Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

14:58

Scotty Spice Comments

Hi Guys,

Elaine has added a comment below showing how well the channels capture the Price Action. With Mastery we will use this to our advantage 🙂

08:14

Software Update

Guys, yesterday afternoon I began working on a software update and will continue working on it today as I’m in the zone.

I will be watching things but not trading, I might post an update if I see something worth commenting on.

The update is related to optimizing the horizontal Grid structure to make it clearer than it is now, based on some feedback.

Good luck trading, “Be The Bear” and wait patiently for those juicy salmon like the one that showed up at 2 pm yesterday 🙂 See below.

07:37

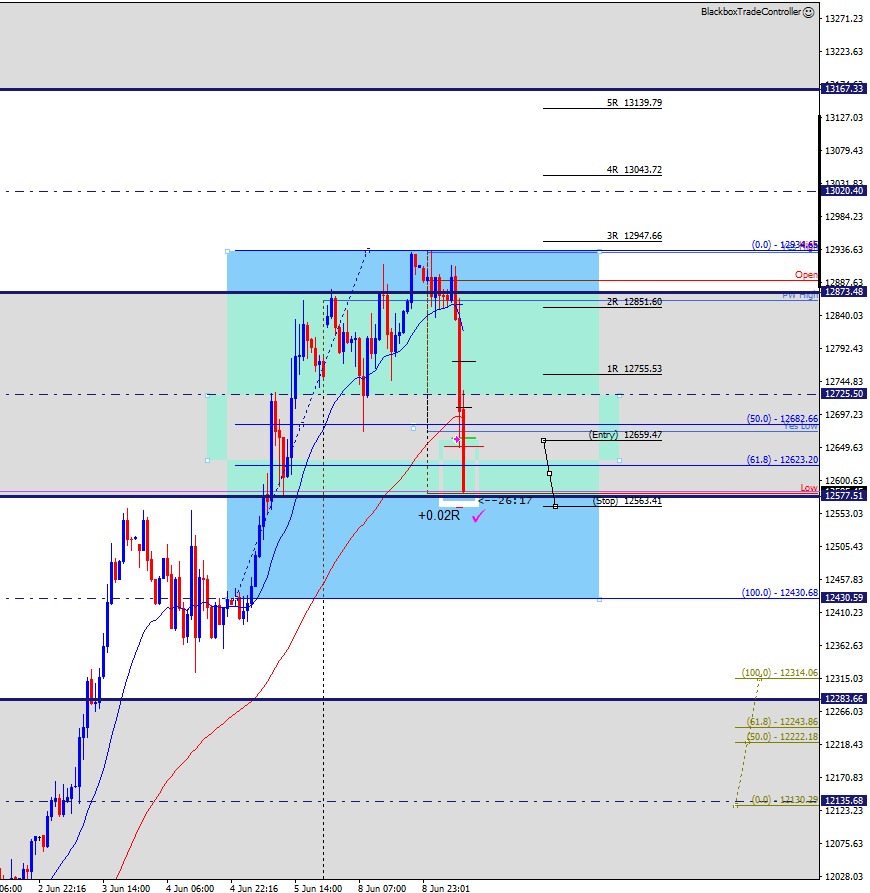

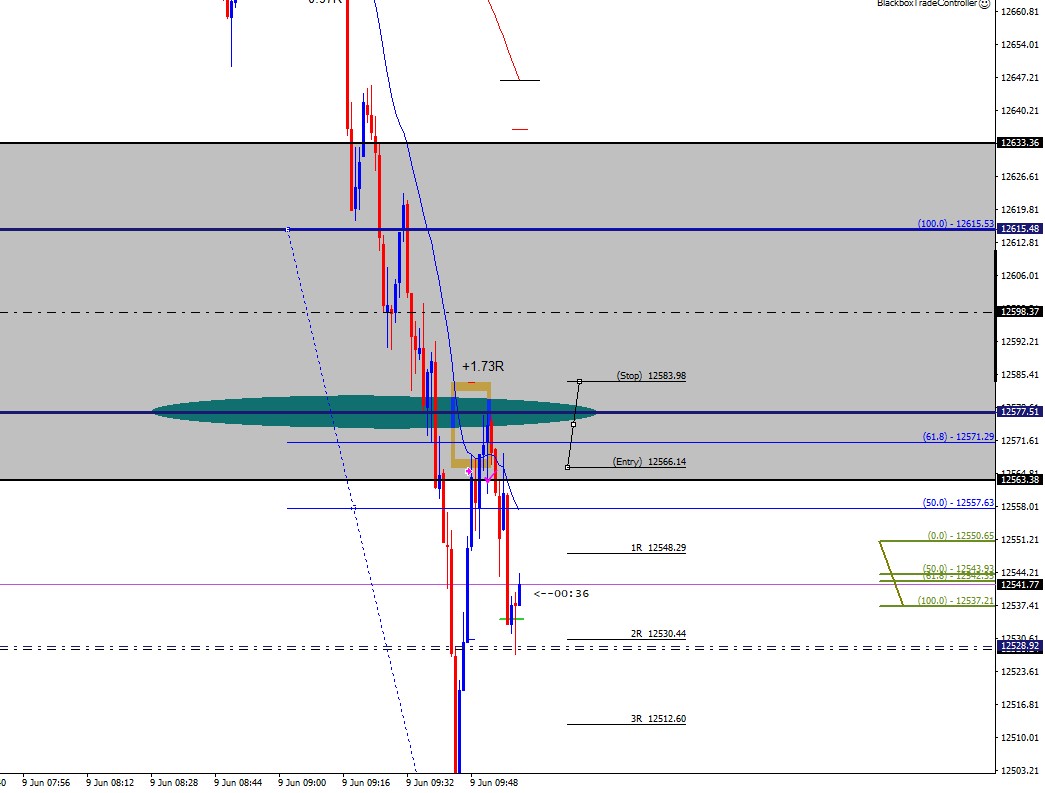

Grade A Setup

