Mon 8th Jun

Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

16:11

Break-Even Buy Trade – Went on to win!!

I’m a bit gutted as I’d anticipated this buy Reversal FIBCON, sent out an alert and then ended up with a BE trade only for it to go on and be a winner 🙁

I was early with my entry but it would of been ok. I should have walked away and let it play out as I closed out when price pulled back to my entry.

Have not been tuned in to the Price Action today!

13:03

Break-Even Sell Trade

I was late with my entry and also felt the setup was tight so I closed out for BE once price moved back up from point B.

This was also a bull channel, see below.

I’d like to see price move above the High and if it fails then maybe we will see a better sell setup on the way back down?

12:17

Micro Range

Price is at the highs

11:19

Blog Comments

Guys, if someone adds a comment then you need to regularly refresh the page to see them.

If I update the main blog I will send out the blog update and it will automatically load a new tab into the default browser as you already know.

If I add a new comment that I want everyone to see I will also send out a blog update to force a refresh.

09:48

Reversal FIBCON at 12873??

If price moves up to test the area of RESCON at the D1 EQZ@12873 and fails to move higher we could see a Reversal FIBCON sell setup form?

This is already the current session High and has two midlines present.

It is also just above the PW High.

The D1 EQZ@12873 level is a key level and can be seen on the Daily chart.

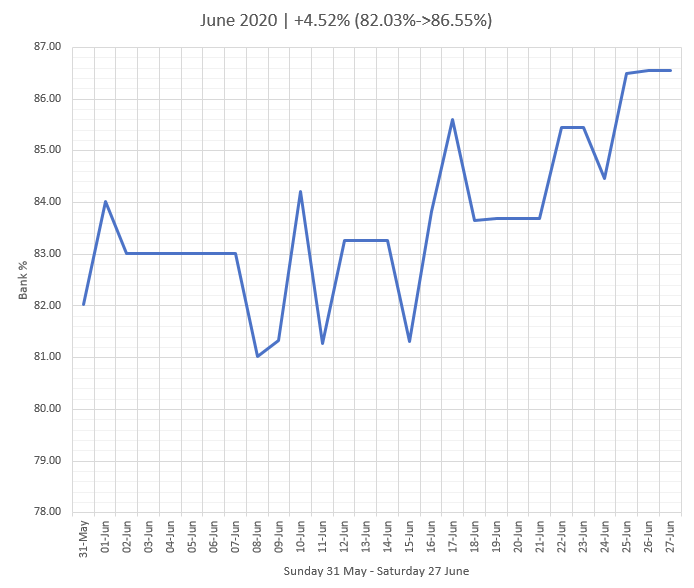

June 2020

End of Month Review

+4.52%

34 trades taken.

12 winners, 18 losers, 4 break even.

% Winners – 35.29%

WNTA Losers: 10

82.03% -> 86.55%

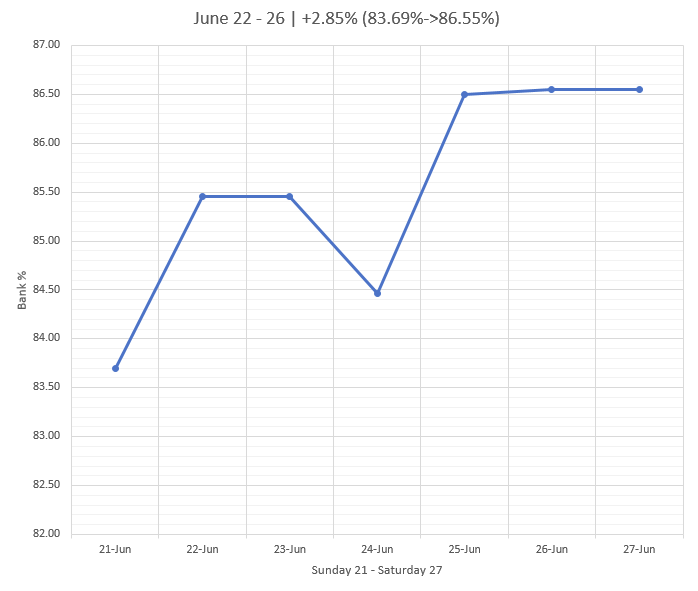

End of Week Review 22-26

+2.85%

6 trades taken.

