Trade Analysis

August 2018

Thursday 16th

10:06

M1 15min MAB (failed 1min MAB) | Sell | -1.00R

A bit unlucky again here, but really I should have tried a few different positionings of the fib tool before settling on an entry point. A fib tool drawn from the underside of the 5min EQZ to the bottom of the move results in a 61% level that favours the 5 or 15min MAB with a later entry and a chance to give more breathing room between the hourly bull channel and the stop.

Wednesday 15th

Wednesday 8th

22:00

M1 | Sell

Checking how the charts looked at the end of that day, and perhaps my last trade wasn’t quite as bad as I had previously thought.

Had I taken into consideration the position of the four higher timeframe MA’s, I could have waited for a better entry at the top of the 5min EQZ. With a fib tool drawn between two 5min EQZs – spanning almost the whole bearish move after a daily high – price reached spot on the 61 fib level before turning around.

15:49

M1 15min MAB | Sell

I let emotion get the better of me with this trade.

Frustrated that I had missed the good set-up earlier, I tried to make this work even though the signs were telling me to leave it alone! I was looking for a 15min MAB, which was just above my entry level. At this point, however, price was looking bearish with an impulsive move up through the 61 fib level, and my stop was left floating around between and below higher timeframe moving averages. A bad trade all around.

14:10

M1 5min MAB | Sell

I think this was probably the clearest and best potential trade that has presented itself today so far. Clear impulsive move through yesterday’s close and the open, a retrace to the underside of those levels, with all but the 1min MA coming down to provide resistance.

With a tight stop, I think +7-10R was possible holding the trade down to the daily EQZ (12577.5), which is believe is a target.

If I had taken this trade, I think I would have taken profits just above the hourly bull channel.

Tuesday 7th

16:22

M1 Low-High GZ | Buy | +0.15R

Not the best of screenshots for this trade. I am writing this at 22:25, though the trade took place at 16:22. I had to go out at 16:45, so wasn’t at my computer to monitor this trade and I ended up closing it remotely through the MetaTrader app, which was a first for me!

My stop for this trade was well positioned (or maybe I was just very lucky) and I feel that had this trade happened earlier in the day, I would have brought in the +2R I was looking for.

Price found resistance at the bottom of the GZ (which you can see more clearly in my previous screenshot at 16:08), and a confluence of four MA’s began to send price in the opposite direction. As the day was coming to a close, however, momentum was lost and price ranged around the daily bull midline, and between the moving averages.

Had I been at my computer for the duration of this trade, I would like to think I would have closed at a better time and had a marginally bigger profit, but it would not have been by much.

Today has been a big boost for me, as I finished with a +3.08R profit and strike rate of 75% and felt that I was in tune with the movement of price throughout the day. If I had been a bit luckier with the trade at 15:30 this could have been even better!

This is nothing groundbreaking, but my best day in a while, and coming off the back of some time off trading, it feels good! Noticing the potential for the low-high GZ trade early enough was key, as I was able to trade the price down into the GZ and profit from the movement, even if the actual low-high GZ trade itself wasn’t a success.

16:08

M1 1min MAB | Sell | +2.00R

Following the trend down towards and into the low-high GZ.

Point B from the previous trade gave a good level of resistance and was almost perfectly confluent with the 61 fib level.

You can see here that I’m currently in another trade with my entry at the daily bull channel midpoint and hourly MA. I’m not sure if I have given the trade enough space to play out with my stop. I’m tempted to pull my TP up to at least just underneath the hourly EQZ (12701.8), but as it’s the end of the day I’d rather ‘bank’ profits earlier if it reaches the +2R level.

15:30

M1 5min MAB | Sell | -1.07R

A big part of the reason I took this trade was that I had convinced myself price was going to fall towards the 1hour MA and low-high GZ.

I feel that I was unlucky with my stop on this one. I did have the space to give the trade more room with a slightly wider stop that would have prevented this.