The screenshot above is of Alex’s winner yesterday. He used a Sell-Limit and let it play out so he didn’t have to sit watching the charts.

Both Elaine and Alex anticipated the setup and had winners. Joel and Rab also spotted it which is exactly what we want to nurture, an environment where we’re all looking for the same trades.

Well done Alex! It was a great end to your day, focus on the process, and how you felt when you identified it.

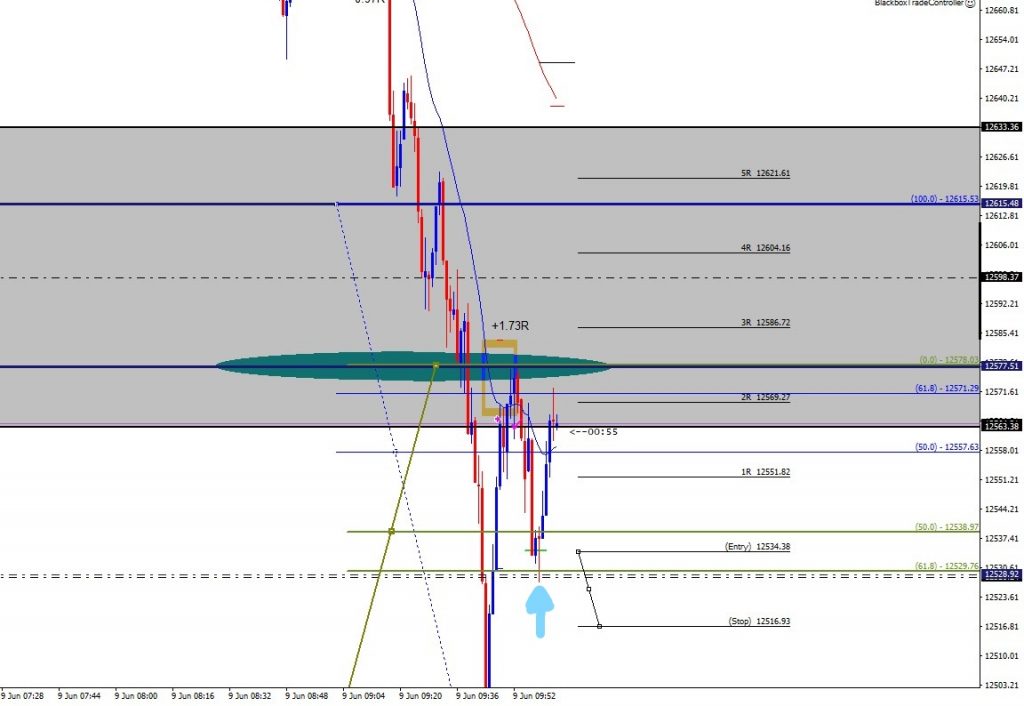

Below is Elaine’s setup, refer to her comment on yesterdays blog to see it in full screen.

06:27

Bears in control

The bears are in control following yesterday’s sell-off. Note how during the overnight session price moved up to touch the magenta line I put on yesterday.

The daily level of 12283 might act as Role-Reversal based on when it acted as resistance back in late February, see the down arrow.