<< May 2018

Thursday 28th

Wednesday 27th

Friday 22nd

08:04

Early Winner!

Well I am pleased to say I started the day with a winner… I did have to be nibble fingered and I managed to get it just right.

However, after starting well the fear of giving back stopped me from entering the buy trade that followed… it’s a fine balance but sometimes you have to trust your instincts, easier said than done eh?!

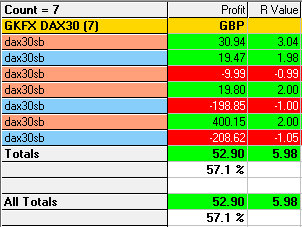

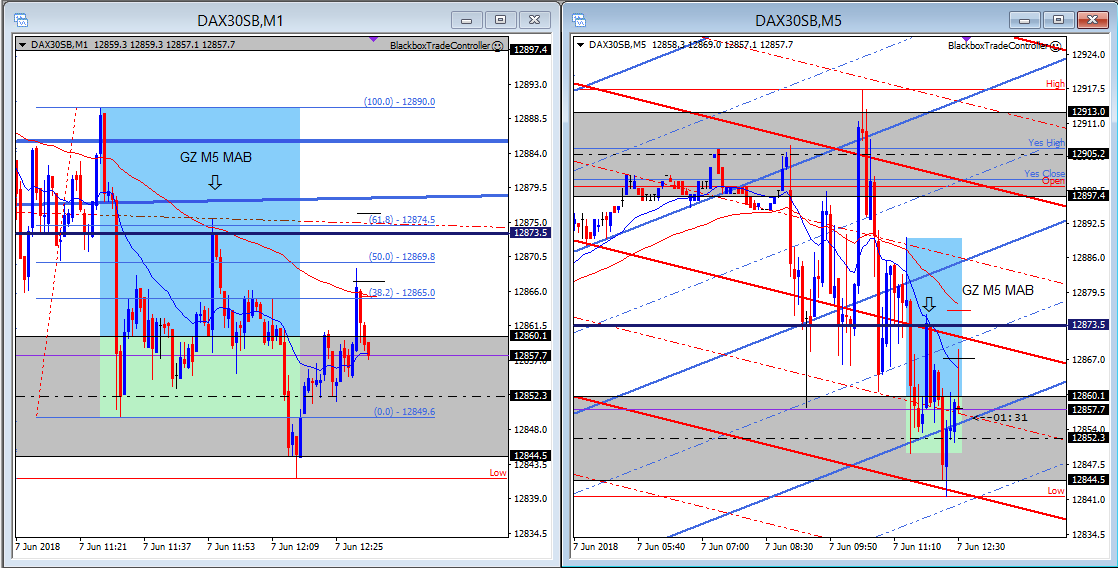

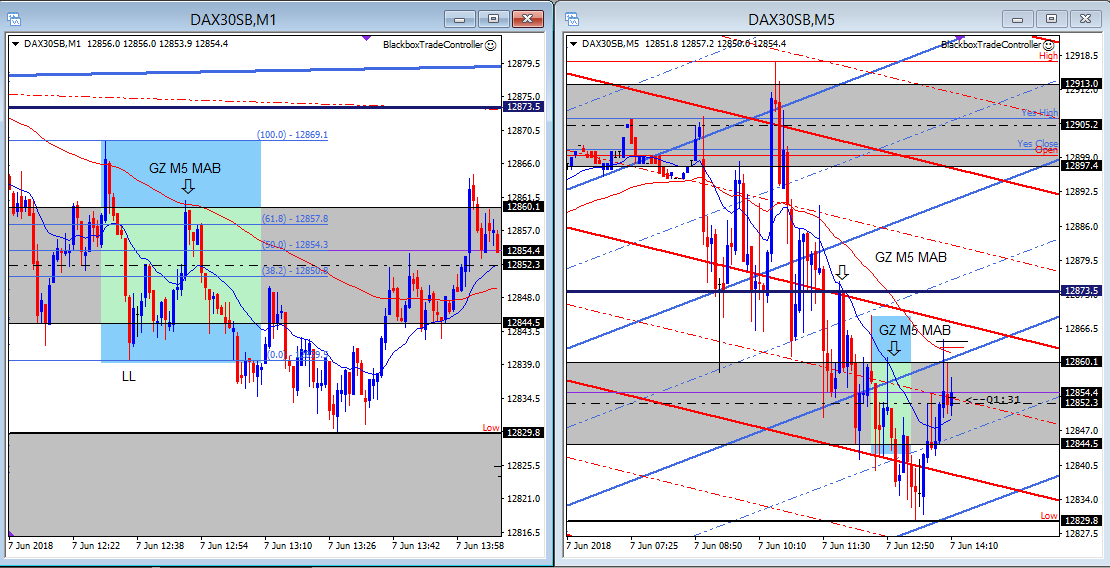

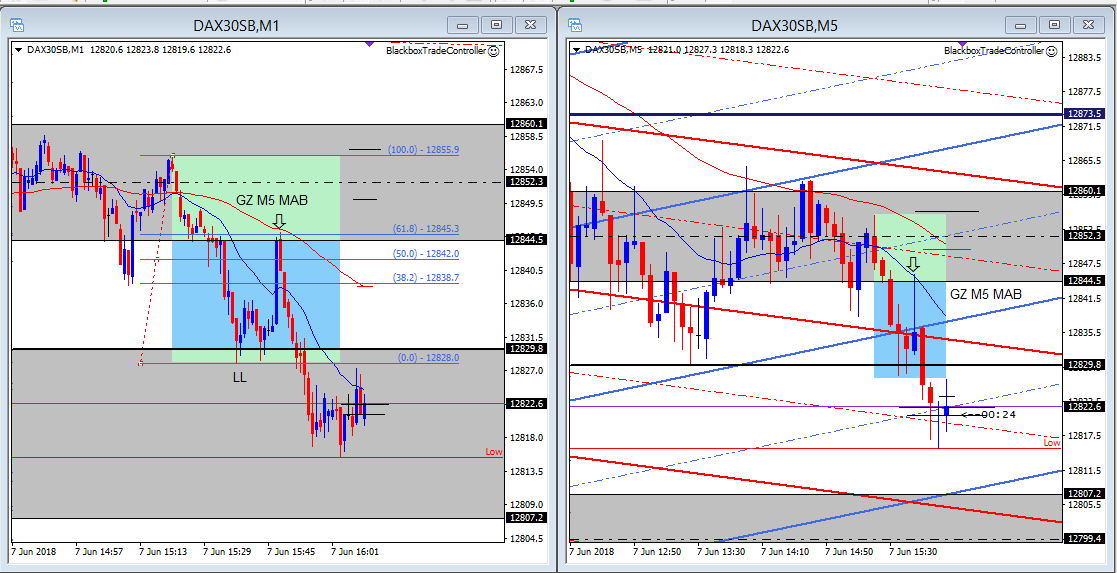

By the way, my early winner is the GZ M1+M5 MAB trade that Phill commented on, as shown below.