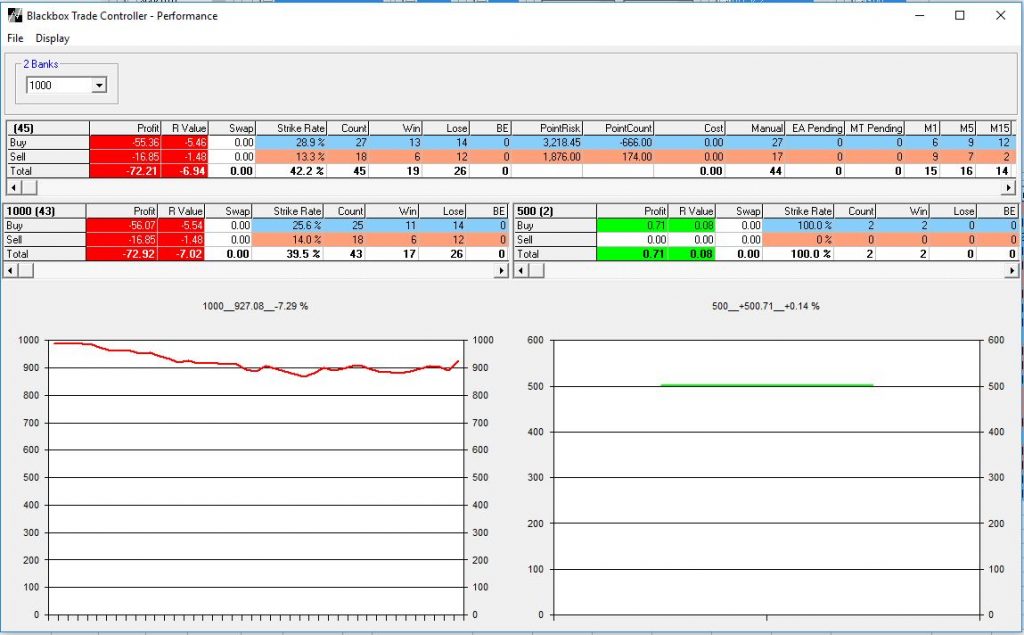

Welcome to the daily DAX commentary where we share with members our unique take on Price Action as the session unfolds. We comment on trade setups that conform to our trading edge and how we use the hybrid Blackbox Trade Controller for MT4.

Use the comments section below to post questions and read what others are saying.

Remember to:

- Follow your trading plan.

- Practice visualization techniques.

- Review and journal your trades at the end of each session.

- And above all else Be The Bear….

17:36

Buy Winner off H1 Bull Mid-Channel, +2.11R

I had to go out earlier and came back to see price had just tested the H1 Bear Channel again and the top of the M15 keyzone (see below).

It was too late to enter a sell trade but was yet another example of how powerful the Grid channels are. Price sold off all the way down to the H1 Bull Mid-Channel that has been supporting price very well over the last several days.

I therefore decided to watch this and entered a buy trade right on the channel and to my delight price reversed and 42 minutes later my +2.11R winner came in 🙂

The more I’m going deeper into the Holy Grid the more I’m seeing great trade setups that have multiple R potential, they’ve always been there, I guess I’m ready now to see them by displaying and combining the different components of the Grid accordingly.

Below is the M15 chart where the arrows show the power of the H1 Bull and Bear channels.

10:12

GZ M5 Buy MAB loser, -0.97R

I anticipated a sell if price moved up to the H1 Bear Channel boundary at around 12410.0 but took my eye off the ball and just missed it 🙁

It was also confluent with a keyzone I’d marked up on the M15 chart (see below), it proved to be a great sell setup and another great example of the power and potential of the Grid structure to guide us in our trading decisions.

I then took the GZ M5 MAB which was a decent setup BUT on this occasion it looks like the power of the H1 Bear Channel rejection made it a lower probability.

Note that the power of the sell off took price down to just above the H1 Bull Mid-channel, clearly a target for the bears based on Grid structure.

This is shown on the M15 chart below, this shows how the sell setup had multiple R potential.