Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

20:03

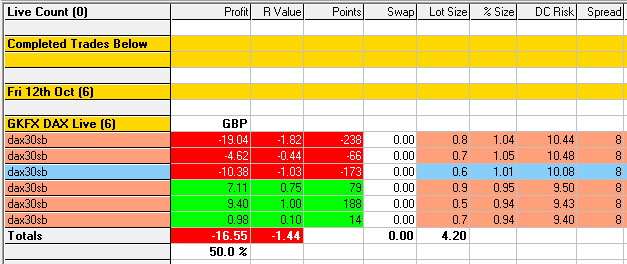

Today’s Results, -1.44R

Below are my comments before I took a late losing trade. I was +0.38R in profit till then!

The late trade was a sell@RESCON that didn’t work out

…………..

A break-even day of fine margins where it could so easily have been a +5R day.

My trade management is a work in progress for sure but that means I’m taking good enough setups consistently for this to be where my focus needs to be 🙂

20:27

Sell@RESCON loser, -1.82R

Ouch!!

I sold when price moved back up to the key H1 EQZ level @ 11516.8, it started well but then I ended up moving my stop to allow the H1 Bear channel to play its part, did not work out and resulted in a -1.82R loser 🙁

Both the H1 EQZ and the H1 Bear Channel had been acting as support earlier but failed to function as resistance when I needed them to.

This has been my latest live trade at 20:09 on a Friday, the bulls got a boost from somewhere, I was on the wrong side of it.

19:49

GZ M5 Sell MAB loser, -0.44R

This would have been a +2R winner had I not trailed my stop at around 1R in profit.

I should have kept it above the 61.8@11490.3 but even then it might have been tight. I could have gotten a better entry but the end result was a -0.44R loser only to see it go on to win – such fine margins!!

19:41

Buy@RESCON loser, -1.03R

I took the buy trade when price eventually moved down to the H1 EQZ@11516.8 and the 61.8@11517.8 as mentioned below at 12:14.

It started well but this time the level failed. I’m wondering what clues were there in the way price approached the level.

It slowed down and sat above it forming what could be called a “Bearish Rectangle” for over 30 mins before the break. Yesterday on two occasions it approached the level at speed and bounced perfectly.

I was pleased that I waited until it reached the level, on this occasion it didn’t work out.

12:14

Buy Setup@61.8 level@ H1 EQZ@11516.8 ??

I’ve marked up a possible Buy setup if price moves down to the H1 EQZ@11516.8

Point A is taken from Yes Low, point B is taken from today’s High (Yes High also) and look where point C falls – perfectly confluent with the H1 EQZ and look-left to see what happened twice yesterday.

12:03

GZ Sell@RESCON, +1.00R

This was great sell setup at zone of RESCON, I was pleased with my entry and decided to move my target in case the bears took over and drove it down to the H1 EQZ@11516.8 which they had done twice yesterday.

After seeing my target passed price reversed at the Open+H1 Bull Channel then moved back to hit my stop. Price is currently moving back down, had I not trailed so closely I’d still be in the trade.

I was GREEDY, should have moved my target down to just above the Open 🙁

However, VERY pleased with the anticipation and read of the setup, MUST manage trades better 🙂

11:57

Sold break of M5 EQZ level, BreakEven +0.10R

Price has not moved up to the areas of RESCON mentioned earlier after failing to hold above the D1 EQZ@11693.8 it has moved down to test the Open.

This was not a good trade, I sold the break of the M5 EQZ@11590.3 and trailed a tight stop only to be closed out for break even.

There was strong support at the H1 EQZ Mid-line at 11580.4, I would – should – not take this trade again.

08:12

Major RESCON@11810…..

I’ve identified a second area of RESCON just above the one I posted earlier.

What makes it stronger is the Role-Reversal structure when you look-left. At the 11810 level the following components of the Grid are confluent:

- D1 Bear Channel

- H1 Bull Mid-Channel

- H1 Bear Mid-Channel

- Role-Reversal structure

So there are two possible zones of RESCON if price can break above the D1 EQZ level at 11693.8, maybe a juicy salmon will show up!

At present price is struggling to break above the D1 EQZ@11693.8