3 winners, 3 losers, 0 break even.

% Winners – 50%

WNTA Losers: 1

83.69% -> 86.55%

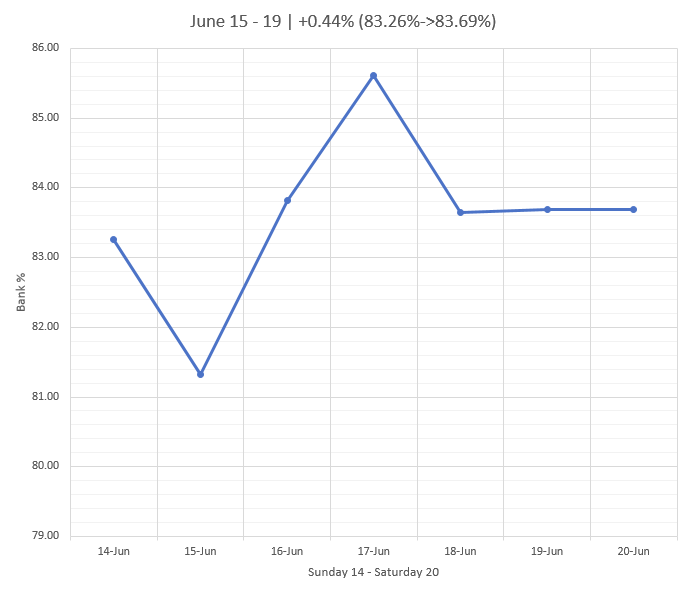

End of Week Review 15-19

+0.44%

11 trades taken.

3 winners, 5 losers, 3 break even.

% Winners – 27.27%

WNTA Losers: 4

83.26% -> 83.69%

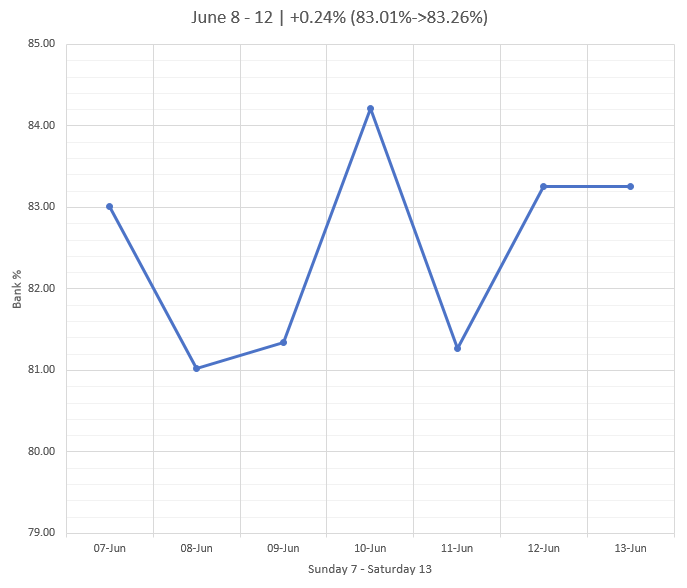

End of Week Review 8-12

+0.24%

15 trades taken.

5 winners, 9 losers, 1 break even.

% Winners – 33.33%

WNTA Losers: 5

83.01% -> 83.26%

This weeks results have been tarnished by one particularly bad afternoon of trading, where I let emotion get the better of me; had I been more discplined this could have turned out to be my best week so far this year. Despite this, the way things have been going the last couple of months, I’m still happy to be ending the week in the green, with some profits however small.

The breakdown of this weeks trades are as follows:

Winners: 2 M5 MABs, 2 M1 MABS and 1 REVFIB.

Losers: 4 failed M1 MABs, 3 failed REVFIBs, 1 failed M15 MAB and 1 failed M5 MAB.

Of the losers, 5 were WNTA trades, 2 I am undecided on, and 2 were WTA trades. Cutting out WNTA trades would have seen a Win% of 50.0%.

The majority of my losing trades this week were M1 MABs and REVFIBs. I got caught up in Low Probability M1 MABs, and I was looking too hard for REVFIBs. The one winning REVFIB trade had good markup in the build up and good confluence to support the trade.

The failed M15 MAB was due to a higher timeframe H1 MAB set up being present, which made the M15 MAB Low Probability.

