Risk-Reward / Thinking In Terms Of Rvalue

Professional price action traders think only in terms of chart structure, risk-reward and the percentage growth of their trading bank.

They do not think in terms of pips or points when measuring their performance.

They never risk more than 1% to 2% of their trading bank on any one trade; therefore they can take numerous losses in a row and still have money left in their bank to trade another day.

There is a culture within the UK based spread betting community to think in terms of £’s per point, this approach does not lend itself to good money management. It is often used by trading system marketers to give the illusion that traders can easily increase their profits by simply increasing the amount staked per point.

Alarm bells should ring if you see headlines that focus on profit in £’s per point whilst omitting to mention anything about risk.

Professionals think in terms of Rvalue (R) which is the amount of the trading bank that will be assigned to each trade i.e. the Risk.

For example, if 2% of the trading bank is assigned to each trade then 1R = 2%.

If a trade results in a 2R winner the bank grows by 4% (2×2%), alternatively if the trade is a loser the bank shrinks by 2% (1×2%).

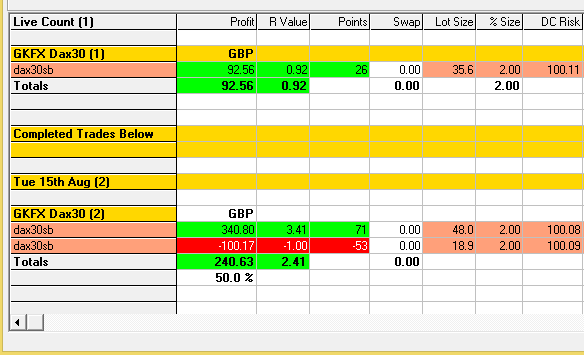

The Blackbox Trade Controller has been designed to support thinking and trading in terms of Rvalue by enabling the user to predefine trade money management parameters such as the trade bank, trade size and risk-reward.

The Trade Tool automatically calculates position size based on the user defined trade bank settings and has been specifically designed to setup and enter trades based on Rvalue, such that the distance between trade entry and the stop-loss always equates to 1R.

The Trade Console displays trade results in terms of the deposit currency, Rvalue and points, therefore promoting a consistent and professional approach to money management.

The configuration of the user defined trade money management parameters is covered in the Blackbox Trade Controller Installation Guide (section from 12:15 – 14:25 mins).

Why do Professionals Think in Terms of Rvalue?..

To demonstrate why thinking only in terms of pips or points is meaningless, let’s take a look at two trade setups.

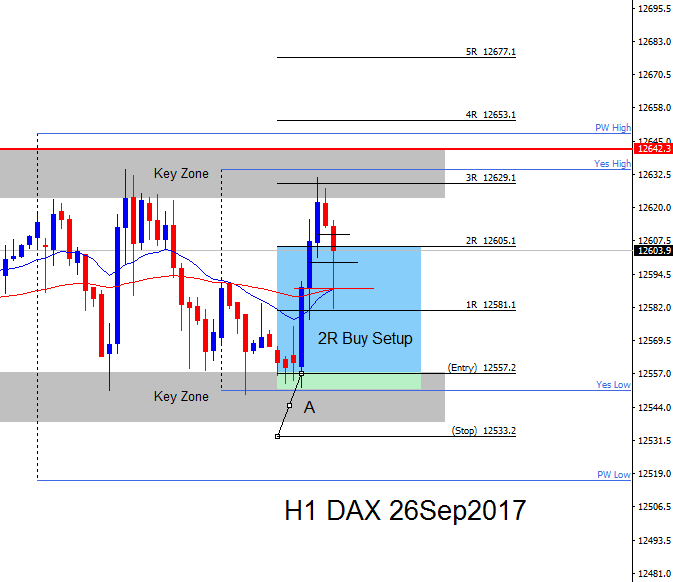

The example below shows a trade setup that formed on the 1 minute time frame and another that formed on the hourly.

Both of these setups resulted in 2R winners however the points profit were considerably different; the 1 minute trade produced 8.3 points profit whereas the hourly trade produced 47.9 points profit.

Nevertheless, each trade resulted in the same percentage growth of the trade bank.

Similarly, the risk on the 1 minute trade was 4.1 points whereas on the hourly it was 24 points, even although both trades were risking 1R of the trade bank due to the position size being set accordingly.

Can you see why thinking in terms of pips or points is meaningless when trading chart structure?

A 2R winner on the 1 minute time frame is the same as a 2R winner on the hourly or daily time frame. The obvious difference is the time it takes for the setup to form and play out.

Some traders would argue that the lower time frames such as the 1 minute and 5 minute are simply noise and should be avoided.

In our experience this is not the case, we believe that there are advantages in trading the lower time frames and have therefore chosen to specialize in trading the German DAX Intraday.