End of Week 11-15 June

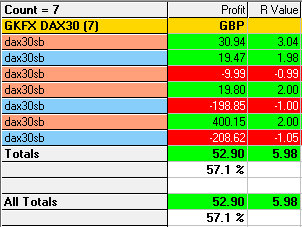

I ended the week +5.98R with a 57.1% strike rate, though relatively few trades were taken. Paying more attention to higher timeframe structure could have eliminated a couple of the losing trades.

I changed my account settings midway through the week to better reflect what I would be trading with when I go ‘live’.

11:00

As Alex had anticipated in a blog alert, price moved up through the 15min MA towards the open and yesterday’s close, before beginning it’s move down towards the bottom of an hourly equ. zone at 12975.

An impulsive moving pushing through previous support, retrace to 61 fib level, 1min MA and the top of the hourly equ. zone at 13103 which should act as some resistance. Stop placed above hourly bull channel and 5min MA. TP pulled down to 3R level just above the bottom of the 5min bear channel and daily bear channel midpoint.

10:50

Impulsive move to lower low, 61 fib level confluent with the 1min MA, 5min MA and 5min bear channel midpoint. Stop placed above the open, hourly bull channel midpoint and 5min equ. zone midpoint. Once again I didn’t take notice of the 4hour MA coming up from below. Ignoring higher timeframe structure seems to be a theme for this week.

13:45

At 14:45 the bulls took control and pushed price up through the daily equ. zone level and the daily bull and bear channels that had been acting as resistence for the last week. (Main Refinancing Rate announcement?)

Impulsive move and higher high after after a brief period of consolidation, retracement to the 61 fib level and confluence with the 1min MA. Stop below 5min and 1hour bull channels.

14:58

Impulsive move through a daily equ. zone level for a lower low, and the 61 fib level fell nicely on the underside of the daily equ. zone for the retrace. Perhaps this was playing with fire as price had been bouncing off the hourly MA, but looking at the impulsive move I felt that the bears were strong enough to push price back down.

A nice setup, but with the hourly MA hanging around, maybe I was a bit lucky with this one? I think I’d still take it again!

10:05

Lower low, retrace to 61 fib level, midpoint of 5min bear channel and microzone. Took the trade after some hesitation – I should have taken the trade at the first touch of the 1min MA – with my stop above the open, yesterday’s close, a daily equ. zone level, the 5min MA and the top of the 5min bear channel.

12:10

Sell off from an hourly equidistant zone to create a lower low, retrace to 61 fib level, the top of a 5min bear channel and the 5min MA in play. Didn’t take the trade at the time, but could have ridden it down to the bottom of the 5min channel for 4-5R with a stop above the hourly equ. zone level.

12:40

Impulsive move up from the low of the day, bought at yesterday’s close and the bottom of a 5min equ. zone, with the 61 fib and the hourly MA between my entry and stop. Price was choppy before the retracement, and bears were in control when I entered the trade, with the 1min and 5min MA above to push price down further. Price moved down through the open to the daily bull channel midpoint – which I had not noted – before moving up.

Would not take this trade again.

Hi Joel,

Great first blog and great results for last week.

I can see that you are waiting for retraces/pullbacks that are nice and clear. The only exception to this as you note is the buy trade at 14:40 on the 11th June.

Phill.

Hi Joel,

Phill made me aware of your post as I didn’t check it on the weekend!

Well done! I admire your patience waiting for high value set-ups. I could definitely use some of that!

By the way, considering that your 3R trade came after my input, should I give you my bank account details?! 🙂 I am joking, I am glad the reading was ok, I was afraid of posting something and then the market does exactly the opposite!

Look forward to seeing more of your trades!

Cheers.

Alex