The M5 MAB failed due to poor Stop Loss placement, however the read of the market for the trade was decent and I ended up getting onto the same trade minutes later for a good profit.

I kept all of my losers to -1R, and all of my winners were +1R and up, which is what I am looking to see.

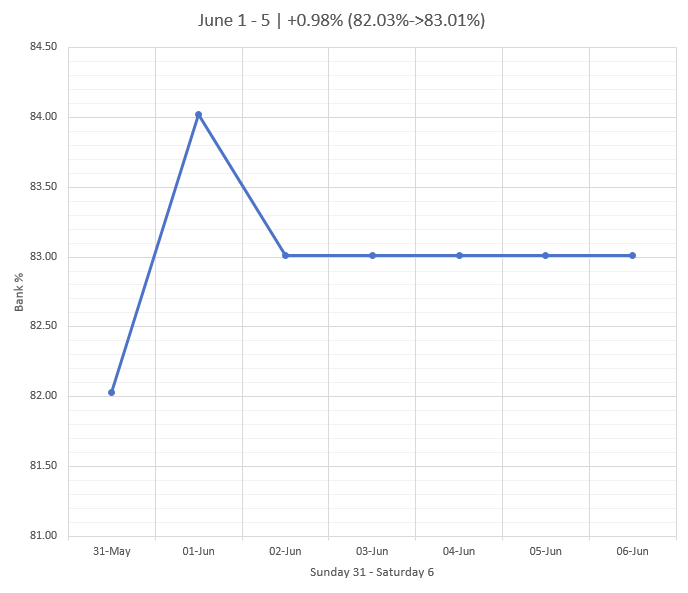

End of Week Review 1-5

+0.98%

2 trades taken.

1 winner, 1 loser, 0 break even.

%Winners – 50.0%

82.03% -> 83.01%

Tue 5th May

Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

Mon 4th May

Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

12:45

5 Trades In One

Had busy morning so here’s 5 trades in one entry. I had two losers to start May with, the first one was aggressive followed by the second one which had decent structure but did not work out.

I then switched to buy mode and ended up with a BE.

The fourth trade as another sell back below the H4 EQZ@10538, I went for more than the 2R – which did come in – only to end up with another BE. Should have settled for the 2R!!

I then spotted the first decent juicy salmon swimming by and got a +3.55R winner. I was able to find a good bear channel and was going for 6R at the PW Low, this was too aggressive but pleased with the winner.

Note how price reached the channel midline before reversing back up into what turned out to a range.

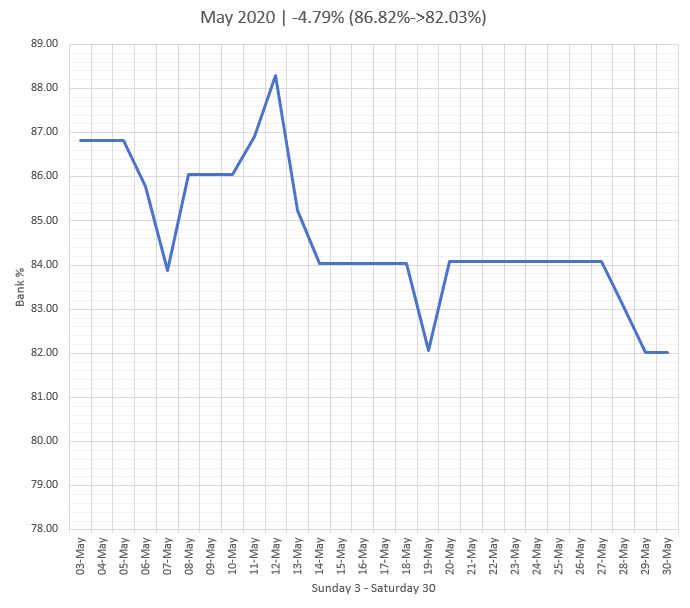

May 2020

End of Month Review

-4.79%

25 trades taken.

6 winners, 17 losers, 2 break even.

