Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

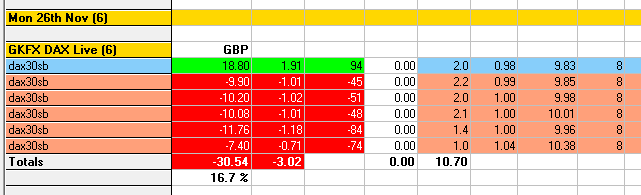

12:22

GZ M1 sell Micro-MAB loser, -1.01R

This was structurally good but contexually poor!!

It started off well but I should not have considered this one due to the 11325 level/zone being such a battle ground.

As my 2R was above the D1 Bear Channel this time I talked myself into it. Maybe 50% of these will work out but on the back of two losers it feels like a very poor trade.

11:24

Two sell losers, -0.71R, -1.18R

I took two sell trades when price broke back below the key level at 11325ish….

So far the D1 Bear Channel has held resulting in two losers.

The bottom of the M15 KeyZone is at 11300, that is where my 2R was intended.

Note the 11354 level and how precisely the bull spike reversed at it. Trading the M15 channels has lots of potential, but not so far today when the D1 Bear Channel is in the way of a move down.

I wasn’t trading yesterday, but I had the charts up and was in and out of the room. When you sent the alert out at around 12:20 I marked up a couple of opportunities using a keyzone I’d drawn up a bit earlier.

I think your sell trades around this time had the right idea, just weren’t in the right place!

(https://blackboxsoftwaresolutions.com/mon-26-nov-2018/)