10:49

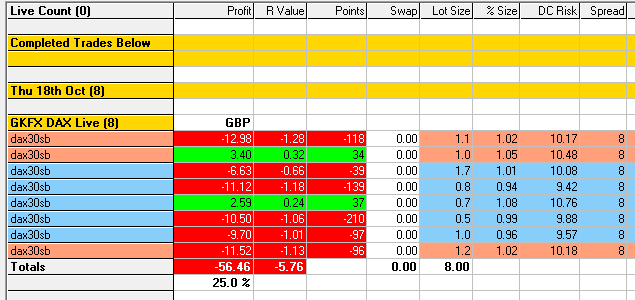

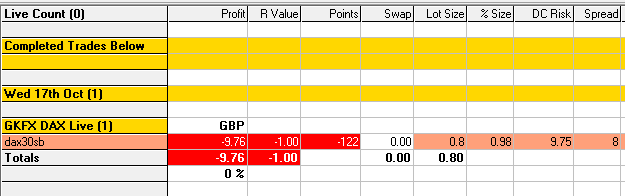

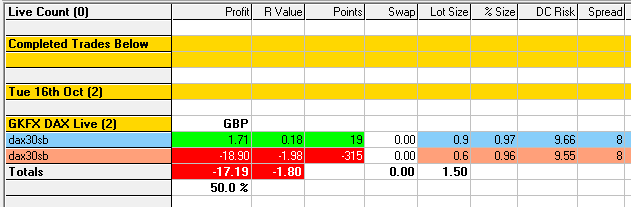

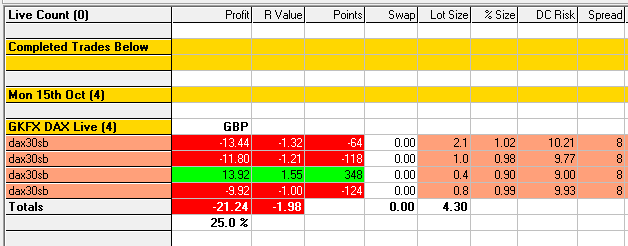

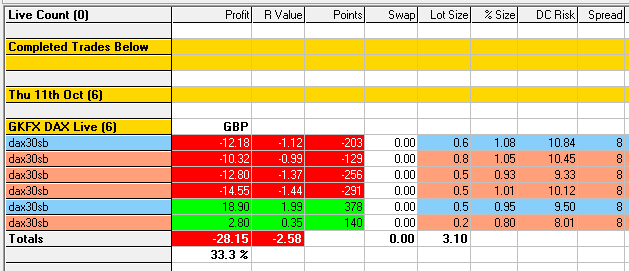

Double bottom +1.41R

I missed the M15 and H1 MAB that I had marked hours ago for fears of a Low-High FIBCON wih the Daily moving average as support.

However, I managed to identify this Double Bottom structure that gave me some valuable profit! Ideally I could have pur a tighter stop loss, but I wanted to give some room in case of a retracement. Anyway, happy with this trade, let’s see if the market offers anything else for today.

09:00

GZ M1 Buy FIBCON -0.24R

No two days are the same! Yesterday it took ages for price to move up, and today in 30mins I missed a multiple R bull move starting at the same level I bought yesterday without any luck.

That’s probably the reason why I took this trade. FOMO kicked in and invited me over to a party that was finishing. I liked the idea of a Role Reversal at the 11772 level.0 but as soon as price broke both that and the 61.8 level marked with the Fibtool, I looked for an exit point. It was a -0.24R that was going to be worse if left alone.

I wouldn’t take this trade again.