%Winners – 24.0%

86.82% -> 82.03%

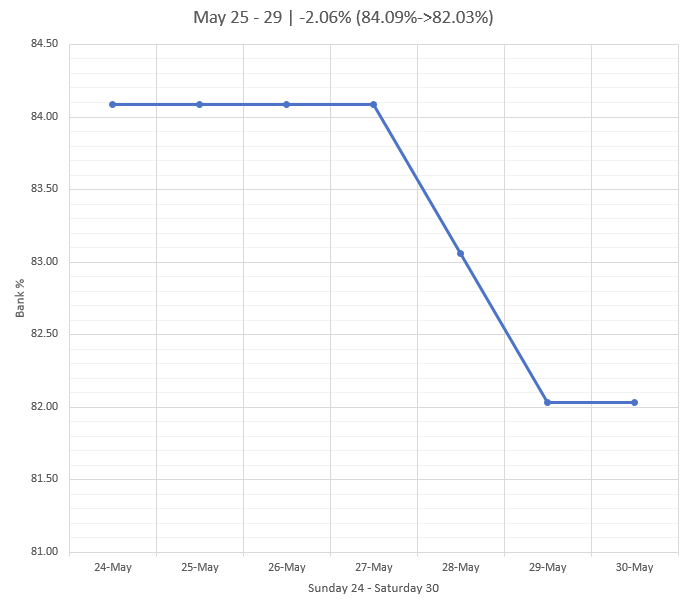

End of Week Review 25 – 29

-2.06%

2 trades taken.

0 winners, 2 losers, 0 break even.

%Winners – 0%

84.09% -> 82.03%

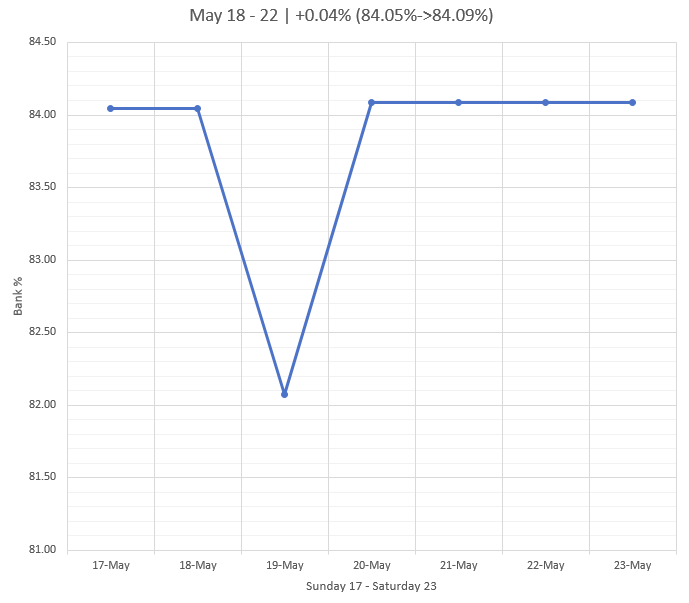

End of Week Review 18 – 22

+0.04%

3 trades taken.

1 winners, 2 losers, 0 break even.

%Winners – 33.33%

84.05% -> 85.09%

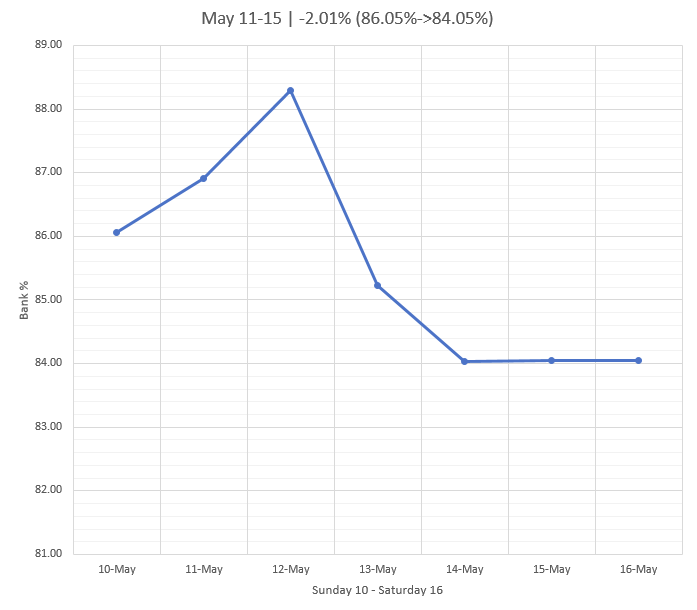

End of Week Review 11 – 15

-2.01%

13 trades taken.