09:42

M1 1min MAB | Buy | +2.00R

The set-up for this trade wasn’t as clear cut as the previous, but price seemed to be interacting well with the 1min MA and after breaking through resistance at yesterday’s high I felt it could act as a good support level on the retrace. I intially hesistated and waited for the 1min MA to come up and meet price. I could have, and should have, got a slightly better entry to squeeze another 0.5-1R out of the trade, but I’m happy with the +2R.

09:22

M1 1min MAB | Buy

I missed this one but really should not have. A nice set-up with the impulsive move coming off the bottom of a 5min EQZ (12685.7), up through the top of the 5min EQZ (12701.4) and an hourly EQZ border (12701.8) that was previously resistance. Price retraced back into the GZ, confluent with the hourly EQZ, 5min EQZ, bear channel and the 1min MA.

Monday 6th

12:35

M5 5min MAB | Buy | -1.05R

My first trade after a couple of weeks break from trading. I placed the stop below the weekly, daily and 4hour MAs, feeling they would provide support along with the 5min MA.

The better trade was one with the entry at point A, as Phill documented in today’s DAX commentary.

June 2018

<< May 2018

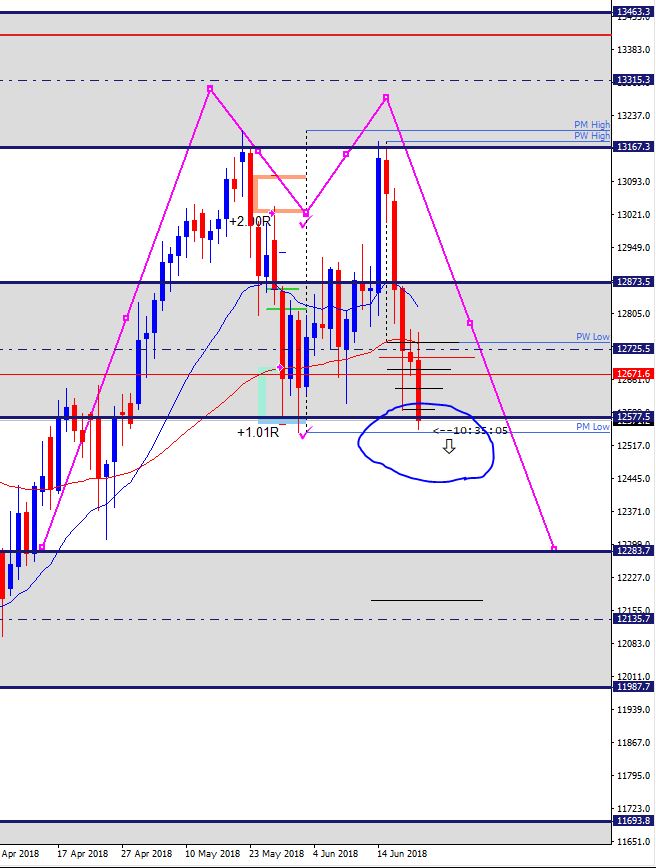

Wednesday 27th

Double Top Clearly in Play

Still amazed by the speed of the movement, the Double Top was clearly in play!

Price broke the PM Low, retraced the day after and retook the bearish trend on Monday with a very aggresive move.

The question now is: will it go now towards the PW Low to then resume its way dow to end of March levels or is the downtrend ending?

I’d like to hear your views on which signals should we look for in order to make the most of such a nice price action!

Thursday 21st

Trade Ideas

It looks like the market likes to play with fire.

Faster than expected at the beginning of the week and helped by concerns over a trade war between US and China, price is now playing around the Previous Month Low (PM Low).

It might not be today, and it might not happen at all, but a Double Top could have formed days ago at the 13167.3 level (base of a daily equidistant zone), and if prices manage to close below the PM Low level, further weakness might be seen in the market, at least until reaching the 12283.7 area, where price retook a bullish trend near the end of April.

I would like to see a rebound today in order to consolidate price and then a nice way down to end of April levels.

