Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

13:40

Perfect GZ M1 Sell Micro-MAB

I’ve stopped trading but just spotted this perfect GZ M1 Sell Micro-MAB at Yes High.

These take skill to trade but look closely at the Role-Reversal structure when you look-left. You could not consider these setups unless you have something like the Trade Tool BUT they are worth mastering because they are high quality and high probability. We only need to be right 40-50% of the time so long as we average 2R winners and don’t increase our risk so much we skew the traders equation.

As I’m typing this sell setup rolled into another as shown below. A-B-C followed by A-B-C…..

Maybe I should have trade for another hour or so…..

12:26

Had to take a break…..

I’ve had to stop trading due a few phone calls and have just come back to see a decent sell at the H4 KeyZone@11637.6 and the H1 Bull Channel.

Point A is at the High, point B at the H1 MAB@11580.4, the bear spike down to Yes High would have netted a nice 2R winner.

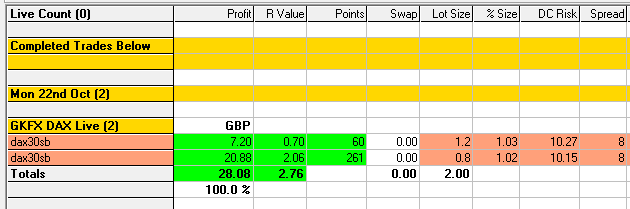

I’ve got to stop trading for the day due to other commitments and am very pleased with the morning results, +2.76R 🙂

The potential for more was there by just doing the basics, A-B-C then look at the context, follow the plan and if it looks good execute.

The recent drawdown can be partly attributed to me going for multiple R winners at RESCON or SUPCON instead of taking 2R off the table when it was there.

10:27

GZ M1 Sell FIBCON Winner, +0.70R

As I type the 2R would have come in but I closed out when Yes High looked like it would go through a Role-Reversal and act as support.

I sold at the H1 Bull Channel and the H4 KeyZone@11637.6, just above the 61.8@11633.8, pleased with the setup, another A-B-C sell but allowing for the RESCON above.

Shame I didn’t let it play out as it would have been 2R but very pleased with the anticipation, it pays to Be The Bear 🙂

09:50

GZ M1 Sell MAB Winner, +2.06R

It’s felt ages since my last text book 2R winner but by following the plan and marking up those A-B-C patterns I took the sell at Yes High as shown.

I did not move my target even though it was a litte lower than I wanted, ideally above the H1 Bear channel, but it worked out – just 🙂

After the ‘Factory Reset’ last week I really enjoyed this one due to the process!

08:49

Mark up those A-B-C’s……

After last week it’s back to basics, ie. marking up A-B-C patterns as they form in real-time. All of this is in the plan, I’ve just not been following it !!

No trades so far but I’ve marked up the chart and where you see an arrow it shows a trade entry point that with good timing would have been a 2R winner.

The whole point of the Trade Tool and the Price Action Grid is to take very precise short-term 2R trades.

This will result in more trades but so long as they’re high quality they should be taken as this will leverage the traders equation where 40-50% strike rate will result in a positive equity curve.

I believe that once we do this this hour after hour, day after day we will eventually reach a stage where we are in the zone, in the flow, and will roll from one trade to another, switching from buy to sell as structure guides us 🙂

It takes determination to enter at that level! I would have suffered too much there. Well done!

Hope to see more of that!

Nice trade Phi!

Why didn’t you move your profit target above the H1 Bear Channel?

Was I being too cautious with a Stop above the H1 Bull Channel?

I could have squeezed out a bit more profit with a tighter stop, but I’m very happy we both saw that trade so clearly and took it at the right time.

https://blackboxsoftwaresolutions.com/mon-22-oct-2018/

I was tempted to move my target above the channel but decided to let it play out, wish I’d done that with my second trade, would have been a 2R.

Well done on the trade, this A-B-C approach is pretty cool eh?