Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

16:12

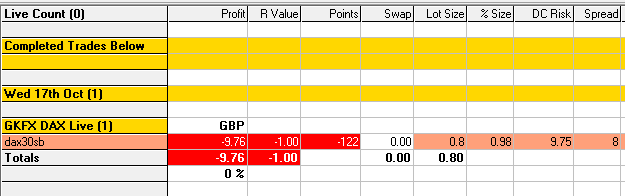

GZ M1 Sell FIBCON loser, -1.00R

I spotted this M1 FIBCON that formed on the break of the D1 EQZ@11693.8, I marked it up and liked it.

The measured move was also supportive of a move down to the H1 Bear Channel and the D1 Bull Channel.

I was The Bear and got a good entry and stop meaning my target was also good, just below the Lower-Low.

Another one that didn’t work out, another loser 🙁

I’m looking at the M5 – see below – chart for any clues that may have made this a lower probability setup. Maybe the wicks showed the presence of buyers preventing price moving lower??

It was a decent setup, I did NOT break my rules and I did NOT chase price OR increase my risk 🙂

There was clear space between the Lower-Low and the H1 Bear Channel, another reason why I liked it.

11:03

Missed great H4 Buy MAB at D1 EQZ, too fussy!!

Wow, I was just too fussy on the buy at the D1 EQZ@11693.8, I wanted to see price reach the 11685 level. I was just about to enter when it moved up and I did not want to chase price.

Well done if anyone took this !!

I can feel the effect of my last few days trading, last week I feel sure I’d have taken it.

Habit number 5 of wealthy traders is:

They approach trade number 5 with the same mindset they did on the 4 previous losing trades.

Just updated my blog with the same thing. Entry at the 5min ema or wait for a deeper retrace to the H1 EQZ border?

I was SO close to selling at the high at 8:15 when price came back below the H1 Bear Channel , the RESCON was good but after some of my last few trades I talked myself out of it 🙁

Typical, but that’s the effect of a few losers, I must learn to detach emotionally from them.

At this rate if price was to move up to the H1 EQZ@11772.0 it will be an M15 Sell MAB 🙂

I almost took that very same trade, but my reasoning against it was just as you said, becasue of the ‘wicky’ candles, which I precieved as uncertainty between buyers and sellers.

At the beginning of the day, I was anticipating a move up towards the Daily ema after the 4hour MAB, so my thoughts were that in uncertain conditions the Bulls would come out on top. I don’t know if this thinking makes sense, or if I’m just making things up and lucky that it played out that way!

It was much easier for me to step aside and not take this trade, as I had just banked +2R, then seen a very nice 5min MAB, so didn’t feel the need to risk anything more with another trade.

https://blackboxsoftwaresolutions.com/wed-17-oct-2018/

Your reasoning was spot on, and after the trade I came to the same conclusions due to the context of the RESCON Grid structure, ie. the H4 MAB plus the D1 EQZ..

Well done on the M5 MAB 🙂