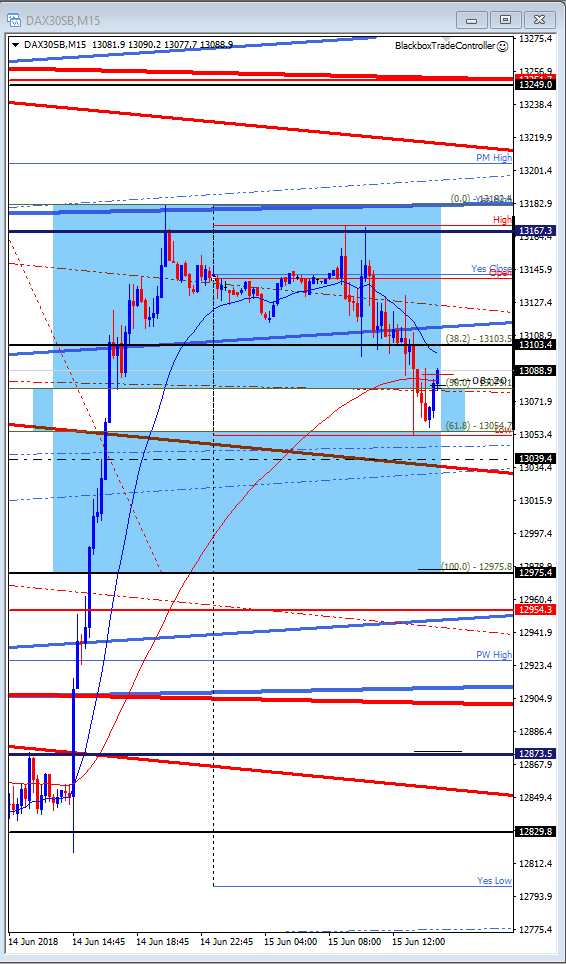

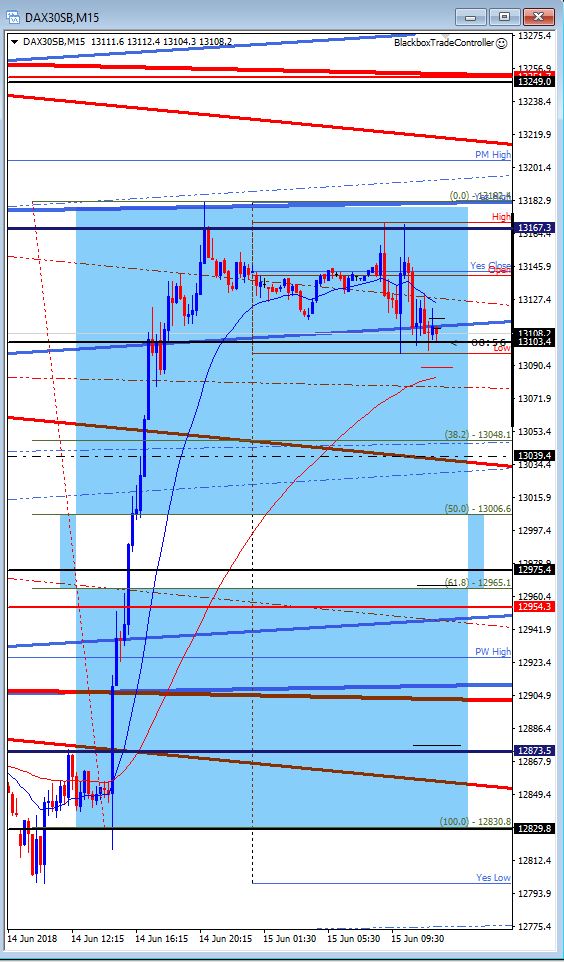

Friday 15th

Epic FIBCON at the 4 Hour EMA?

If it manages to break the 13103.4, fasten your seatbelts because I expect it to go all the way down to the 12975.4 level, that is, to the bottom of the hourly equidistant structure.

I expect a move upwards before going down to break the resistance at the 13103.4 level, possibly to 15ema or Yes Close/Open levels!

