End of Day Review

-0.44%

4 trades taken.

1 winners, 2 losers, 1 break even.

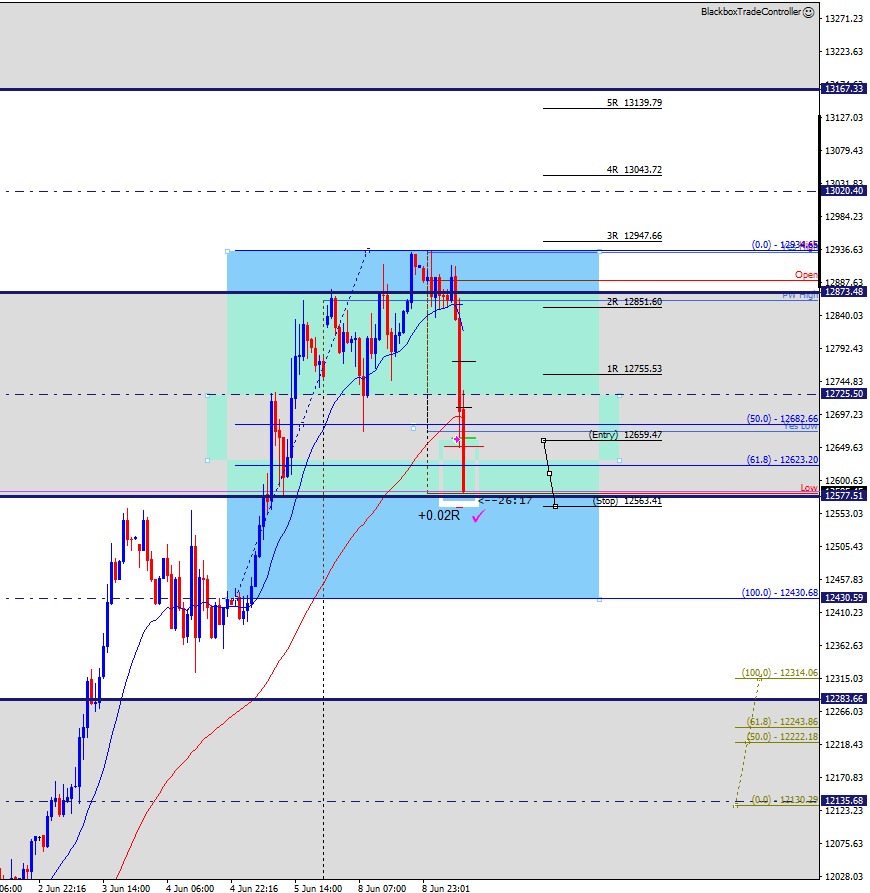

08:48

H4 MAB Buy | Breakeven trade +0.02R

First trade of a new chapter in my trading journey!

After so many days of bullish price action, bears drove price down Yesterday’s Low and there it was the 4 Hourly Moving Average, which often in a sell off offers some resistance. I opened a trade on the 1H chart placing the stop loss below the key 12577.51 level.

Indeed it did offer some resistance, but I was so conservative on my stop loss, even having catched price reversing for a while, my trade was not even above 1R. Once price went above Yes Low once again, I moved my stop loss to breakeven should price not hold.

