Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

16:47

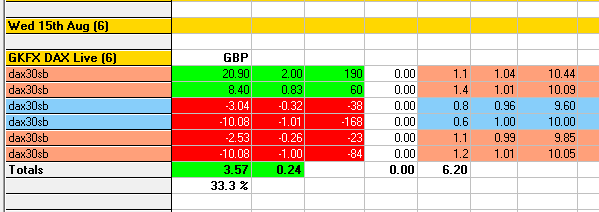

Pleased with todays trading 🙂

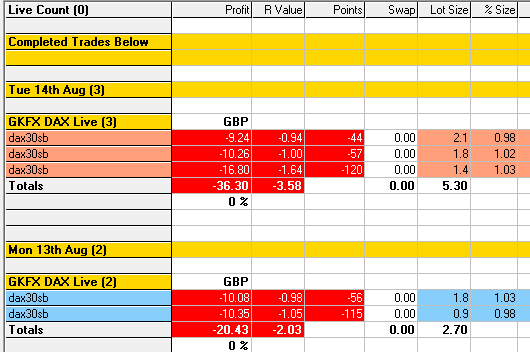

Following on from yesterdays poor performance I’m pleased with how today went. Another four straight losers was not a good start BUT the key difference was the trades were reasoned out, they just didn’t work out, see below.

To then have two winners by being consistent in my approach and end the day with a small profit feels good. I controlled my risk and was close to being 2-3R in profit.

Yesterday hit me hard, not from having three consecutive losers but it was the emotional spiral that I experienced. Today I’ve benefited from:

- Displaying and following my plan.

- Anticipating setups well in advance.

- Reducing my risk when the trade moves into profit.

- Waiting patiently for a value entry which means I wasn’t tempted to move my stop.

- Being The Bear!!

Onwards and upwards….

16:28

GZ M1 Buy FIBCON off PM Low

After the +2R winner I took a break, however, I should also have been anticipating a reversal FIBCON off such a key level as the PM Low.

I came back to my desk to see that’s exactly what happened and it was superb buy setup as shown. The retrace to the 61.8 level was perfectly confluent with the PM Low, price moved up quickly to the H1 Bear channel to form an M5 Sell MAB.

16:19

M1 Sell MAB Winner, +2.00R

I anticipated the move down to test the PM Low, just below the D1 EQZ mid-line at 12135.7 so once price broke through the H1 EQZ level at 12154.6 I took the M1 Sell MAB that quickly followed.

It played out as anticipated for a nice +2R winner 🙂

This means I’m in profit for the day, the traders equation in action, see below.

16:04

M1 Sell MAB Winner, +0.83R

This setup is the best so far, a proper Juicy Salmon!

I marked up the Role-Reversal zone and got a great entry as shown. It quickly went into profit and in my haste to move my stop I dragged it down to the H1 bull channel boundary and before I had chance to move it back up above the channel I was stopped out for +0.83R, it then went on to hit my 2R target.

Very happy with my anticipation and entry, not so happy with my trade management, should not have rushed it. Maybe after ten consecutive losers I was keen to lock in a profit?

14:25

GZ M1 Buy MAB loser, -0.32R

This trade was again based on a reversal pattern, only this time off the Monthly MAB.

Structurally it was very good, my entry was late otherwise I would have locked in a profit. Instead I trailed my stop to reduce my risk.

I’ve now had ten consecutive losers as a result of yesterdays three howlers. We’ve mentioned how fine the margins are in trading, like golf, tennis, etc.

Today I’m OK with the trades taken, this last one should have been a winner, it was poorly executed. The traders equation will do its thing, one good winner and I’m break-even on the day 🙂

14:17

Just missed Monthly Buy MAB

I was having lunch when price moved down to the Monthly MA to produce a rare MAB.

When I returned to see it positioned the Trade Tool as shown just as price moved back up above the two mid-lines, a sort of micro FIBCON.

If I’d been at my desk maybe I would have taken it??

12:40

Buy loser -1.01R

This was a CT trade based on price reversing back up due to a combination of:

- D1 Bull Channel

- H1 Bull Mid-Channel

- D1 EQZ level at 12282.6

- H1 EQZ level at 12282.4

- M5 EQZ level 12278.1

acting as an area of SUPCON.

For a while it looked promising but eventually the bears moved price lower. The reasoning behind the trade was that multiple R was possible if price moved back up into the D1 and H1 channels.

This has been observed many times, however on this occasion it didn’t play out as anticipated.

So that’s three losers – again – but the big difference compared to yesterday is that I’m happy with my reasoning. It’s a wee bit frustrating to not have taken advantage of the strong move down.

12:32

Sell Stop loser -0.26R

For the first ime in ages I setup a Sell Stop PO with the 2R just above the 12331.0 M5 EQZ level. This was based on the pressure that was building up as price broke down through the H1 Bull and Bear channels plus the D1 bull channel.

However, due to the speed it broke through the slipage meant my target was much lower. I trailed my stop and eventually got stopped out for -0.26R.

The trade was based on a breakout which did take place, it just didn’t work out. Trailing my stop meant I didn’t take the full 1R loss 🙂

Sell and Stop Limit PO’s do have their place in a traders arsenal, price did go on to move much lower.

10:03

GZ M1 Buy MAB loser -1.00R

Took the sell M1 MAB back down to the session low but didn’t work out.

I took the trade because the PW Low was in play and I’d anticipated the 61.8 level BEFORE price had broken down through the PW Low.

I’m happy with the setup compared to the three sell losers from yesterday. I’d argue that 40% of these setups will be winners. It wasn’t the juciest of salmons but I wouldn’t class it as a minnow due to the PW Low.

I was pleased with my patience waiting for the entry and pleased I didn’t move my stop 🙂