After setting up my laptop price was moving below the Open. I reasoned a Golden Low-High Buy trade was possible at the H1 Bear Channel.

Price briefly retraced back up the Open, I positioned the Trade Tool and was SO close to taking the sell down to the Golden Low-High when price gapped down 🙁

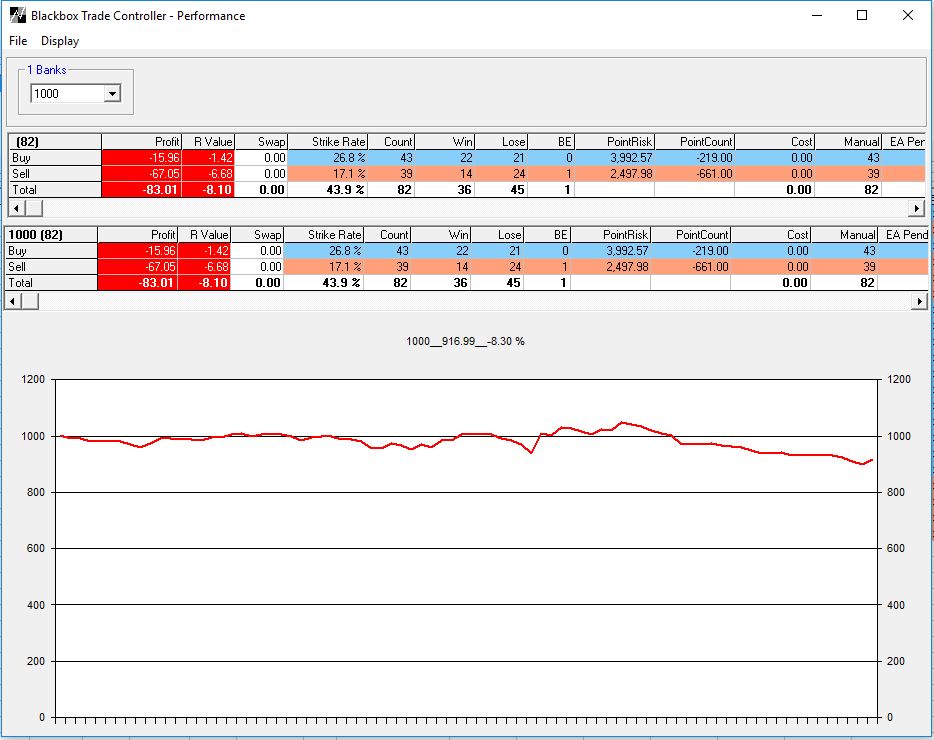

I took the Buy trade but did not get a good entry and then decided to reduce my risk only to get stopped out before price went on up and would have given me the 2R winner.

Such fine margins!!!

I then took the M5+M15 Sell MAB that was structurally good. It immediately went in my favour which is always cool but it then reversed and continued on up. However, I did reduce my risk which went in my favour on this occasion.

So, two losing trades and was SO close to taking the sell down to the Golden Low-High zone which was a potential 3R based on my read.

The M5+M15 Sell MAB I can reason was low probability due to the context of price moving up off the H1 Bear Channel and the 61.8 level of the Zone.

This is the fine margins and reality of trading, it’s part of the journey, embrace it, minimize risk, control emotions that can lead to such things as “revenge trading”.

“Be The Bear”, wait patiently for the next setup, be consistent and the traders equation will take care of things 🙂