Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

09:46

Some end of week thoughts….

Some end of week, start of month thoughts.

How different a trading day can be. If I’d been able to take the 6:40 M5 MAB I’d intended to go for multiple R due to the overnight bullish context. I like to think there would have been a possible 5R trade.

I then missed the GZ M5 MAB at 8:06. I was sat with the Trade Tool but failed to execute, hence the option to use Limit orders at times is something I’m considering as it forces precision PLUS it can remove some emotion once setup, maybe even walk away so you don’t get tempted to over think things etc.

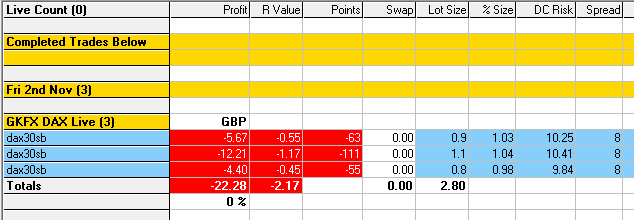

I was in buy mode and took the next GZ M5 MAB at 11627.5ish at 8:39, then had doubts due to the context (coming down from RESCON) so closed out for -0.45R only to get drawn back in and take another loser – with a gap – for -1.17R.

I then took the GZ Buy FIBCON@11600 plus the H1 Bear Channel that I’d marked up before taking the two losers. It was a much better value setup but I then had doubts, told myself I was over-trading and closed out for -0.55R.

I’m very quickly down -2.17R from three trades when in a parallel universe I’m up 7R 🙂

I’m stopping for the day as it’s NFP later and markets are often tough due to lack of commitment by traders as they wait for the Adrenaline rush of the announcement. The sun is out but too cold for a ride (for me anyway) so we’re going to enjoy a walk later as we’re busy over the weekend and the weathers not so good.

After the period of drawdown from the 11th-18th October I recovered to end October up 6.19%, that’s three consecutive profitable months so it’s all going on the right direction. I also feel SO close to a 5R-10R day, on days like today it’s vital to limit losses so time to stop and enjoy the sunshine 🙂

I’m experiencing a period where I have to work on my mindset, something all traders go through on the journey to success. This last week I failed to maximize the profit potential on several trades, I must let trades play out AND trust Grid structure. I was doing a good job of this but these last two weeks I’ve managed good setups poorly.

So even though I’m happy with the progress I know I’m SO close to crossing a threshold where 10-20% a month is possible!!

Over the weekend I will watch Adam Khoo’s video on what 7 reasons why traders struggle to be profitable. I’ve seen it before but it’s time to watch it again.

and also this video of the habits of successful traders.

We must remember trading is predominantly a mind-game so we must progam ourselves accordingly.

08:55

GZ M5 Buy MAB loser x2, -0.45R, -1.17R

I’m not in the right mindset it seems!!!

I took the next GZ M5 Buy MAB at 11627.5, did not work out, ended up taking two trades, two losers.

I’d previously marked up the lower GZ FIBCON@11600 and the H1 Bear Channel. I took it then had a moment of doubt, closed out for -0.55R only to see it move up!!

I feel sure that if I’d not had the first two losers I’d have been more patient with the third. It was much better value and I’d anticipated it before taking the first two trades.

Three quick trades, all losers, time to stop me thinks!!

Below is the third Buy trade at 11600

08:30

Another GZ M5 Buy MAB Setup – Missed 🙁

I had this marked up but just missed it using the Trade Tool then wasn’t sure on the second opportunity.

It was a buy trade with the bull trend so it was the right side of the market to be on. I had the Upper boundary of the M1 Micro-Channel marked up but wasn’t sure about the lower one at the time of the M5 MAB. I’ve now placed it accordingly.

Following on from yesterday I’m thinking that a Buy Limit order would have been a better option for the following reasons:

- My precise trade entry levels would have to be reasoned out.

- No need to time the Trade Tool when price can move quickly.

- You can leave your desk if you need to. It’s like a fisherman sets up his net and comes back later to see what the tide brought in 🙂

It’s something I plan to develop….

Developments on US-China trade negotiations seemed to gave market a boost!

that would explain it….