Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our Trading Edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your Trading Plan.

- Practice Visualization Techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

06:46

Software Updates

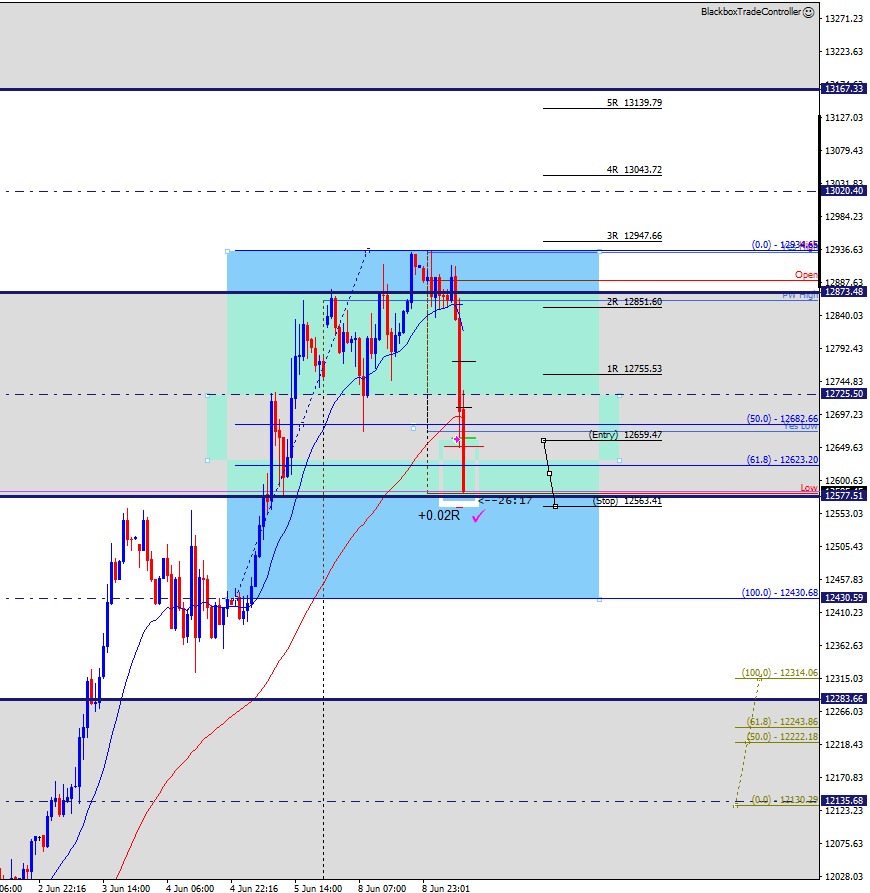

The above screenshot (M15 chart) shows the excellent sell setup that took place at 2 pm last Wednesday that both Elaine and Alex successfully took.

The update I’m working on will introduce something we’ve called the ‘Universal Price Action Grid’, it can be found on all markets and will look exactly the same.

Note how points A, B, and C all form at predefined levels on the Grid. Also, note how well the GZ (and the Role-Reversal) fall within two of the Grid levels (12651 and 12614).

Look closely at how well price interacts with the Grid levels.

(Note the following trade was taken on a demo account as I’m testing out the new environment).

Whilst testing this on other charts late Thursday evening I spotted a sell setup on the AUDUSD M15 chart. I, therefore, set a Sell-Limit order to trigger if price retraced back up to point C overnight.

At 8:55 am Friday morning the trade triggered, 9 hours 43 mins later it closed out at 6:39 pm. Below are the screenshots I took.

What happened was that after overlaying the new Grid on different charts I began to forget what market I was looking at as I was seeing only patterns because each chart looked identical except for the price levels.

This is an exciting evolution of our Pure Price Action approach, I will continue to complete the software updates over the next few days.

The important thing to note as you look at the AUDUSD screenshots below is that the Grid looks exactly the same as on the DAX.

Also, note that these two setups can be anticipated well in advance and shared with the members 🙂

This screenshot shows the sell setup on the M30 chart late Thursday evening, point B was still forming and I really liked the GZ@0.69079

This screenshot shows the next morning, price has retraced back up to the GZ.

This shows the sell limit triggered and a sell trade entered at 8:55 am. Several hours later price finally moves down towards Yes Low with my target just below.

Note how price produces a Double-Top whilst trying and then failing to push above the D1 EQZ@0.69079

This shows the trade complete 🙂