Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

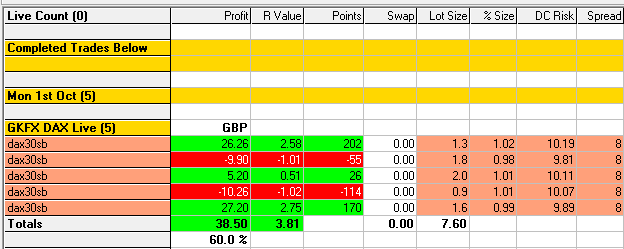

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….