Happy trading

Alex

Thursday 14th

Possible FIBCON with Support at 12829.7 Level

July 2018

Wednesday 18th

09:10

Low-High FIBCON

Let me tell you something: if you saw that coming, you gained my respect. I didn’t! I just traded a FIBCON with the YesClose level as point A.

I was lucky enough that it didn’t hit my stop loss, and as it happens in these trades where the retracement ends near your stop loss, I ended up with a poor entry level. That explains the reason why I didn’t let it go further up. When the last candle you see in the chart reached its top and went down quiclky, I let fear takeover and tightened up my stop loss. It came down, gave me a +1.15R and went for the 2R level, classic!

08:57

1M Chart Double Top

Risky way to start the morning but it made me wake up quickly!

Not a trade that would be among the BlackBox edge, but as soon as I saw the structure forming I realised that if it managed to brake the Key Zone midline at the 12765.8 level, the Double Top could be in play.

I kept the stop loss tight while it was going down as it is a risky trade, that’s why I didn’t max it up. The movement downwards reached exactly the level I was expecting it to reach (Daily channel+Yes High area), but it took me out first!

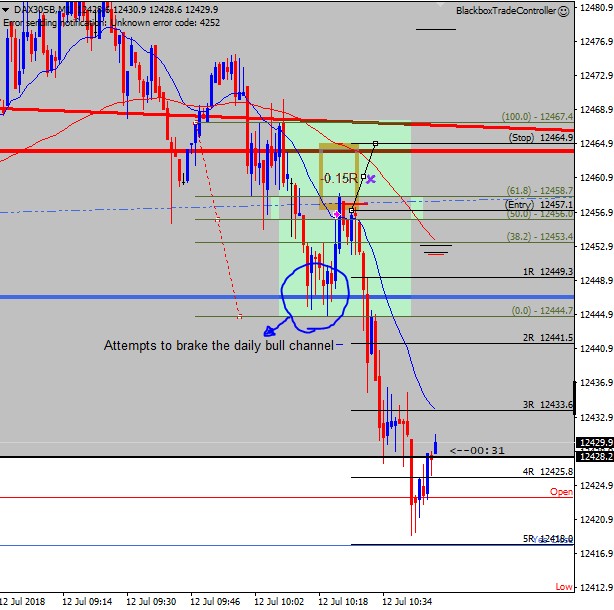

Thursday 12th

08:23

M1 Sell FIBCON

What a frustration! I missed what it would have been a perfect first trade.

After seeing price interacting with the Bull Channel trying to brake it, I thought that price would likely move up to find resistance and then come back down, probably to look for the 1248.2 equidistant channel boundary. So when price went up to the Fib Toll 61.8 level, even though structurally wasn’t perfect I decided to give it a go!

After a couple of mitues I decided to close the trade thinking that price was going up again towards the M5 MAB, only to see that right after I closed the trade, price did exactly what I was expecting when I entered a trade, that is, a strong movement downwards. Guess what? It reached the channel border as originally expected, a 3+R trade that would have been a perfect start.

You may wonder why I took such a poor decision? I need to finish early today and loosing 1R would have put me in a bad position for the rest of a short trading day. Mind tricks that I shouldn’t be listening to!

Wednesday 11th

08:40

Traded Sell FIBCON

Yes! I got my reward for being patient. Unsure of where to fix point A (100.0 level of the FIBCON tool or the place where the downward movement initiated), I guess I put it right where it had to go!

After some playing around with the bottom of the Daily Bear Channel, it managed to brake it and went to my 2R.

Should I have moved my target furhter down? I did :), but then closed it manually to avoid being greedy. Price action showed that for me to get more than 2R I should have allowed a significative retracement, something that I was not going to allow and could have ended with a 1R or less trade.

08:27

Missed GZ M1 MAB

As you can see in the image above, the market today gave us a really nice opportunity to profit from the initial retracement after the sell-off.

Even though we know by experience that the first contact with the M1 MAB after a sell-off usually offers a quick retracement, I doubted too much and decided not to trade it. It would have been an easy 2R trade!

July 2018

August 2018 >>

July 2018

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 |