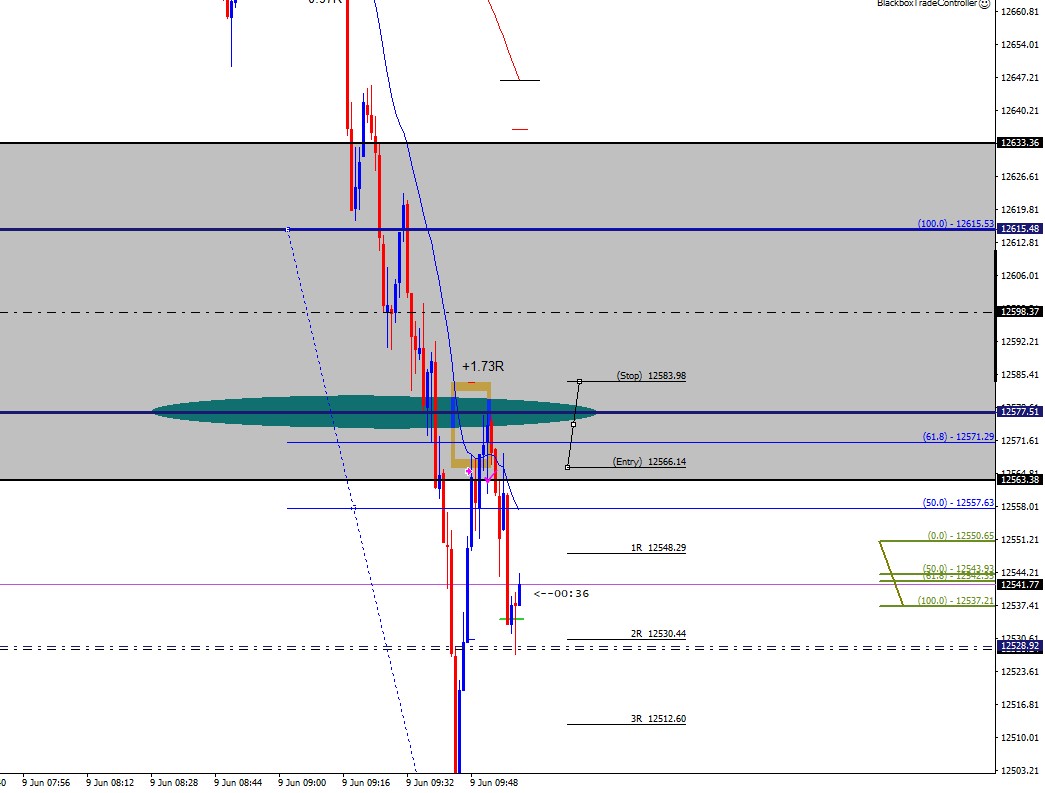

09:16

Reversal FIBCON Buy | -0.97R

Second trade of the day, talked myself into a Reversal FIBCON that was not on the plans of the market. The sell-off was still ongoing, this was clearly a poor trade, and while the first trade offered an almost half and hour battle, this one lasted less than a minute. Patience needed!

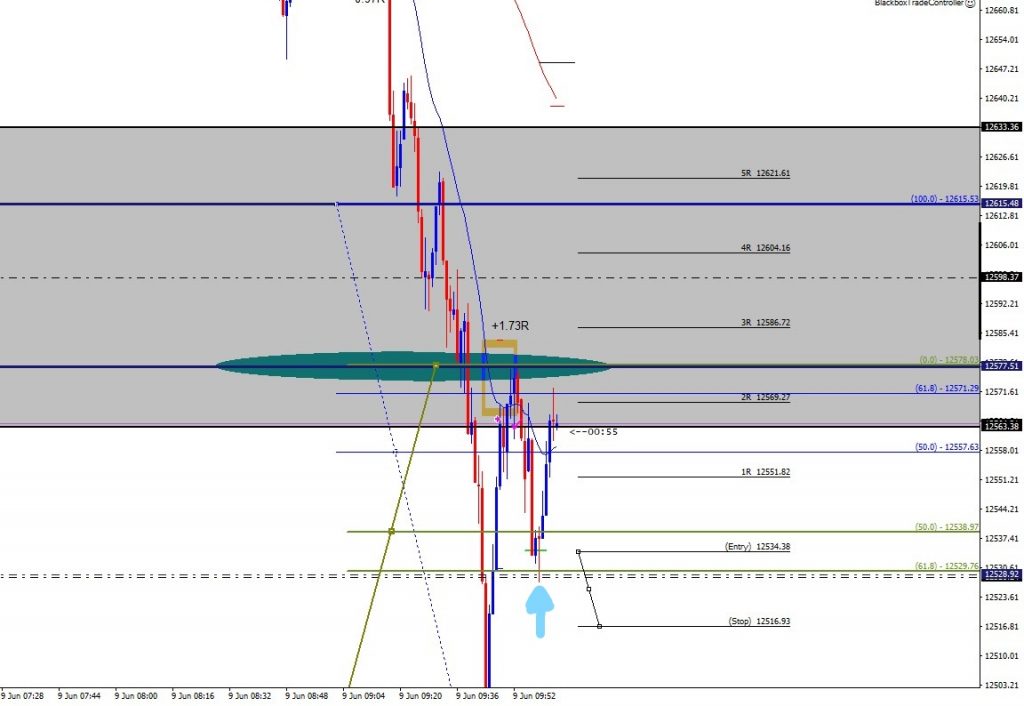

09:48

M1 MABCON Sell | +1.73R

After a bad second trade, I needed to at least have some understanding with the market! I had marked with the green elipse an area of strong support when price was still above it. Soon after that, bears kept taking price lower but the retracement offered an attractive M1 MAB with the previously marked area nearby now acting as resistance.

It worked to perfection, after watching price break several layers of resistance on the way down, greed took over and I moved my take profit level further down the original 2R. Looking at price hesitating just above my 2R level, I closed the trade and took profit.

I should have never touched the take profit level, that was sitting just above an interesting channel mid-line that price tested and started a recovery. It was a 2R trade closed early.

Touching my take profit level make deviate my attention from what I was looking on my previous trade, that is, a possible Reversal FIBCON, a pattern that normally offers multiple R. The chart below shows exactly what I missed!

It turns out that my take profit level was the perfect entry point to profit from the whole structure of the Reversal FIBCON:

10:55

M15 Chart Reversal FIBCON | -1.22R

My successful previous trade, combined with the sense of having missed the next leg of the same movement, was probably the reason why I ended up opening the one below.

It lasted more than half an hour from start to finish, and it was around 1R at some point. That tells that structure was there to support this trade.

However, I entered it too soon, and I moved my stop loss to an area where I saw support.

The support was indeed there, but after touching my stop loss, of course. If that area was support, I should have either entered the trade already taking that into account, or not take the trade at all.

Good learning stuff for my first day after more than 18 months without trading!

Welcome back! Not a bad start after an 18 month break!

Was the choice to use an elipse for the area of support/resistance an aesthetic choice or does it hold some analytical value?

Thanks Joel!

I need to admit that I am stealing your template every day now, it is exactly what I needed 🙂 Hope you are alright with that.

The elipse doesn’t really hold any analytical value. It is just ugly enough to make me pay attention to areas I beleieve are of major support/resistance. I am rusty, at some point I’ll find something nicer!

No problem at all, I’m glad it is being made use of! All I’ve done is add the review section to the top of the template that Phill and Elaine produced.

There’s a monthly template there too, with a similar review format underneath.