3 winners, 8 losers, 2 break even.

%Winners – 23.08%

86.05% -> 84.05%

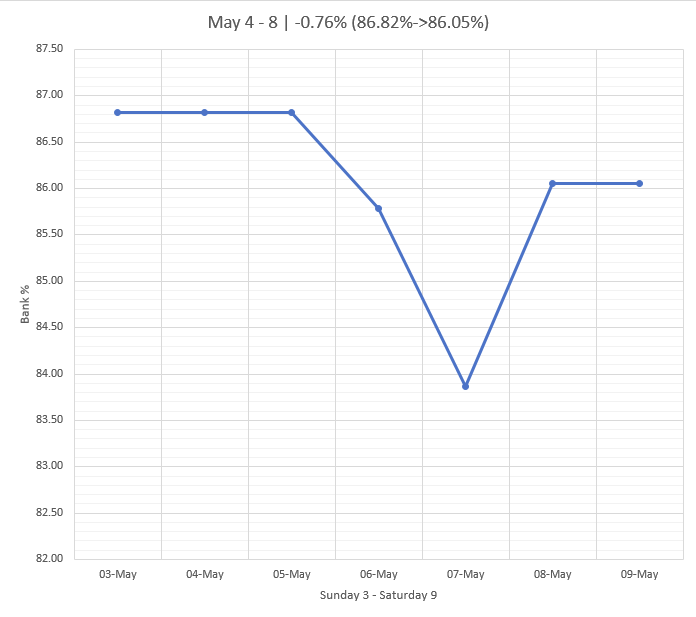

End of Week Review 4 – 8

-0.76%

7 trades taken.

2 winners, 5 losers, 0 break even.

%Winners – 28.57%

86.82% -> 86.05%

Thu 30th Apr

Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

09:07

Talked myself out of another Sell at the current low

I am SO not in the Zone this morning!!

I talked myself out of this sell setup that was good enough to take despite price bouncing off the current lows at the D1 EQZ@11104

The probability of a Double-Bottom is HIGH under these circumstances yet I was too cautious, it had :

- H4 EQZ Midline@11143

- GZ when point A is taken from the Open.

- Channel Boundary

- Double-Bottom potential

structural support going for it yet I passed.

Time to switch to there projects as at lunchtime some big economic announcements are due so things might slow down after the early sell-off.

I’ll console myself in the fact that I’ve managed my emotions and not chased price, broke my rules, etc. and ended up with losers due to indiscipline 🙂

I’ll regroup ready for the next time, the DAX is a river full of juicy salmon!!

08:23

Talked Myself Out Of a Great Sell 🙁

My bullish bias has robbed me of two great sell trades so far 🙁

This next one was just after 8 am and it was a potential 5R as shown. I was SO close to entering the trade as the structural support for taking it was excellent:

- Yes High

- The M5 MAB

- The H4 EQZ@11230

- The M30 EQZ@11230

- Great Role-Reversal – see M5 Chart from the earlier blog entry.

- Channel boundary in play

- The level had shown it was currently resistance from 7 am

I’m also aware that it’s the last day of the month and I’m wanting to protect my results as I’m in profit.

07:21

Early GZ M1 Sell Micro-FIBCON

I talked myself out of this sell setup as I was biased to buy trades but it turned out to be a great example of how if we follow our rules and trust the Price Action Grid some baby salmon swim by!

It had the following going for it:

- Break below H4 EQZ+M30 EQZ@11230

- GZ confluent with Role-Reversal – see M5 chart below.

- Break below Yes High

- Break below Micro-Channel.

With good timing a 2R was possible before price moved back up. This type of setup is a quick in and out and don’t be greedy, point B should be the target then closeout.

Using the Trade Tool and the Grid we can consider taking these types of micro-setups whilst controlling risk.

Wed 29th Apr

Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

16:27

Today’s Video

08:49

M1 Sell FIBCON Break Even,+0.08R

I took a sell when price broke below the D1 EQZ@10808 but it was counter-trend, so when it struggled to get below the H1 MAB and the 10797 level I trailed my stop and was stopped out for BE.

My stop was generous which meant the 2R target was just above the PW High, either way though had I not been closed out the trade would have been a loser.

The bulls have been in control for the last few days but the 10808 level is a major battleground just now.