Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

12:04

Middle Of Range Sell Low Probability?

I took the sell setup at 12374 without fully concentrating, however, I closed out once I reaccessed the context, it proved a good call.

Why?

If we are in a range then the middle of the range setups that are opposite to the direction price is moving can be low probability. In this case a sell trade against the momentum of the move back up the range.

We will update the section on the website with rules for trading ranges.

One such rule is that (in this case) we favor buy trades over sell trades whilst price is moving back up OR stand aside until price reaches the TOR. We can set alerts to inform us and take a break whilst this plays out.

We can never know for sure what will happen, at times these middle of the range setups work out but we must learn to deal in probabilities and context.

10:32

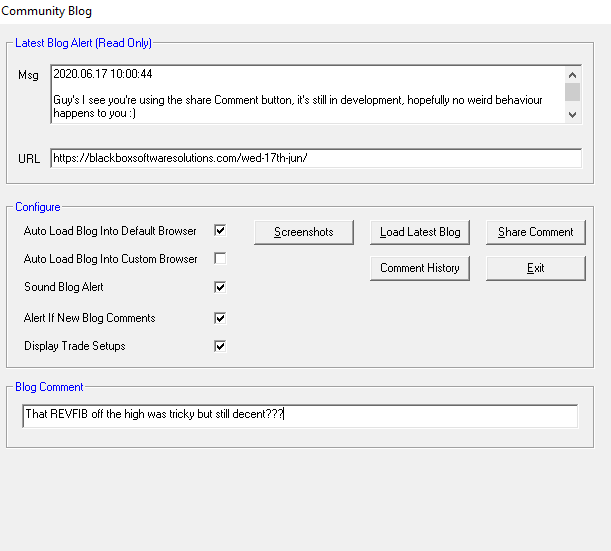

Sharing Comments

I’m about to upload the latest BTC, the Community Blog window has been updated as above. You can add a comment of up to 200 chars if you want.

The ‘Share Comment’ button will notify others that you’ve posted a comment on the blog.

When new comments are shared you will be alerted and they will automatically be displayed. If you want to look at the comment history at any time use the ‘Comment History’ button.

This is not intended to replace posting comments on the blog, just to allow you to tell others without me sending out a blog update.

However, it can be used to send a simple one-liner if you want.

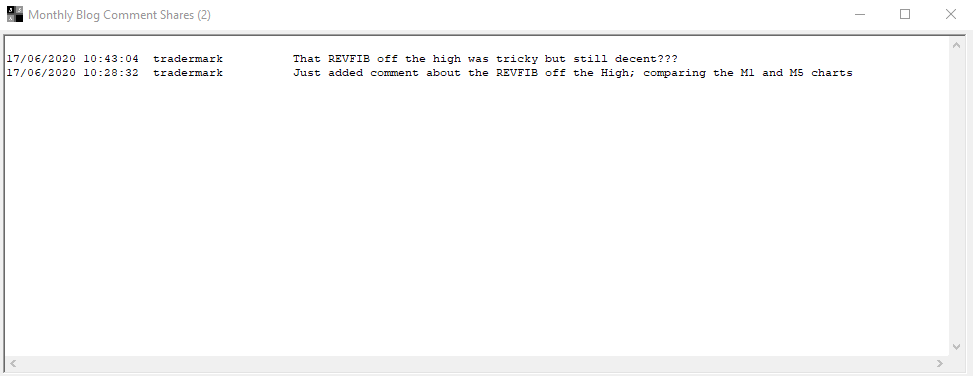

Start using once you update and we’ll see how it goes. Below is what the display will look like. It’s a floating window showing the current months shares with linefeeds between days.

09:59

Shae Comment Button

Guy’s, I see you’re using the ‘Share Comment’ button.

Are you getting notifications?

It’s still in development, will be completed later today.

09:05

Yes High at Key 61.8 Level

After reading the comments below from Alex and Joel regarding the Daily GZ and Yes High I took a look at what happened on the M1 chart yesterday afternoon – Wow!!

As they commented, by identifying this structure we can reason out that there might be:

- A move up to it offering buy setups (Joel)

- A possible sell setup if price fails to move above it (Alex)

A sell REVFIB formed with great structure and context 🙂

Note once again that:

- Point A was at a Grid midline level@12429

- Point B was at a Grid midline level@12355

- The GZ 50% level (point C) was at a Grid midline level@12392

This is way beyond coincidence and each day we are seeing how precise the updated Price Action Grid is.

When we get used to seeing these chart patterns (GZs) they offer multiple R as can be seen by what happened. A reasonable target would have been the D1 EQZ@12281.54

The updated s/w will allow us to share more effectively this information. Even though I’ve not been trading the last few days I’ve really enjoyed feeling the synergy that’s developing between us. It’s time to take things to another level 🙂

07:20

GZ M1 Buy FIBCON

Yesterday’s High was just above the midline of the D1 EQZ@12429, it was also the 61.8 level of the GZ marked up at 12418, when you look left you can see that the midline was in play during last week.

