Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

18:46

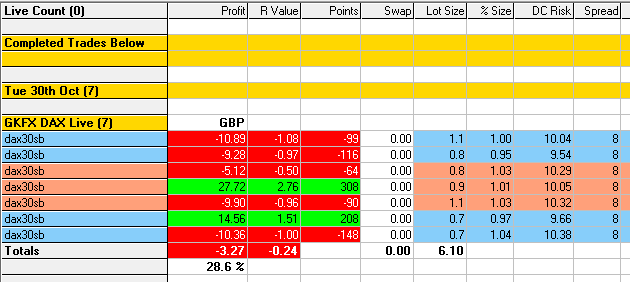

Today’s Results, -0.24R

I ended up slightly down on the day after two losing MAB Buy trades due to price coming back down from the top of a range.

Structurally they were good but contextually they were low probability due to the price making its way back down a range.

The fifth trade should have been a 2R winner had I not trailed my stop so early, more fine margins.

12:27

Two MAB losers, -0.97R, -1.08R

After taking a break I came back to see the bull spike back above 11325 and the retrace in play. I took the M1 Buy MAB@11325, did not work out.

I then took the much better setup of the GZ M5 Buy MAB at 11310.1, did not work out though it was a decent setup, the better of the two.

On this occasion the Impulsive A-B Bull leg did not provide the FIBCON energy needed.

Whilst price is moving between Grid structure it has not been kind to us as can be seen by the strong move back up off the H1 Bear Channel.

10:35

GZ M15 Sell MAB loser, -0.50R

I was So The Bear on this setup and waited patiently for the M15 MAB at the 11325 level.

I was happy with my entry and stop just above the 50% level of the current Golden Low-High zone. When price moved below the 11325 level I reduced my risk and protected my stop with the 11328 level.

I moved my stop too early, the 2R would have just come in 🙁

Great anticipation, great entry and stop, poor trade management.

08:36

Four trades, 2 winners, 2 losers, +2.31R

What busy 30 mins after the 8am open, I’ve taken four trades as follows:

- I took the M5 Buy MAB though I entered early at the H1 EQZ 11388.8 level. This has been a key level as shown when looking-left on the M15 and H1 charts. I almost talked myself out of it due to the RESCON but went with the bullish 7am momentum.

- Took a great Buy@SUPCON@11328.1, just above the H1 MA. Should have let it fully play out for 2R.

- Took the M1 Sell MAB@11363.0, not great Role-Reversal structure to support it, didn’t work out.

- I then took the GZ M5 Sell MAB, a much better setup! On this occasion I moved my target as structure supported it, this one worked out 🙂

The 1st and 3rd trades were weaker setups – easy afterwards of course.

Yeah! I was hoping someone was profiting from the RESCON buy @ 11325.1 and the GZ M5 Sell MAB! Well done!

Traders equation showing its power once again!

Yes, the traders equation is like magic, so long as the risk is kept to 1R and we get at least +1.5R, otherwise it skews it.

It’s SO important to get a good entry so that you don’t feel a need to move the stop though on very rare occasions structure does support it but best avoided.