Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

08:43

GZ M1+M5 Buy MAB Setup

I talked myself out of this buy MAB setup, I used the recent Lower-Low as point A, it gave the 61.8 level at 11416 on the D1 Bull Channel.

I was definately affected by my early loser at the same structure!!

When point A is taken from the D1 Bull Channel then look where the Golden Zone falls!!

I’m not tuned in it seems and I have to go out for a few hours at 9:30, it might be for the rest of the day.

08:21

GZ M1 Micro-FIBCON Sell Setup

I had to leave my desk just after the 8am open, I’ve just come back to see the GZ M1 FIBCON marked up above.

It takes skill to trade these and you need the Trade Tool but I want to draw attention to point A at 11428.5 that was produced by the spike up off the 11415 level.

Note how perfect the 61.8 level is at point C at 11415.5 and it’s confluent with the D1 Bull Channel and the M5 EQZ.

07:08

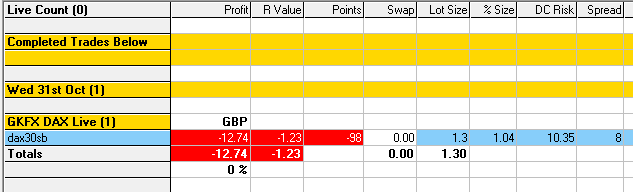

GZ M1 FIBCON loser, -1.23R

I anticipated a bullish gap up followed by a retrace after observing the 7am open many times.

There were two possible buy entries, I chose the lower probability just below Yes High. Had Yes High + the M5 EQZ@11431.5 not been present I wouldn’t have taken it.

The gap down resulted in a -1.23R loser as I didn’t move my stop.

These setups are tough to trade and should probably be left alone unless you take only the best value entry if two options are clearly present.