Also, note that the wick on Yesterday’s candle is pretty much the height of the GZ.

Today I hope to complete the s/w updates ready for release.

Wow, can’t believe it actually happened!

I marked this up yesterday before midday

https://blackboxsoftwaresolutions.com/wp-content/uploads/2020/06/ge30.sb_H1_11jun2020_0000_xxxxxxxx_xxx_REVFIB-H1.gif

I clearly have a problem setting stop losses though, I am being over conservative on the higher timeframes!

Elaine marked this zone up and showed me after price had tested the 61.8 level when it set the high.

The stop-loss needs to be based on the time frame and potential profit, however, note how price sold off once it failed to move higher at 15:30 yesterday.

That’s where we’d be looking to sell on the lower time frames if an entry presents itself and maybe consider multiple R due to the context?

The move up to the top of that GZ was the basis for my buy trades yesterday.

I often get suckered in to those higher timeframe MABs and FIBCONs, and get caught out by the movement of price when I enter on a lower timeframe. I think the better thing to do is use that higher timeframe move as a signal of the direction of price and then trade the move on the lower timeframe. I picked out a couple of MABs as price moved down from the 12429 level yesterday afternoon, and being on the ball for these would see more profit that the one higher timeframe trade.

https://blackboxsoftwaresolutions.com/wp-content/uploads/screenshots/themabtrader/ge30.sb_M1_16jun2020_1555_xxxxxxxx_xxx.png

Absolutely both Phill and Joel, take the higher as a reference and profit on the lower timeframes understanding what it might be going on.

Your reasoning is spot on!

The plan is to up our game on spotting these chart patterns, sharing them, and trade accordingly.

Just got onto an M5 MAB Buy trade. Closed early at the 1min ema as price is coming down from Yes. High and after the way price acted coming down from the same level yesterday, I wasn’t sure whether it would get past that 1min ema.

https://blackboxsoftwaresolutions.com/wp-content/uploads/screenshots/themabtrader/ge30.sb_M1_17jun2020_0905_19087169_buy.png

Maybe it will rise just a little higher and we will see a REVFIB set up?

Great trade Joel! I had to divert my attention from MT4 and when I look back, even with having the trade tool previously placed to take that trade I missed the train.

I did take the potential REVFIB thinking that maybe the resistance at Yes High will make price go lower, a loser trade….

If it brakes the 12355.53 level it looks like a double top could be on, with further movement down, let’s wait and see!

The Share Comment feature seems to be working fine for me, I get an alert in the BTC and a pop-up with who sent the alert.

And I’m getting the notifications coming through from the MT4 app on my phone

That’s great!

It’s still in beta, will complete today. This allows you to let others know you’ve posted a comment.

I was sat waiting for price to reach the 5min ema before entering the trade, but a smaller FIBCON set up was in play, shown by the ABC markup, with the fib drawn between two KS levels.

https://blackboxsoftwaresolutions.com/wp-content/uploads/screenshots/themabtrader/ge30.sb_M1_17jun2020_1043_xxxxxxxx_xxx.png

Price has come up off the Open and H1 MAB at the 61.8 level of the Lo-Hi GZ.

Is this going to result in a rise in price? A REVFIB at around 12374 based on the higher timeframe move down from the 12429?

I see what you mean. Maybe one clue was the midline@12355 when you look-left, great micro Role-Reversal.

Just missed out on this REVFIB, once again due to waiting for a deeper pullback, to the fib GZ taken from the Open. The GZ that ended up playing out was from a fib taken from the 12300 level.

https://blackboxsoftwaresolutions.com/wp-content/uploads/screenshots/themabtrader/ge30.sb_M1_17jun2020_1121_xxxxxxxx_xxx.png

Hi Joel,

That was a decent buy setup due to the context of price being in a range with the Open being the current BOR and Yes High being the TOR.

The sell at 12374 is decent structure BUT if that is the middle of the range then the bulls might be intent on pushing up towards to top??

Quite a battle going on just now…

I was involved in both of the trades mentioned Joel!

I labelled today’s section as “The day of great setups and a lot money left on the table!”

https://blackboxsoftwaresolutions.com/wed-17th-june/

Happy days!

Zoomed in on the M1 chart, can you get any closer to the pip?

Price turned right at the 12429.53 level.

https://blackboxsoftwaresolutions.com/wp-content/uploads/screenshots/themabtrader/ge30.sb_M1_17jun2020_1341_xxxxxxxx_xxx.png

https://blackboxsoftwaresolutions.com/wp-content/uploads/screenshots/rabster/ge30.sb_M1_17jun2020_1603_11480318_sell_ww.png

Metoo

Me To,

https://blackboxsoftwaresolutions.com/wp-content/uploads/screenshots/tradermark/ge30.sb_M5_17jun2020_1550_11480287_sell_webinar-1.png

see setup