trade at the 61.8 level, structurally I liked it.

I closed out for +1.37R due to the Inner FIBCON’s Golden Zone between 11241.4 – 11247.6, of course price did eventually break threw and I’d have had the +2R but as I mentioned recently, when marking up the A-B-C patterns in real-time you start to see more and more the Outer-Inner FIBCON structure.

Marking up and mastering the Outer-Inner FIBCON structure in real-time I believe is key to our future success!!

In the MABs and FIBCONs examples section you’ll find this structure on a few of the screenshots, it’s time to go deeper into it….

FIBCONs are the building blocks of price action as price makes its way or and down. By marking them up in advance such that it becomes hard-wired into our routine we will start to set more accurate profit targets based on the Golden Zone of the Inner-FIBCON.

I was pretty sluggish early this morning due to a late night so decided to watch instead. There were two good GZ M1 Buy MABs I was tempted with once price made the Higher-High at the Open before a brief retrace – 1st M1 MAB – before moving up.

Both M1 MABs are shown below, note the Grid levels in use on the micro-retraces, 11114.1 and 11167.0

Also note how useful the short-term Micro-Channels can be once they give you enough points to mark them up.